USA State Payroll Rates + Resources: State of Alabama: Obtaining a TIN + Unemployment Insurance

Purpose

This document outlines the processes and requirements associated with becoming a new employer in the state of Alabama. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Alabama's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Obtaining a New Tax Account Number

Good to Know!

If you already have a state of Alabama New Tax Account Number, skip to the next section.

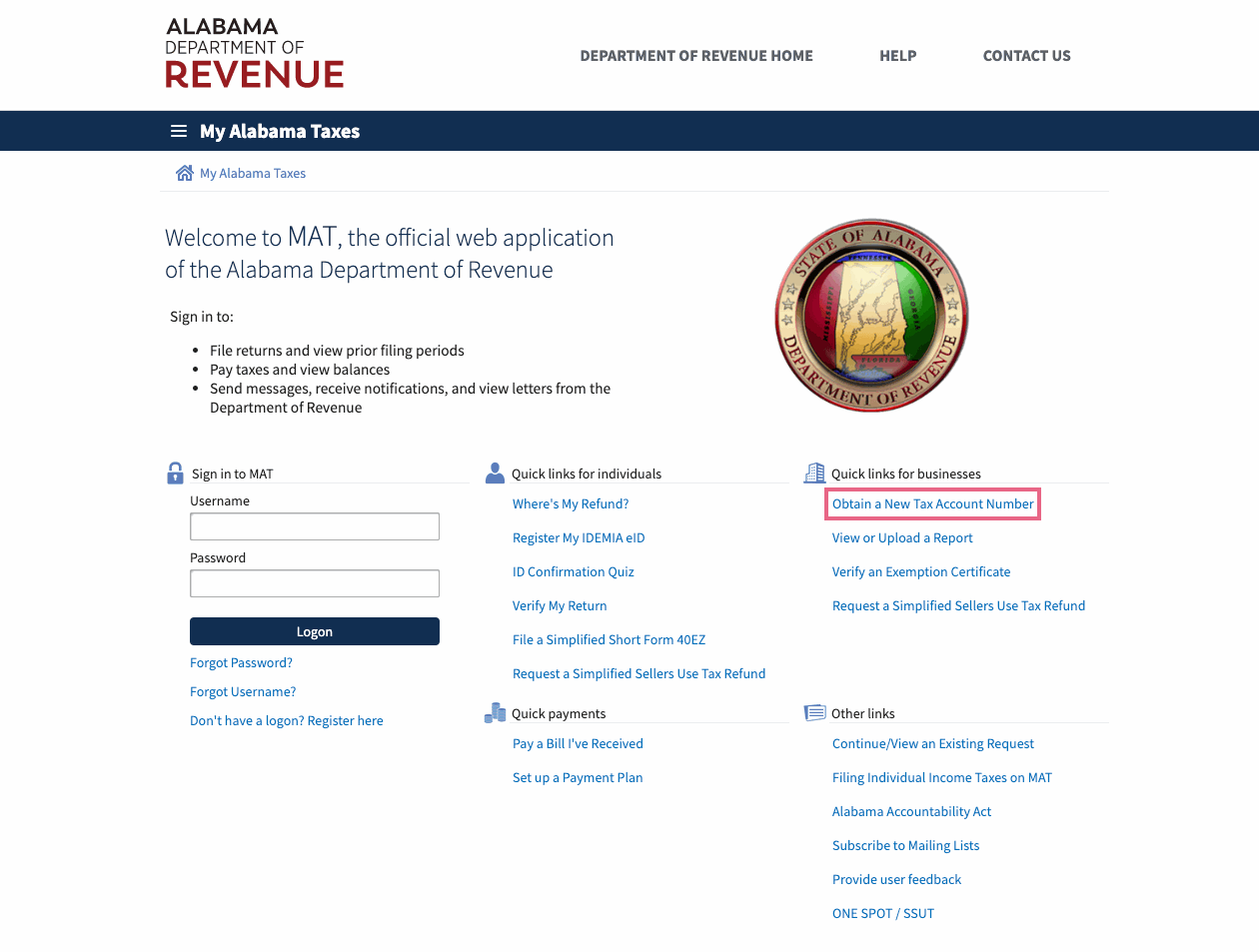

Companies that pay employees in Alabama must register with the Alabama Department of Revenue using My Alabama Taxes (MAT). Once there, click on Obtain a New Tax Account Number under Quick Links for businesses.

