USA State Payroll Rates + Resources: State of Montana: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with Unemployment Insurance Reporting & Payments to the proper authorities in the state of Montana.

Unemployment Insurance Reporting & Payments

As a covered employer for Unemployment Insurance, you must keep payroll records, file UI quarterly wage reports and make timely payment of UI contributions. The state strongly encourages you to file your reports and make payments online at ePass Montana.

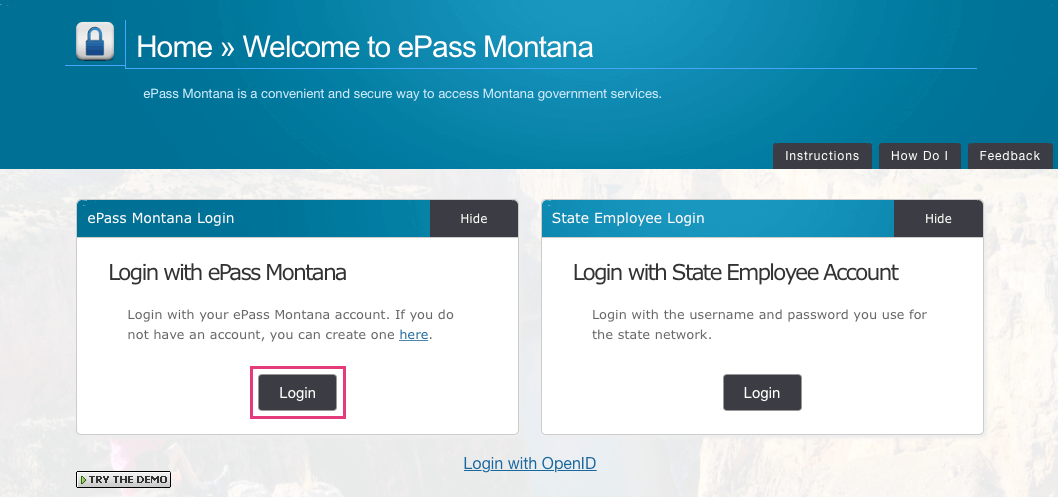

Click the Login and proceed using the credentials you created when registering your account.

If you are not filing and paying electronically, you may do so via a paper quarterly wage report, Form UI-5, and payment voucher.

For your reference, you can view a Sample UI-5 Form and Voucher.

The quarterly report and voucher will be mailed to you at the end of each quarter. The form contains your name, address, account number, rate, any credit balance and a barcode the will be used to capture this information when the report and voucher are returned.

It is important that you do not use someone else's form and payment coupon as the tax, wage, and payment information could be posted incorrectly and may not be properly credited to your account.

You must complete all sections of Form UI-5 and submit it with your payment voucher and payment payable to Unemployment Insurance Division for the tax (plus any penalty or interest due). Please do not staple your check to the voucher or UI-5 form.

To avoid penalty and interest charges, your quarterly wage report and payment must be submitted or postmarked by the following dates:

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

If the due date is on a weekend or holiday, the next business day becomes the date the quarterly reports and payment must be submitted.

For further details, see the Montana Department of Labor & Industry Employer Handbook.

Good to Know!

Montana's 2019 taxable wage base is currently $33,000. There are 10 new employer rate classifications and rates.