USA State Payroll Rates + Resources: State of Maryland: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with Unemployment Insurance Reporting & Payments to the proper authorities in the state of Maryland.

Unemployment Insurance Reporting & Payments

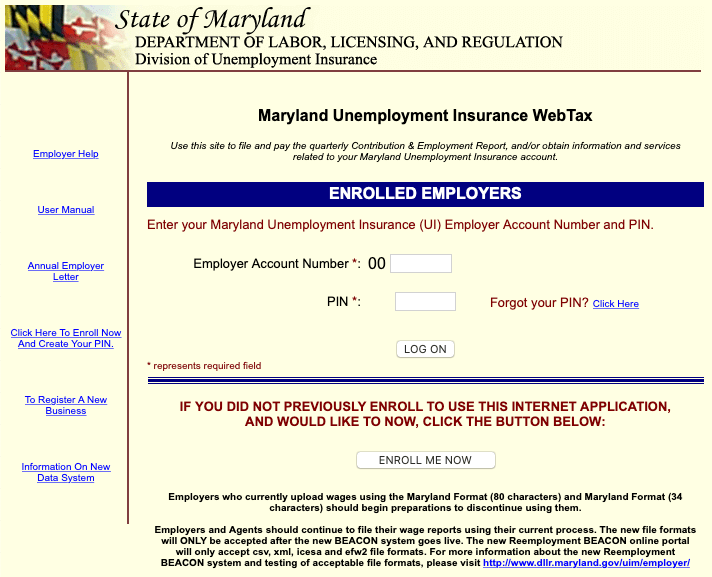

Employers are required to file their Quarterly Unemployment Insurance Contribution and Employment Reports electronically. Reports for the most recently completed calendar quarter and previous quarters due may be filed using the Maryland Unemployment Insurance WebTax web-site.

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |