USA State Payroll Rates + Resources: State of Louisiana: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Louisiana. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Louisiana's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Employer Income Tax Withholding

Good to Know!

If you have already registered for Louisiana's Employer Income Tax Withholding, skip to the next section.

Every employer who has resident or nonresident employees performing services (except employees exempt from income tax withholding) within Louisiana is required to withhold Louisiana income tax based on the employee's withholding exemption certificate.

Wages of Louisiana residents performing services in other states are subject to withholding of Louisiana income tax if the wages are not subject to withholding of net income tax by the state in which the services are performed.

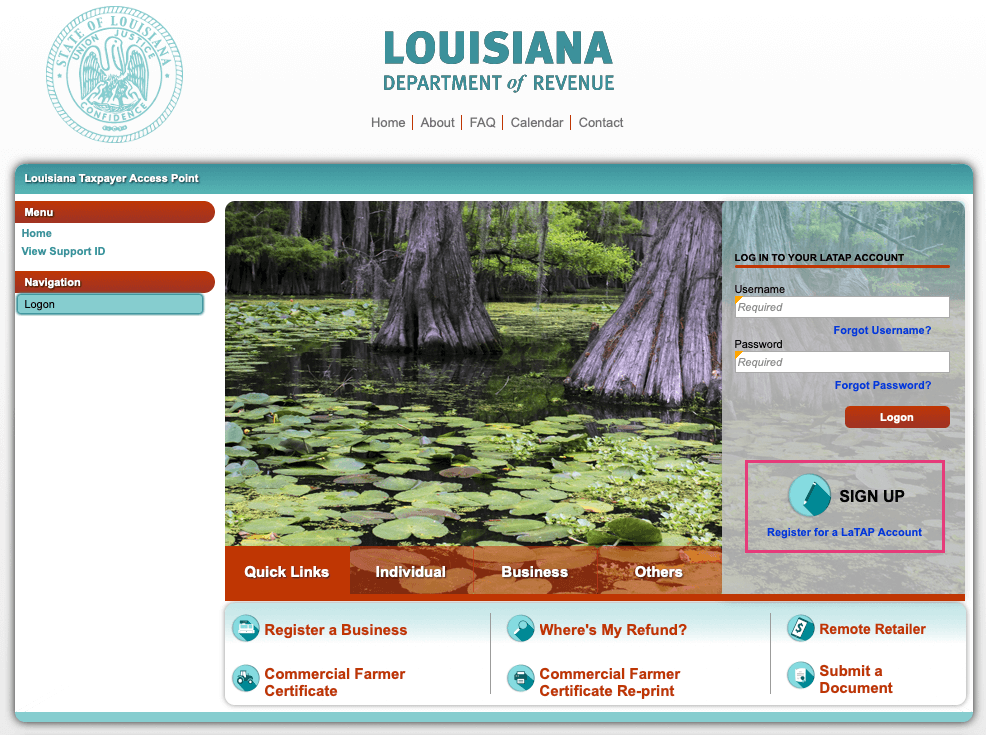

New employers can register online at the Louisiana Department of Revenue Louisiana Taxpayer Access Point (LaTAP). If you don't have a LaTAP account, click on Register for LaTAP Account. You can also register by filling out and filing Form R-16019. Filing instructions are on the form.

Registering for Unemployment Insurance

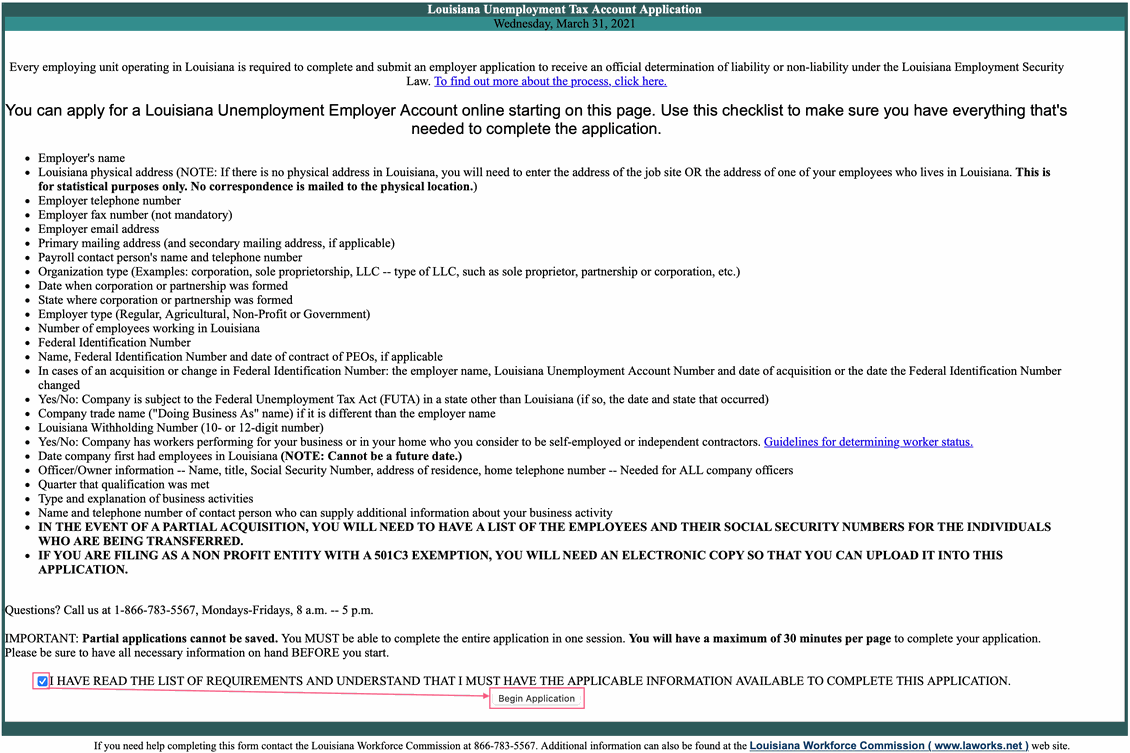

Every employing unit operating in Louisiana is required to complete and submit an Employer Application to receive an official determination of liability or non-liability under the Louisiana Employment Security Law at the Louisiana Workforce Commission Louisiana Unemployment Tax Account Application.

On this page, as shown below, you'll need to read and agree that you have all the information required, then click Begin Application.

Note: Printed forms will not be accepted.

Good to Know!

The 2022 taxable wage limit is $7,700. The new employer’s rate is based on the ratio between their reserve-balance compared to their average annual taxable payroll. To review the formula, please use the 2021 Unemployment Insurance Rate Table.