USA State Payroll Rates + Resources: State of Tennessee: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with submitting unemployment insurance reports and submitting unemployment insurance payments in the state of Tennessee.

Unemployment Insurance Reporting & Payments

The Wage and Premium Report and any premiums due are submitted to the Department of Labor & Workforce Development quarterly and are due within one month after the end of each calendar quarter.

Due dates:

| 1st Quarter | January - March | Due April 30th |

| 2nd Quarter | April - June | Due July 31st |

| 3rd Quarter | July - September | Due October 31st |

| 4th Quarter | October - December | Due January 31st |

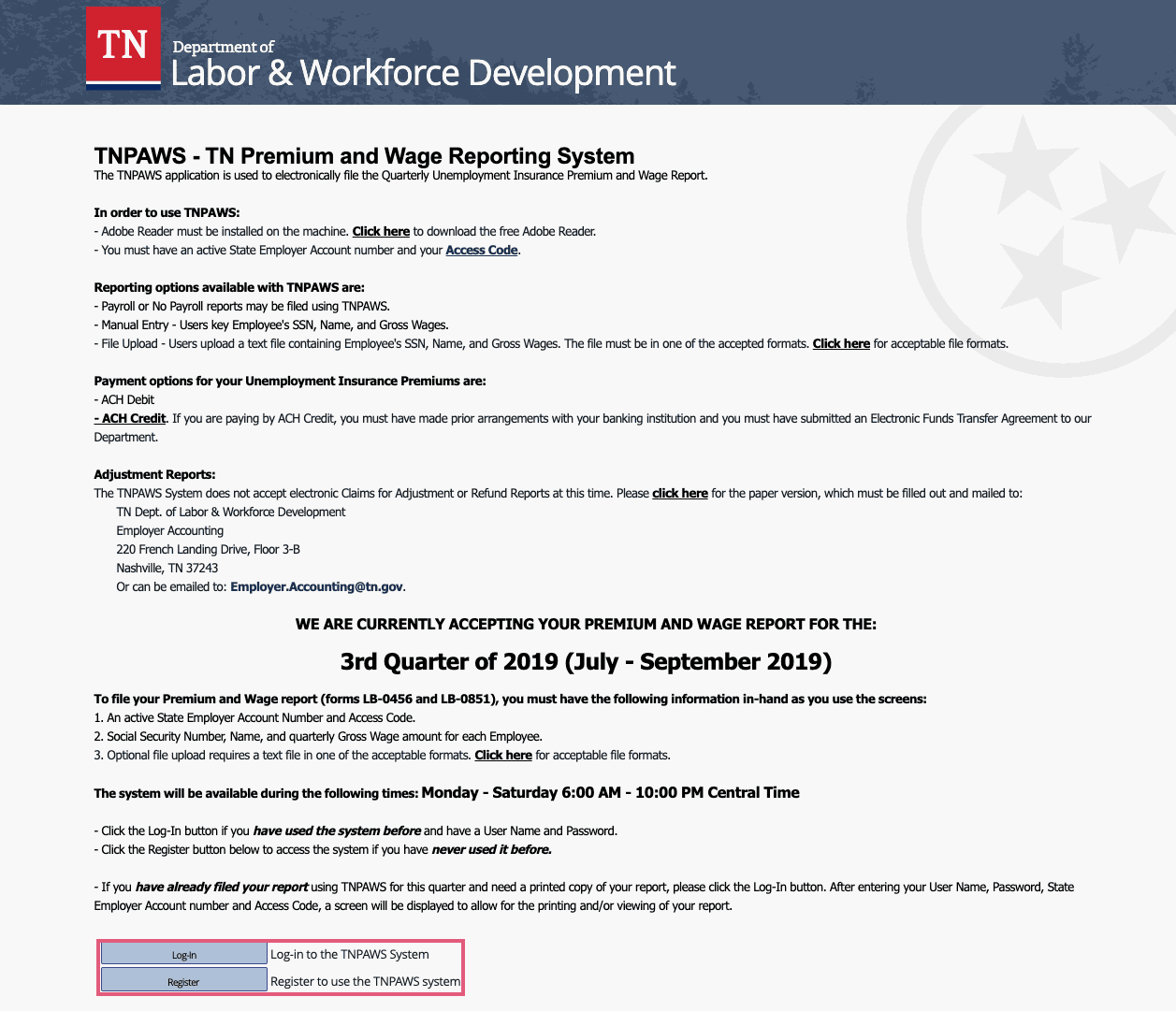

Tennessee Employment Security law requires employers to file their quarterly Wage and Premium Report electronically via Tennessee Premium and Wage Reporting System (TNPAWS).

If you are a new user to the site, click Register on the bottom of this page and create your account.

For further information, see the Handbook for Employers.