USA State Payroll Rates + Resources: State of New Hampshire: Obtaining Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of New Hampshire. Specifically, we will be covering how to Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of New Hampshire's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

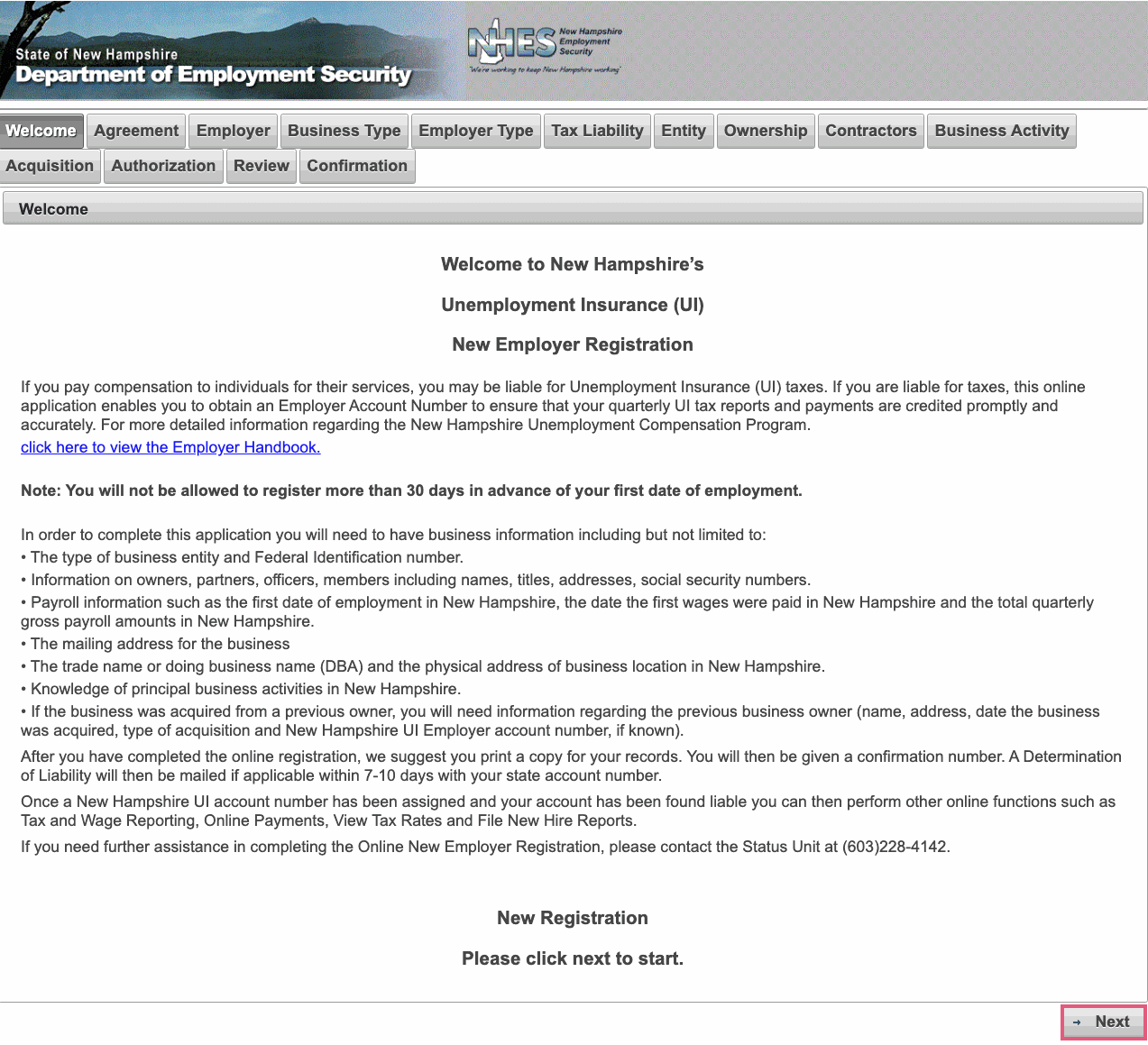

Registering for Unemployment Insurance

As an employing unit, you must file an Employer Status Report from the New Hampshire Department of Employment Security within 30 days of first providing employment in New Hampshire, or acquiring the assets of an existing employer.

When any of these standards have been met, based on the Employer Status Report you submit, you will be determined to be an employer in the State of New Hampshire and liable for Unemployment Insurance contributions.

NHES will send you a Determination of Liability and establish a separate account for you.

Once on the New Employer Registration web-site, click on the Next button complete the steps for registration.