USA State Payroll Rates + Resources: State of Michigan: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Michigan. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Michigan's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Employer Income Tax Withholding

Good to Know!

If you have already registered for Michigan Income Tax Withholding, skip to the next section.

Every employer in Michigan who is required to withhold federal income tax under the Internal Revenue Code, must be registered for and withhold Michigan income tax.

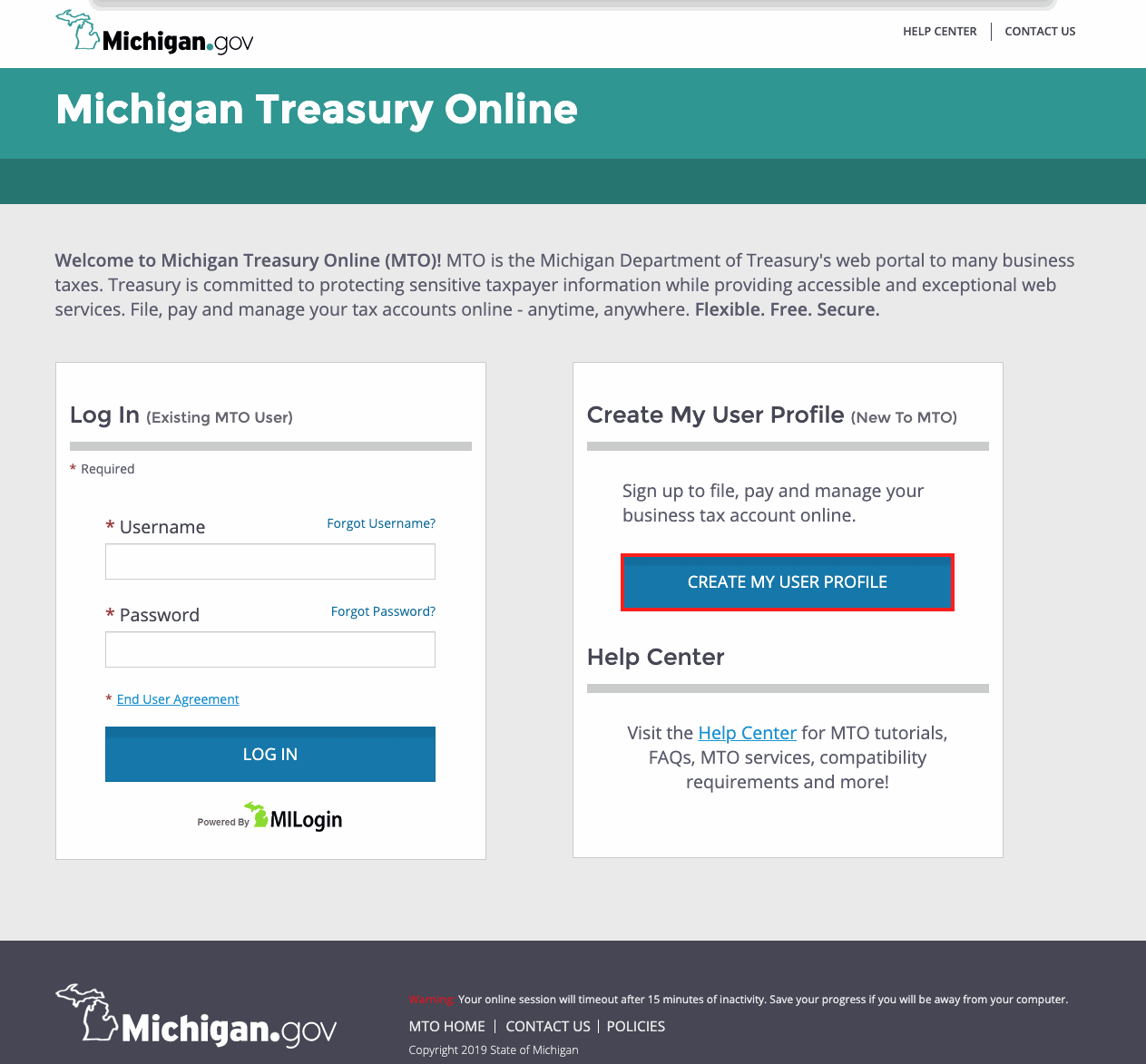

You can E-Register via Michigan Treasury Online. For a new account, click on CREATE MY USER PROFILE. E-Registration applications are processed within 5-10 minutes of submission.

Alternatively, you can fill out and mail Form 518, Registration for Michigan Taxes, and send to:

Michigan Department of Treasury

PO Box 30778

Lansing, MI 48909

Fax: 517 636-4491

Please allow six weeks for the processing of a paper registration application.

Good To Know!

Form 518, Registration for Michigan Taxes will also register you for an Unemployment Insurance account.

Registering for Unemployment Insurance

You can complete a new employer registration form on-line by going to the State of Michigan Web Account Manager (MiWAM) Employer Registration and then click on Start eRegistration.