USA State Payroll Rates + Resources: State of Washington: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes, and requirements associated with becoming a new employer in the state of Washington. Specifically, we will cover how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just Washington's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Unemployment and Workers' Compensation Insurance Account

Good to Know!

If you have already registered for a withholding/payroll tax account, skip to the next section.

If you have employees in Washington, you must register with the Employment Security Department to file quarterly wage reports and pay unemployment insurance taxes and open a workers' compensation account.

When you apply for a business license through Business Licensing Service and check the boxes to indicate you have or plan to hire employees, information from your Business License Application will be forwarded to the Employment Security Department to set up a state unemployment tax account and the Department of Labor & Industries to set up a workers’ compensation insurance account. They register your business and send you a letter letting you know that your business is now registered with the Department. The letter includes instructions for filing wage reports and paying taxes.

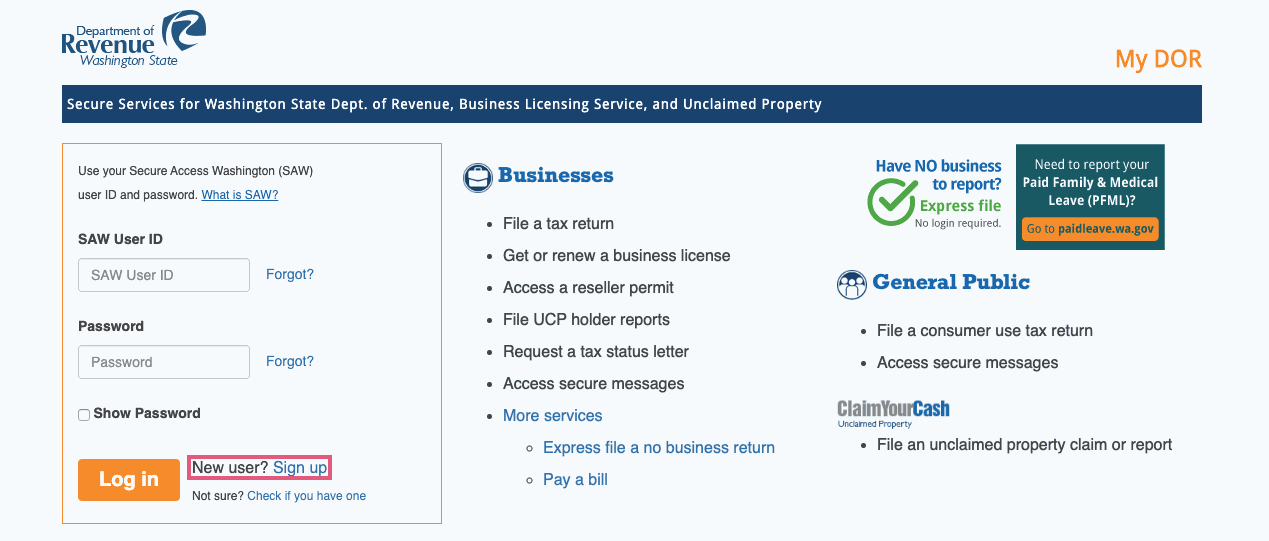

On the Business Licensing Service website, you can either file online with the Washington State Department of Revenue (click on Sign up next to New user?) or by mail with a Business License Application.