USA State Payroll Rates + Resources: State of Pennsylvania: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with Unemployment Insurance Reporting & Payments to the proper authorities in the state of Pennsylvania.

Unemployment Insurance Reporting & Payments

Employers covered by the Pennsylvania (PA) UC Law are required to file reports and remit contributions on a quarterly basis. The reports and contributions are due at the end of the month following the calendar quarter.

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

If a due date falls on a Saturday, Sunday, or legal holiday, the report will become due on the next business day.

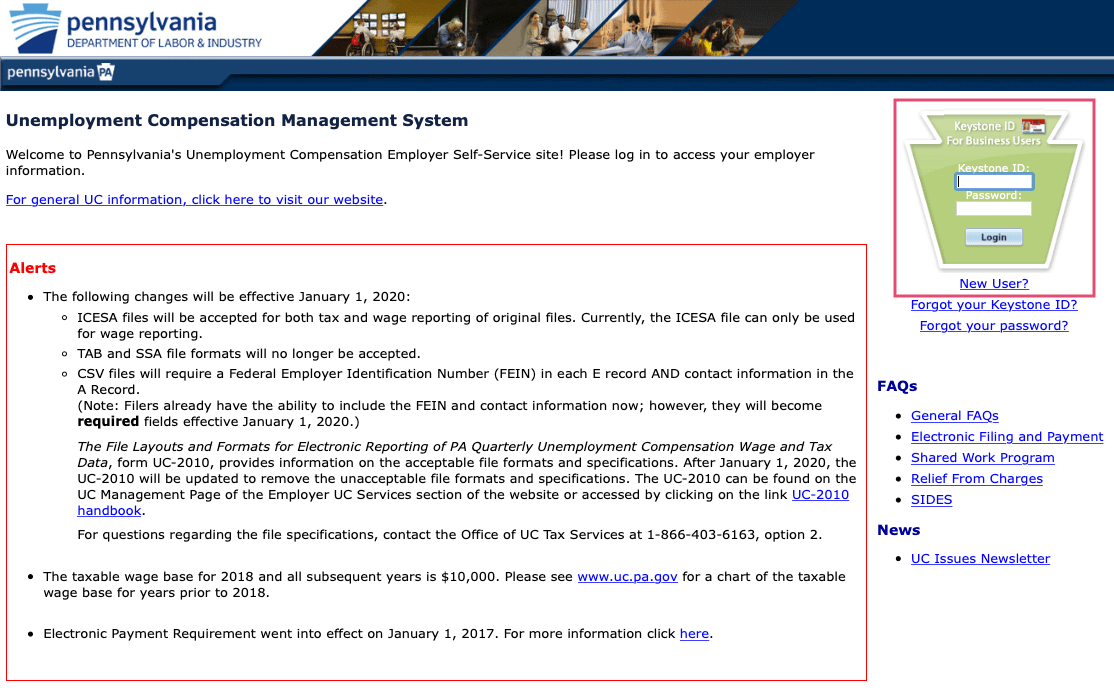

Department of Labor & Industry requires that employers file unemployment compensation (UC) quarterly reports electronically through the Unemployment Compensation Management System (UCMS).

You'll need a Keystone ID for Business Users to utilize this system. If you don't have an id, click the New User? link and create an account. Otherwise, use the on-page form to log in.

For more details, see the Employer's Reference Guide To Unemployment Compensation.