USA State Payroll Rates + Resources: State of California: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of California. Specifically, we will be covering how to obtain a Payroll Tax Account Number which includes withholding (income) tax, and unemployment and state disability insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of California's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Important!

As California payroll tax requirements have many details and can be complex, make sure to review the 2019 California Employer's Guide.

Registering for Payroll Tax Account Number (Personal Income Tax and Unemployment & State Disability Insurance)

If you operate a business and employ one or more employees, you must register as an employer with the Employment Development Department (EDD) (withholding tax and unemployment tax). If you pay wages in excess of $100 in a calendar quarter, you have 15 days from when you made the payment to register with the EDD.

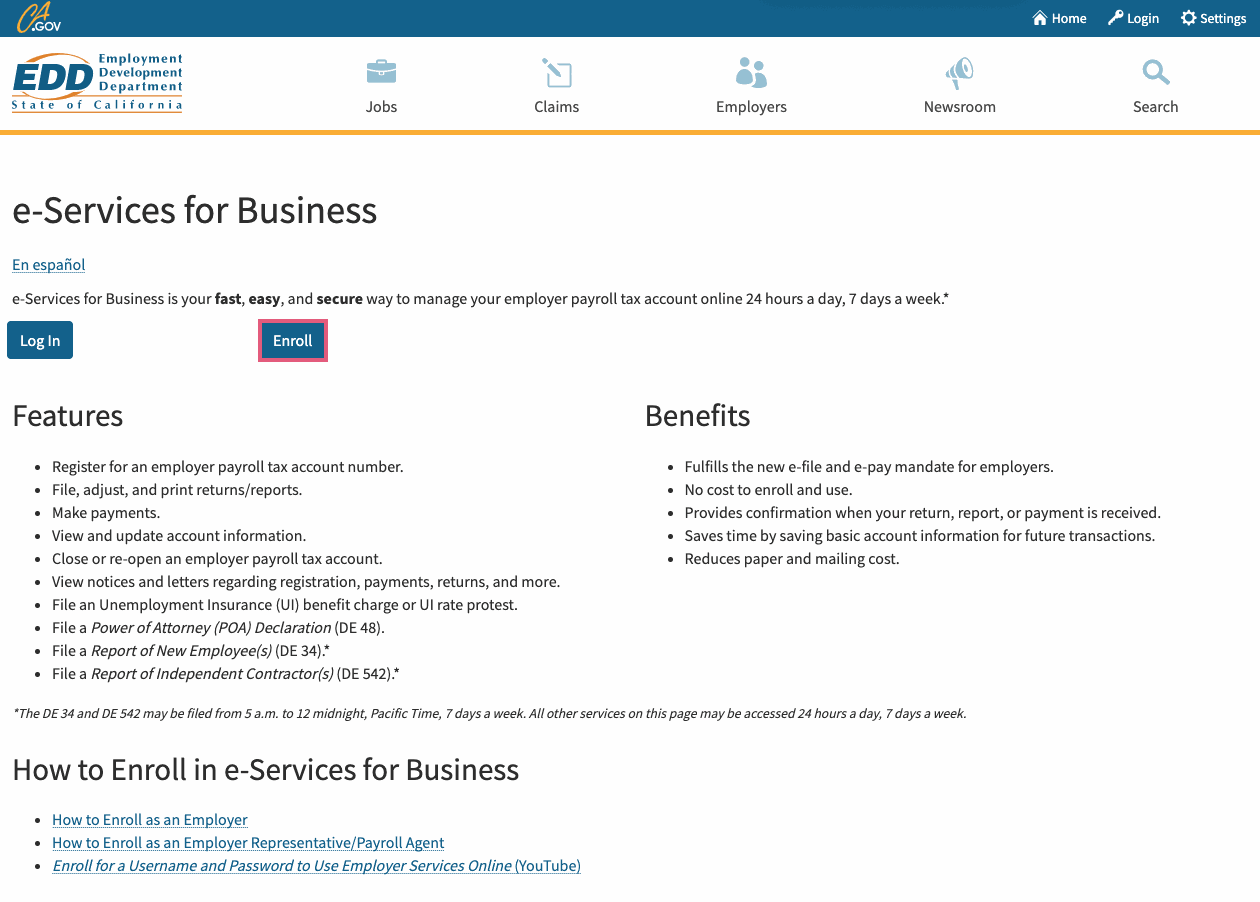

Use e-Services for Business to register for your employer payroll tax account number. Click on Enroll.

In most cases, an employer payroll tax account number is issued within a few minutes. e-Services for Business also fulfills the e-file and e-pay mandate and is a fast, easy, and secure way to manage your payroll tax account online 24 hours a day, 7 days a week.

The most common registration form is DE 1 Commercial (for profit commercial businesses).

For other business types, you can find registration forms here: www.edd.ca.gov/payroll_taxes/forms_and_publications.htm