USA State Payroll Rates + Resources: State of Wyoming: Unemployment + Workers' Compensation Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with unemployment insurance and workers' compensation in the state of Wyoming.

Unemployment and Workers Compensation Reporting & Payments

The State of Wyoming Unemployment Insurance system can be used for reporting employee wage information, reporting worker's compensation coverage, and making payments.

Reports and payments are due the last day of the month following the end of the quarter:

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

Due dates may change because the actual due date falls on a weekend or holiday. For example, if the last day of the month following the end of the quarter is a holiday or weekend, the due date will be the next business day.

Here are Quarterly Report Instructions for the Wyoming Quarterly UI/WC and UI Only Summary Report forms.

Good to Know!

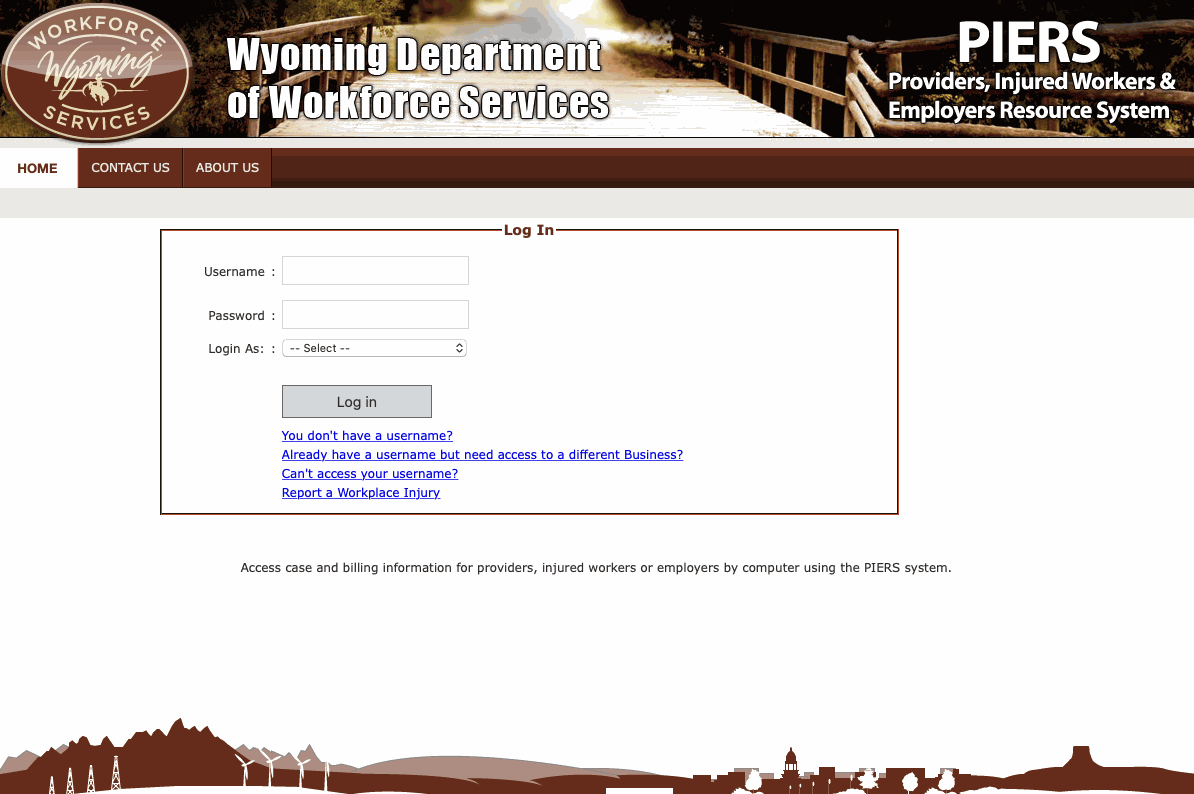

You can access case and billing information for providers, injured workers or employers by using the PIERS system.

Good to Know!

The taxable wage base in 2019 is $25,400 and new employer rates are based on classifications assigned by the Workers' Compensation Division NAICS Groupings.