USA State Payroll Rates + Resources: State of Georgia: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with Unemployment Insurance Reporting & Payments to the proper authorities in the state of Georgia.

Unemployment Insurance Reporting & Payment

All employers who are liable for unemployment insurance (UI) must file an Employer's Quarterly Tax and Wage Report Form DOL-4N for each quarter they are in business. The reports and any payment are due at the end of the month following the end of each calendar quarter as shown below:

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

Tax and wage reports may be filed using the following methods:

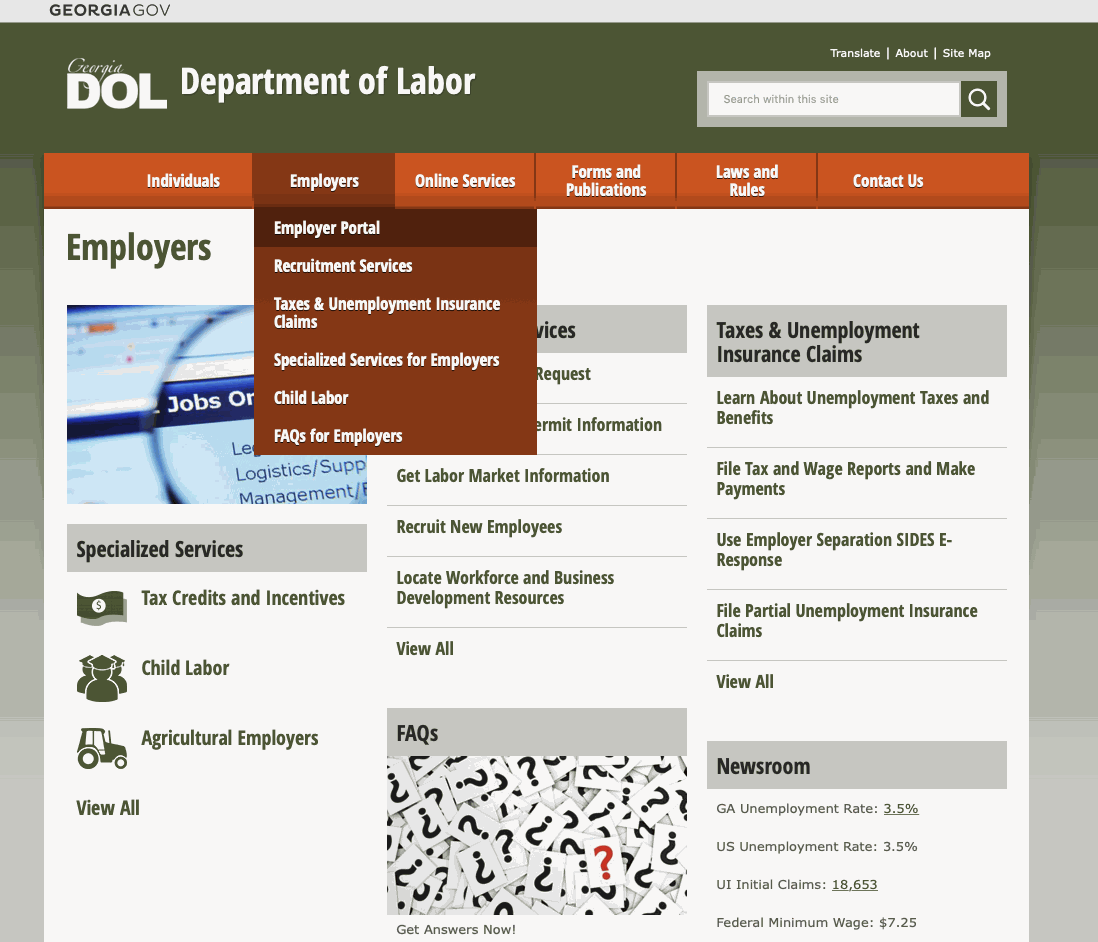

Online: Through the Employer Portal.

USB/CD-Rom: By following the magnetic media instructions on page 4.

Mail: By completing and mailing Form DOL-4N.

For further details, see the Employer Handbook.