USA State Payroll Rates + Resources: State of Utah: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Utah. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just Utah's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Income Tax Withholding Account and Unemployment Insurance

Good To Know!

If you have already registered for an income tax withholding account or unemployment insurance, skip down to the next section.

Unless the employee has filed a withholding exemption certificate, as the employer you must withhold Utah income tax if you:

Pay wages to any employee for work done in Utah.

Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state).

Make payments reported on 1099 forms.

You may be exempt from withholding if you do business in Utah for 60 days or fewer during a calendar year. Advance approval from the Tax Commission is required.

You are subject to the Employment Security (Unemployment) Tax if you meet any one of the following:

An individual or employing unit that employs one or more individuals for some portion of a day during a calendar year.

You acquired your business from an employer who was subject to this Act.

You are an officer of a corporation receiving remuneration for services rendered.

You are considered to be an employer subject to the Federal Unemployment Tax Act (FUTA). FUTA coverage is based upon the employer’s annual calendar year payroll. If an employer is subject to Utah law by virtue of being subject to FUTA, all payroll is subject and reportable in all quarters regardless of the payroll amounts.

You are an employer according to FUTA if you:

Paid wages of $1,500 or more in any calendar quarter, or

Employed one or more workers at any time in each of 20 calendar weeks.

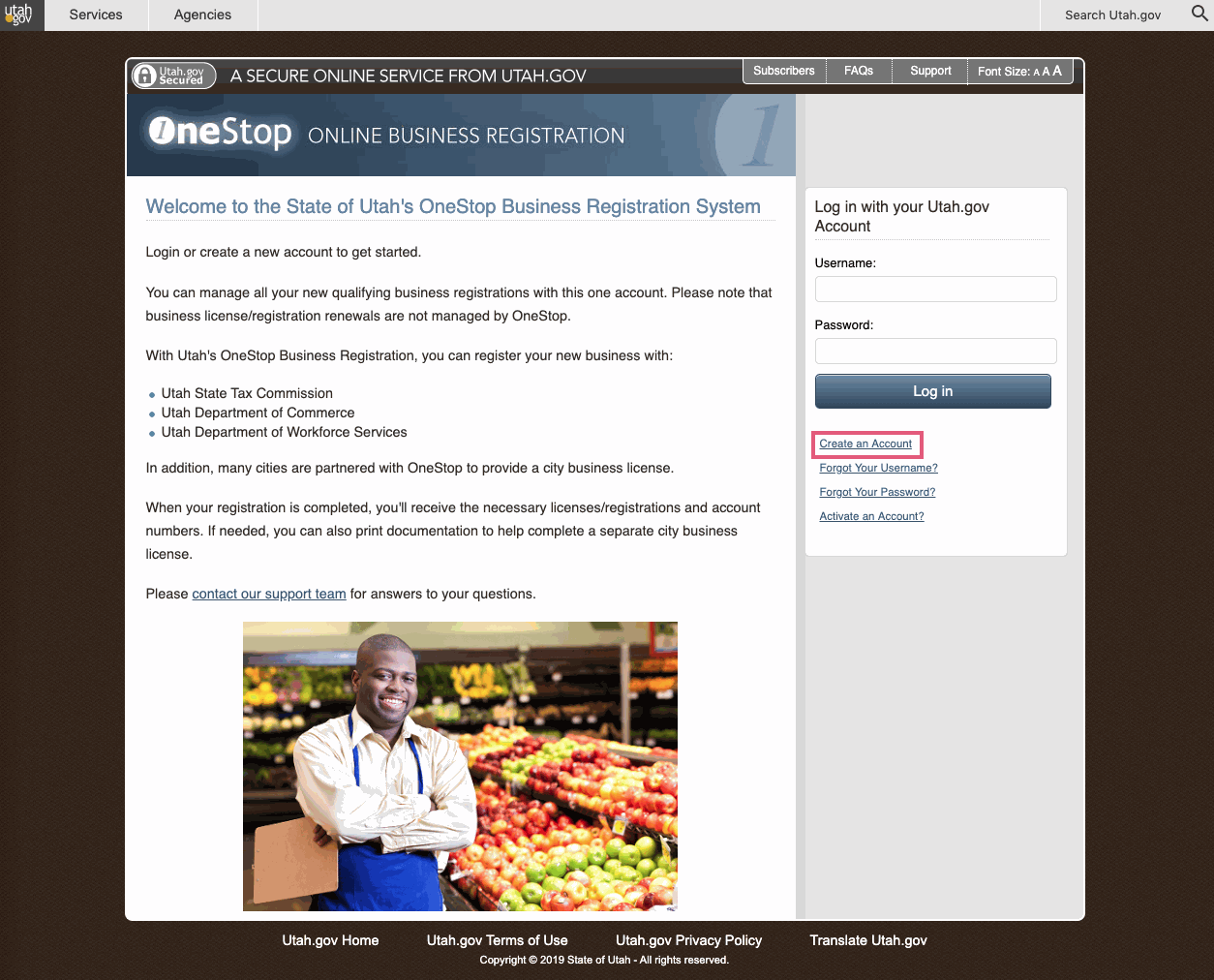

At OneStop Business Registration (OSBR), you can register for a Tax Commission (withholding) account and set up an unemployment insurance account with the Department of Workforce Services. Once there, click Create an Account and register for your account.