Follow the instructions to complete Taxpayer/Account Registration.

Once you register online, it takes 3-5 days to receive an account number. You can read full instructions on how to register select tax types through My Alabama Taxes Help.

Registering for Unemployment Insurance

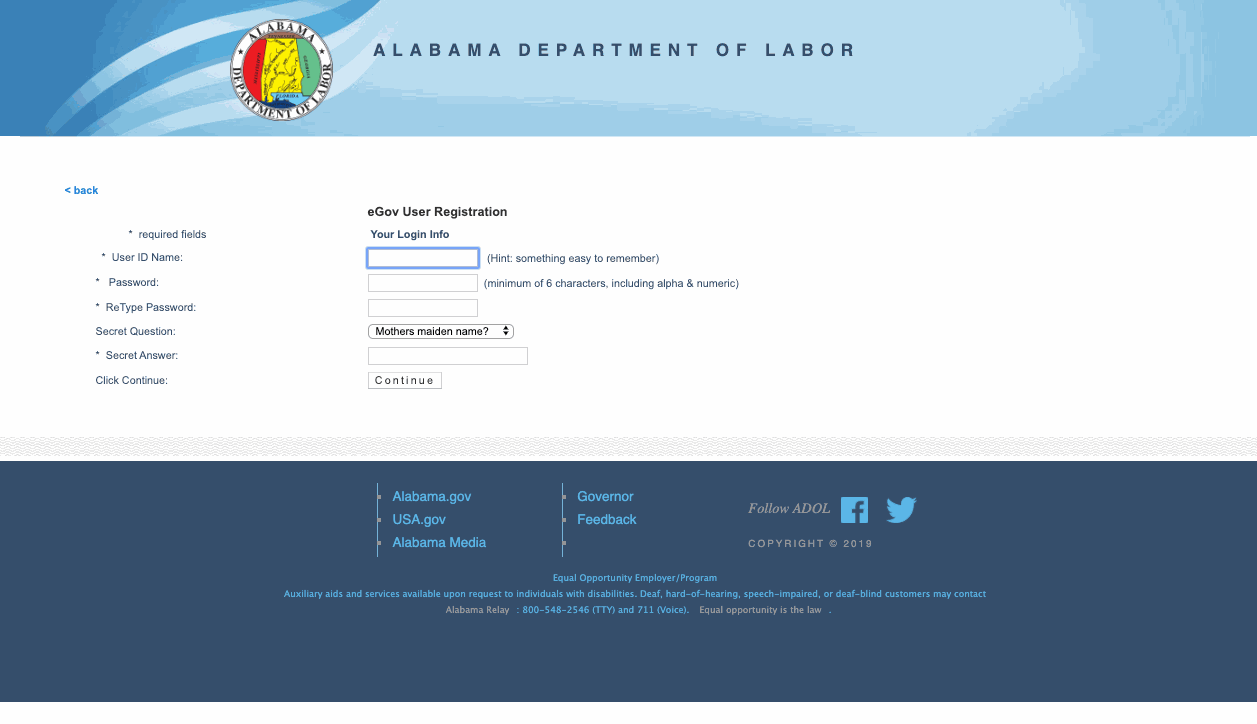

Before you can register for unemployment insurance, you first need an eGov User Registration from the Alabama Department of Labor. Enter a User ID Name, Password, select a Secret question, enter a Secret Answer and then click Continue.

The Alabama Department of Labor will collect basic employer information that will aid in accessing available applications.