USA State Payroll Rates + Resources: State of Maryland: Filing State Income Taxes, W2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with filing state income taxes as well as how to file W-2s and 1099s, if needed, in the state of Maryland.

State Income Tax Withholding

The amount of withholding is determined based on the information provided on the Maryland Form MW507.

Retain this certificate with your records. You are required to submit a copy of this certificate and accompanying attachments to the Compliance Division, Compliance Programs Section, 301 West Preston Street, Baltimore, MD 21201-2326, when received if:

You have any reason to believe this certificate is incorrect;

The employee claims more than 10 exemptions;

The employee claims an exemption from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week;

The employee claims an exemption from withholding on the basis of nonresidence; or

The employee claims an exemption from withholding under the Military Spouses Residency Relief Act.

Upon receipt of any exemption certificate (Form MW507), the Compliance Division will make a determination and notify you if a change is required.

Once a certificate is revoked by the Comptroller, the employer must send any new certificate from the employee to the Comptroller for approval before implementing the new certificate. If an employee claims an exemption under 3 above, a new exemption certificate must be filed by February 15th of the following year.

If on any day during the calendar year, the number of withholding exemptions that the employee is entitled to claim is less than the number of exemptions claimed on the withholding exemption certificate in effect, the employee must file a new withholding exemption certificate with the employer within 10 days after the change occurs.

State Income Tax Withholding Reporting and Deposits

For filing and payment purposes, employers will fall into one of the five types of filing categories:

| Frequency | Withholding thresholds | Due Date |

| Accelerated | $15,000 or more for the preceding calendar year AND $700 or more of current accumulated withholding. | 3 business days following the pay date, where you withheld the $700 +. |

| Quarterly | Less than $700 of withholding per quarter and are required to remit the tax withheld quarterly. | 15th of the month following the end of the quarter |

| Monthly | More than $700 of withholding in any one quarter who are required to remit the tax withheld monthly. | 15th of the following month |

| Annually | Less than $250 withholding per calendar year | January 31st of the following year |

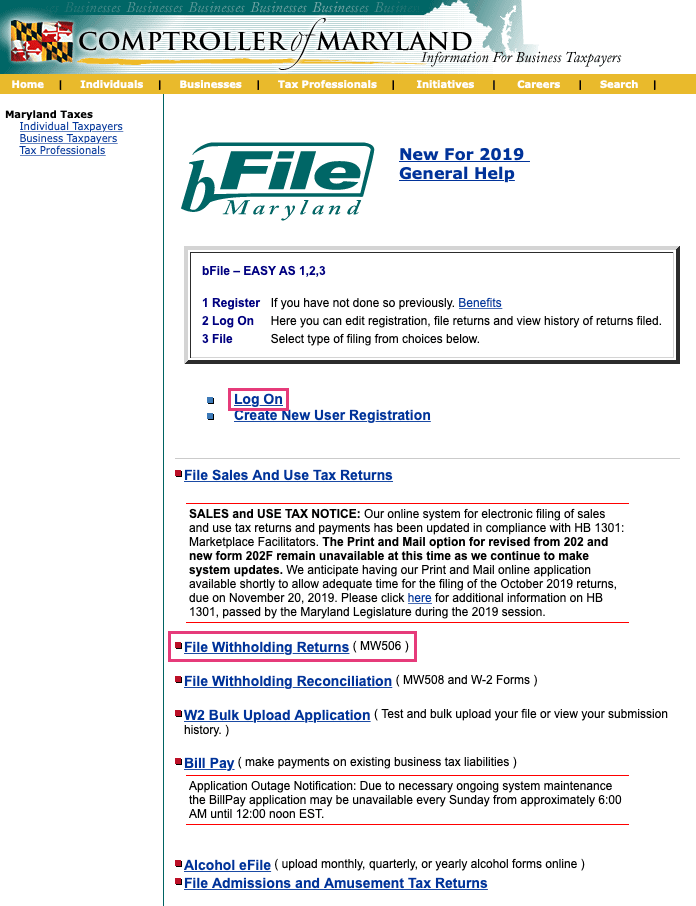

All employers are required to file and pay Employer's Return of Income Tax Withheld (MW506) online at bFile.

Click on File Withholding Returns after logging in.

W-2 and 1099 Forms

W-2 Forms

The state of Maryland has very specific instructions on how to properly complete a W-2 form. See page 7 of the Maryland Employer Withholding Guide.

On or before January 31st of each year, employers must file a year-end reconciliation to the Revenue Administration Division using Form MW508.

Filing 25 or More W-2s:

Employers who have 25 or more W-2s to report are required to file electronically at bFile.

Filing Less Than 25 W-2s:

Employers who have fewer than 25 W-2s to report may use paper filing, however, we encourage all employers regardless of the number of statements to file electronically.

If you are not required to report electronically by federal or Maryland law and do not wish to submit individual wage and tax statements, using federal Form W-2 (copy 1), the Revenue Administration Division will accept a computer printout provided it contains all of the following information:

Employer name

Employer address

Employer Central Registration Number and Federal Employer Identification Number (FEIN)

Employee name

Employee address

Employee Social Security Number

Employee gross earnings

Employee Maryland earnings

Amount of Maryland state and local tax withheld from the employee (one figure)

The printout should list the employee’s names in alphabetical order or Social Security number order. Employers reporting on computer printouts are still required to furnish each employee with the annual wage and tax statement, or federal Form W-2, for reporting salaries and wages for Maryland tax withheld on the employee’s individual tax returns.

1099 Forms

The reporting of 1099 withholding on the MW508 may be submitted by magnetic media or paper.

If submitting 25 or more 1099s, you are required to file by magnetic media. To obtain a complete copy of The Magnetic Media Specification Booklet please the Maryland Taxes website.

For paper filing, see above in the W-2 section.

For further details, see the Maryland Employer Withholding Guide.