USA State Payroll Rates + Resources: State of Idaho: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Idaho. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Idaho's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Employer Income Tax Withholding and Unemployment Tax

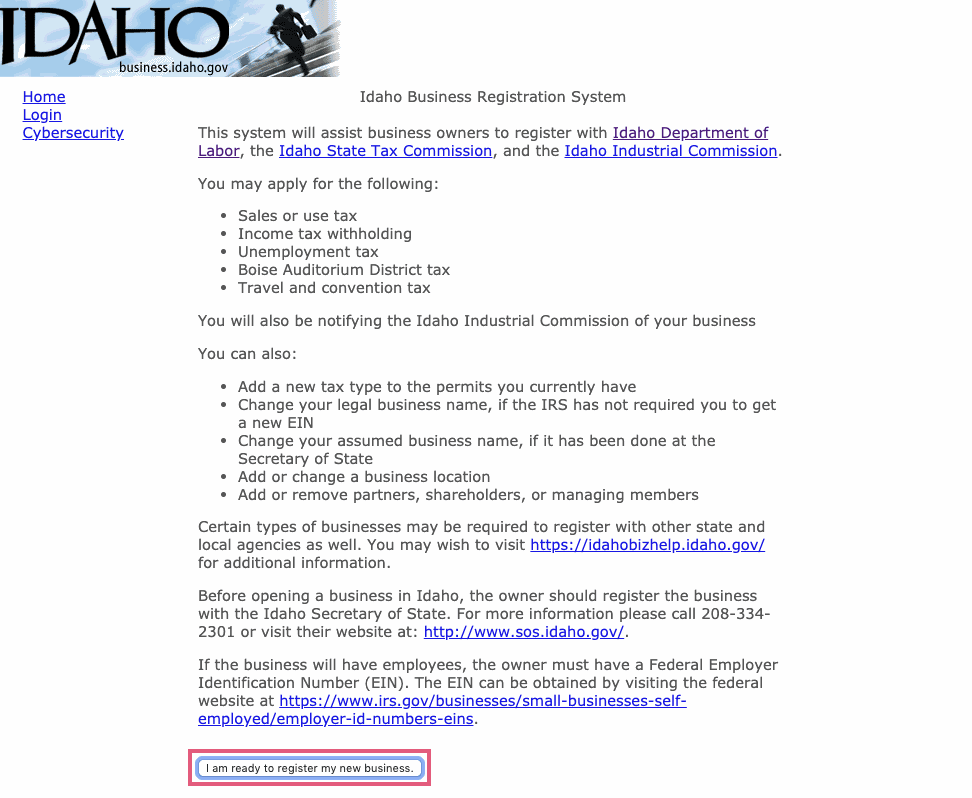

You must have an Idaho withholding account if you have an employee earning an income while living in Idaho. To apply, go to the online Idaho Business Registration (IBR) application. Click on "I am ready to register my new business."