USA State Payroll Rates + Resources: State of Colorado: New Hire Reporting

Purpose

The purpose of this documentation is to outline the processes and requirements associated with reporting new hires in the state of Colorado.

New Hire Reporting

The reporting must take place within 20 calendar days after the date of hire or by the first regularly scheduled payroll following the date of hire, if such payroll is after the expiration of the 20-day period.

If reporting electronically, the employer must transmit twice per month, no fewer than 12 and no more than 16 days apart.

Rehired employees: If the employee returning to work is required to complete a new W-4 form, or has been separated from your employment for at least 60 consecutive days, you should report the individual as a new hire.

You will need the following information for each new hire:

Employee name

Address

Social Security Number

Date of birth

Date of hire—Date of hire is considered to be the first day that services are performed for wages by an individual.

Payroll address

Federal identification number (FEIN)

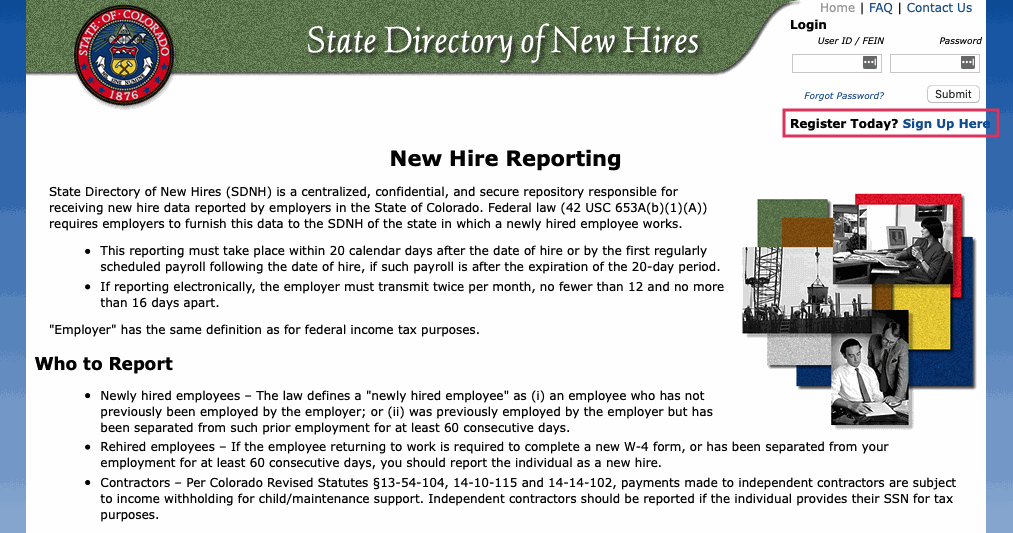

You can report new hires in several ways. The fastest way is through the Colorado State Directory of New Hires website. Once there, click Sign Up Here.

You also have the option to submit the reports via diskette, magnetic media, or cartridge. Contact [email protected] for formatting requirements.

You can also fill out the Colorado State Directory of New Hires form or a W-4 and mail or fax it to the following address:

Colorado State Directory of New Hires

P.O. Box 2920

Denver, CO 80201-2920

Fax: (303) 297 2595

For further information, please refer to the Frequently Asked Questions page or the State Directory of New Hires homepage or contact the directory at (303) 297 2849 or 1(800) 696 1468.