USA State Payroll Rates + Resources: State of New Jersey: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of New Jersey. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of New Jersey's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Register for Taxes and Unemployment Insurance

If you are doing business in New Jersey, you must register for tax purposes by completing Form NJ-REG.

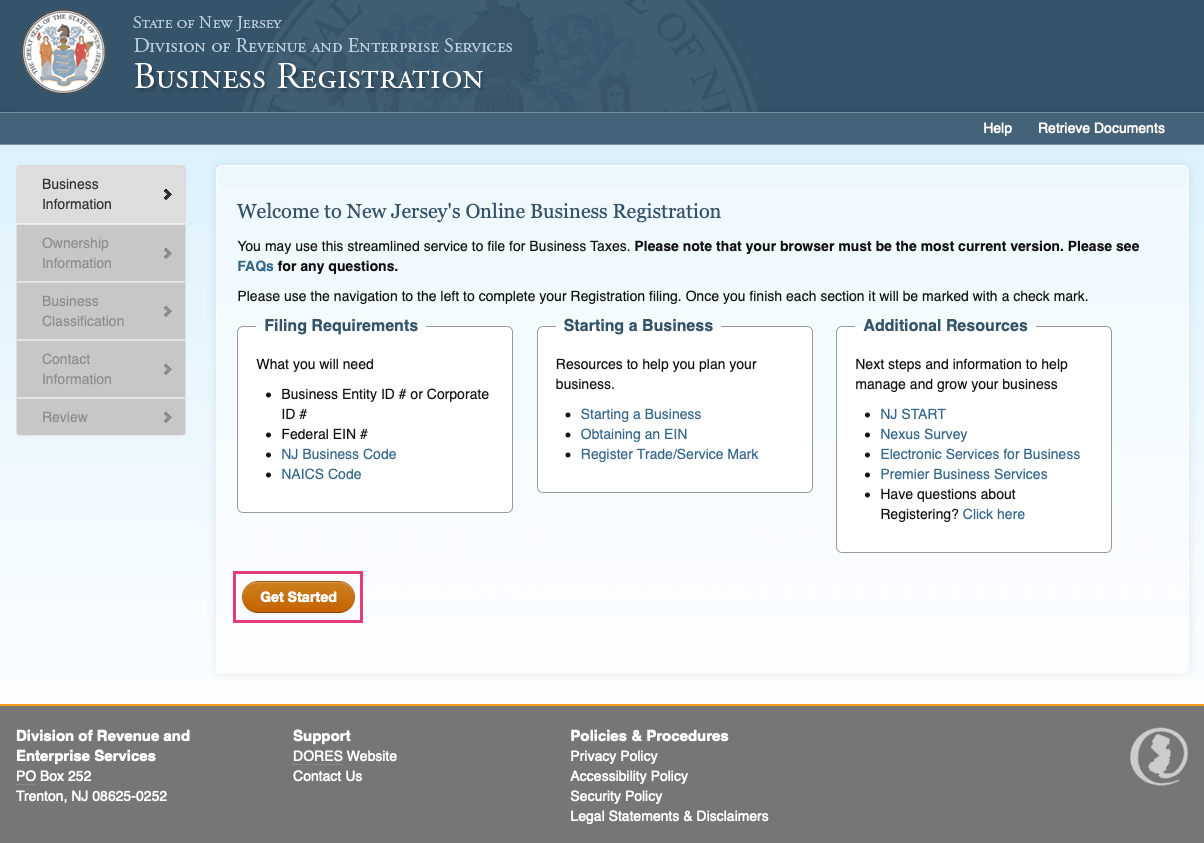

This form may be completed online via the New Jersey Division of Revenue and Enterprise Services.

From this site, click the Get Started button.

Once you have registered, your business will receive forms, returns, instructions, certificates and other information required for on-going compliance with New Jersey State taxes. Many of the filings for the business will be able to be completed online.