USA State Payroll Rates + Resources: State of New York: New Hire Reporting

Purpose

The purpose of this documentation is to outline the processes and requirements associated with reporting new hires in the state of New York.

New Hire Reporting

In New York, you are required to report new hires to the Department of Taxation and Finance.

You must report newly hired or rehired employees who will be employed in New York State within 20 calendar days from the hiring date. A newly hired or rehired employee means an employee previously not employed by the employer, or previously employed by the employer but separated from such prior employment for 60 or more consecutive days.

You'll need the following information for each new hire:

Employer

Name

Address

Identification Number

If depending health insurance benefits are available to the employee and if so, the date the employer qualifies for the benefits

Employee

First Name

Address

Social Security Number

Hire Date

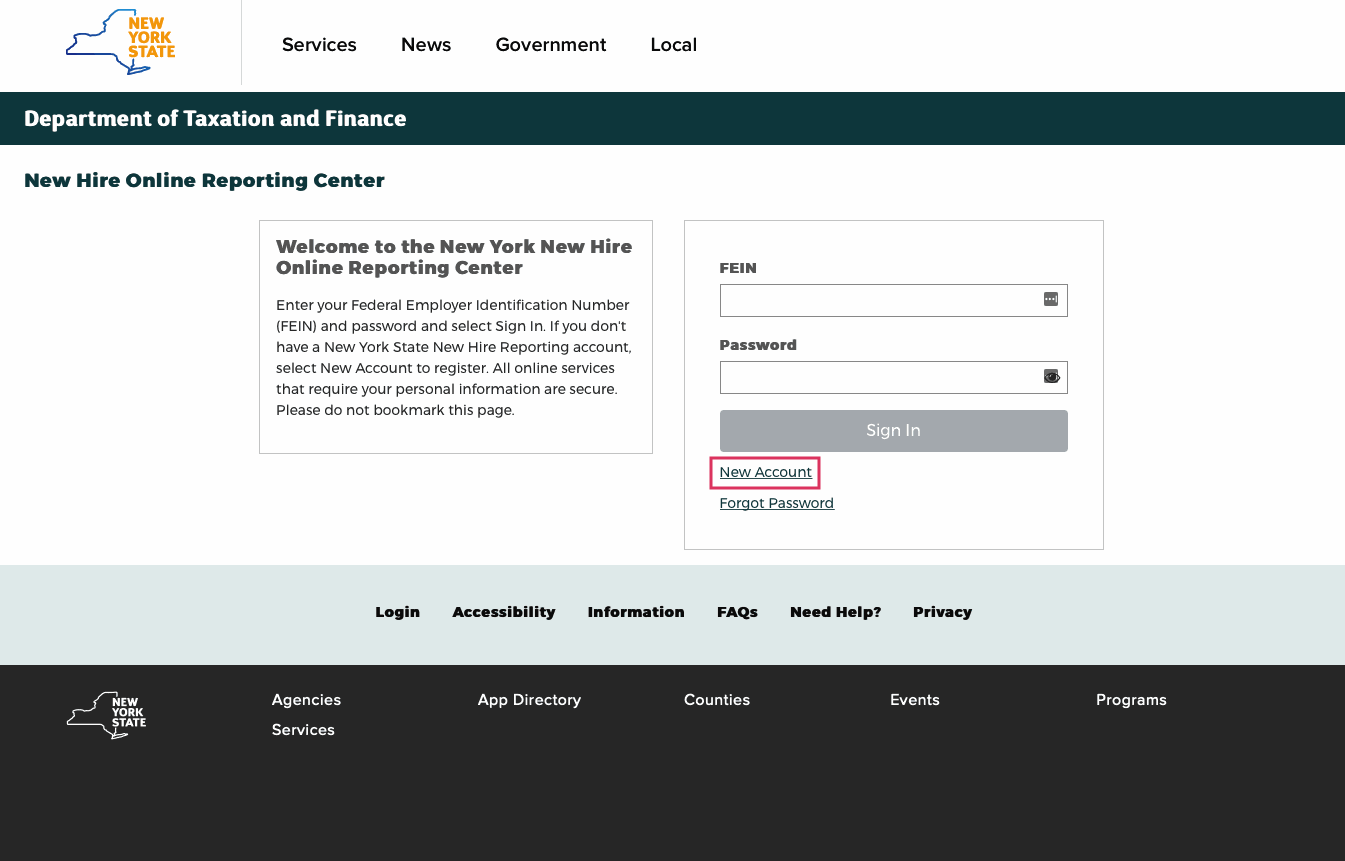

You can report new hires in several ways. The fastest is through the New Hire Online Reporting Center. Once there, click New Account.

You also have the option to file the report electronically. To do so, you must obtain current specifications by contacting Employer Outreach at (518) 320-1079.

You can also submit an Employee's Withholding Allowance Certificate in place of or in addition to the federal W-4 form. Mail or fax these forms to:

New York State Dept of Taxation and Finance

New Hire Notification

P.O. Box 15119

Albany, NY 12212-5119

Fax: (518) 320-1080

For more information, please refer to the New Hire Reporting page or the Frequently Asked Questions: New Hire Reporting page on the Department of Taxation and Finance. You can contact the New York New Hire Employer Outreach Department at (518) 320-1079.