USA State Payroll Rates + Resources: State of Maine: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the State of Maine. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Maine's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for an Income Tax Withholding Account

Good to Know!

f you have already registered for a new Income Tax withholding account, skip to the next section.

Any person who maintains an office or transacts business in Maine and who is required to withhold federal income tax from a particular payment must also withhold Maine income tax unless the payment constitutes income that is excluded from taxation under Maine law.

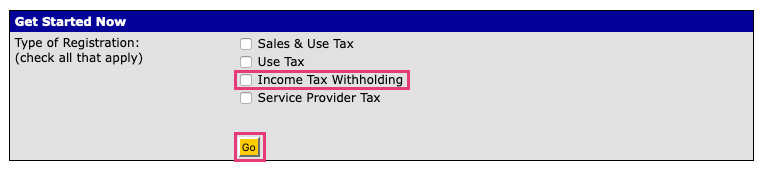

Businesses can register with Maine Revenue Services for Service Provider Tax, and/or Income Tax Withholding accounts. There is no fee to use this online service and you may register at any time, 24 hours a day.

To register, scroll down to the Get Started Now section, check Income Tax Withholding, and then click the Go button.

To complete a paper application, download the printable form.

Registering for an Income Tax Withholding Account

When you first become an employer in the State of Maine, you must request and file an application for tax registration and report your newly hired employee(s).

If you pay $1500 in a quarter in either the previous or current year or, if you employ one or more individuals for 20 calendar weeks in either the previous or current calendar year, (the weeks do not have to be consecutive nor does it have to be the same person employed) you are considered a new employer.

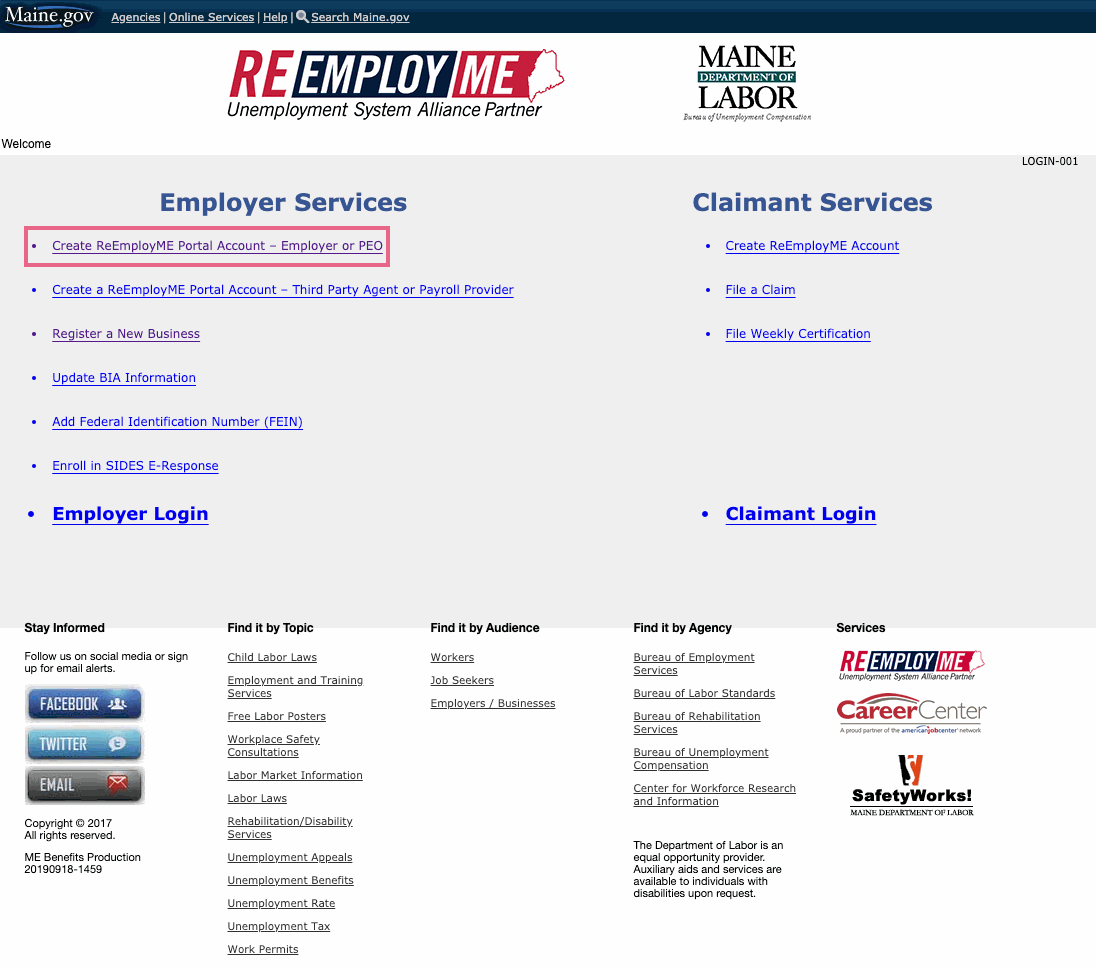

The Maine Department of Labor has developed and implemented a secure and modernized application, ReEmployME, to support the unemployment insurance tax division operations.

Through ReEmployME, employers may register with the department to determine liability for the unemployment insurance tax. This registration has help menus to assist in completing the application. Information will be sent to your business a few days following the completion of your online registration.

Click on the Create ReEmployME Portal Account link.