USA State Payroll Rates + Resources: State of Mississippi: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes, and requirements associated with becoming a new employer in the state of Mississippi. Specifically, we will cover how to get a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Mississippi's requirements. Click here or a basic (not all-inclusive) IRS checklist for Starting a New Business.

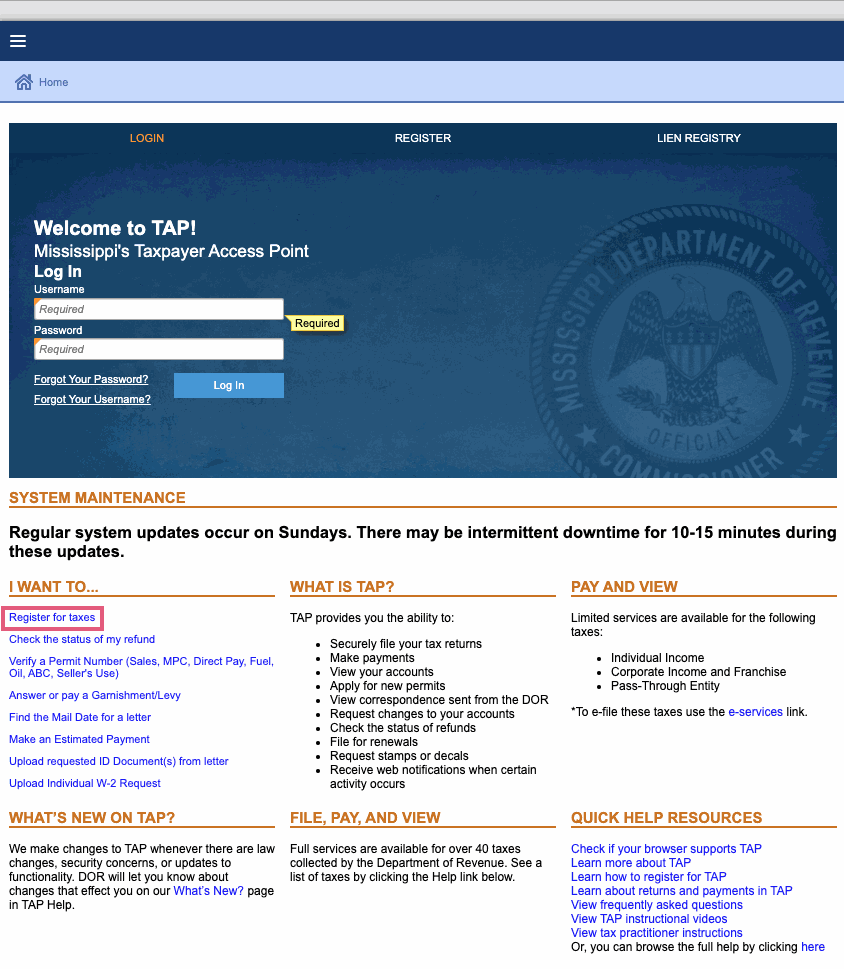

Registering for Withholding Tax

Good to Know!

If you already have a state of Mississippi withholding tax account, skip to the next section.

Every employer engaged in business, licensed to do business, or transacts business in Mississippi or who pays wages to a Mississippi resident (regardless of where the services are performed), or pays wages to a non-resident (persons domiciled outside of Mississippi) for services performed in Mississippi must register for a Withholding Tax account.

Applications for registration may be made online through Taxpayer Access Point (TAP) and clicking on Register for taxes.

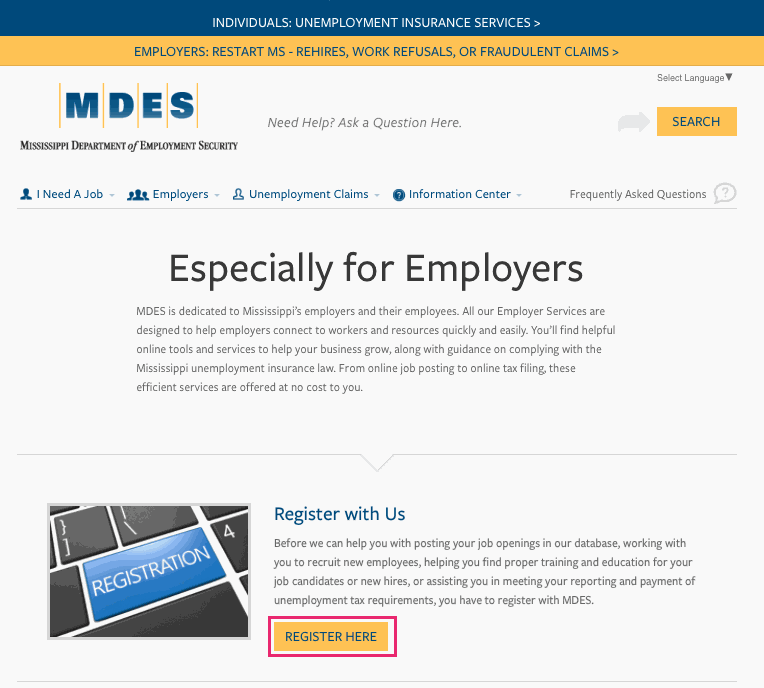

Registering for Unemployment Insurance and New Employer Services

Upon payment of $1,000 in wages in a calendar quarter, you must register with the Mississippi Department of Employment Security. Click on register here.