USA State Payroll Rates + Resources: State of New York: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of New York. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of New York's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Income Tax Withholding and Unemployment Insurance

When you hire employees or buy a business that already has employees who will now be working for you, you must register with New York State. You can register by:

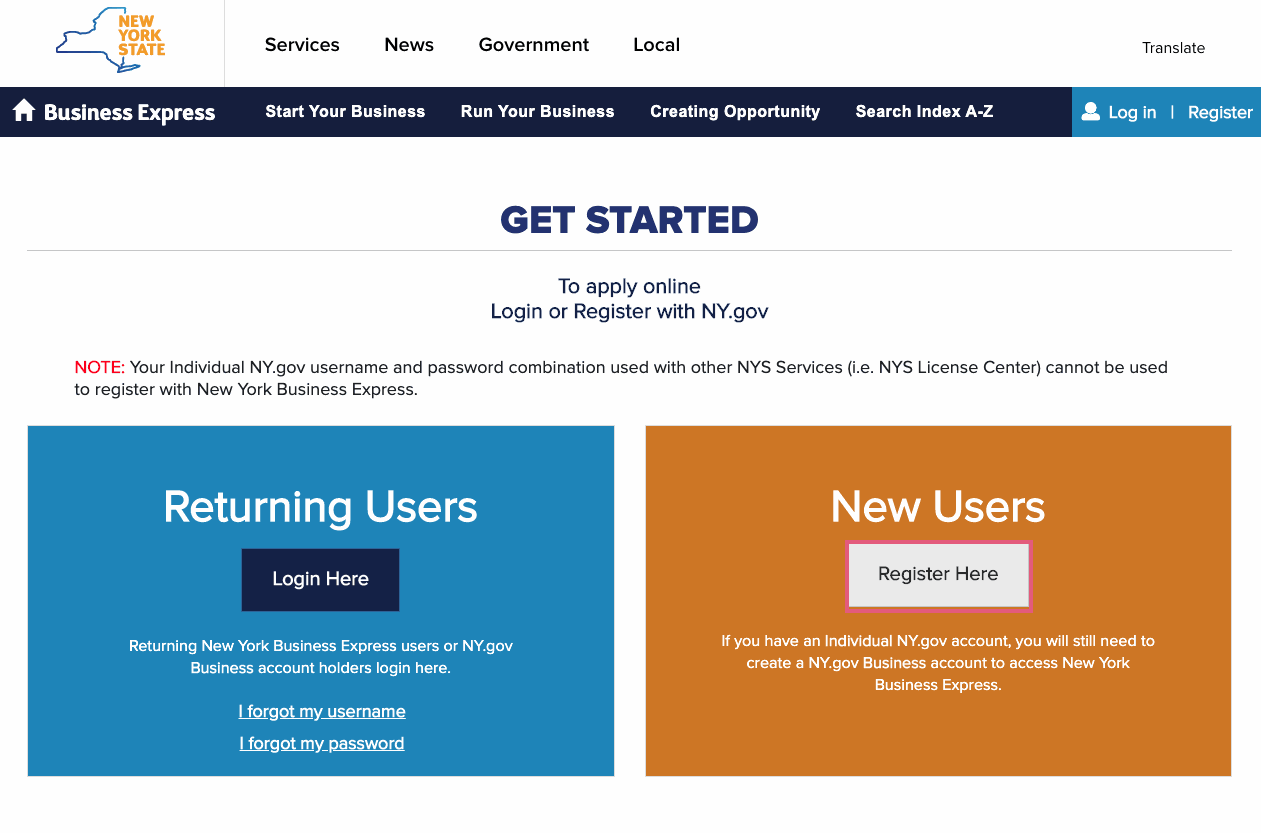

Applying online through New York Business Express (click on Register Here under New Users)

Filling out the form, Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Business Employer (NYS 100) and using the instructions on the form to file it with the NY Department of Labor.