USA State Payroll Rates + Resources: State of Missouri: New Hire Reporting

Purpose

The purpose of this documentation is to outline the processes and requirements associated with doing your new hire reporting in the state of Missouri.

New Hire Reporting

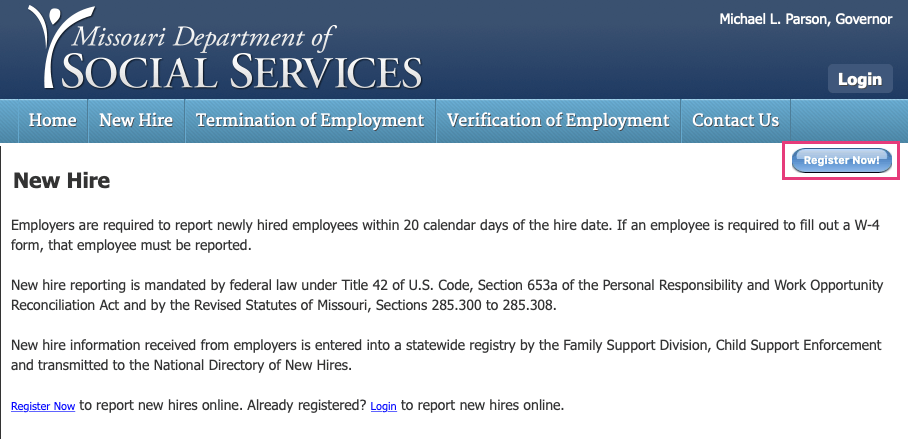

Employers are required to report newly hired employees within 20 calendar days of the hire date. If an employee is required to fill out a W-4 form, that employee must be reported. You can file electronically at the Missouri Department of Social Services.

To register for the first time, click on the Register Now button.

You can also mail or fax using one of the following hardcopy documents:

Federal W-4 Form: If you choose to submit a W-4 form as a new hire report, please ensure that each W-4 is easily readable and has the employer’s name, Federal Employer Identification Number, and address written at the top of each form.

MO W-4 Form

A printed list (see Data to Report for information required in a printed list): The printed list should contain all of the required information, be created using at least a 10-point font size, and have the employer’s name, Federal Employer Identification Number, and address clearly displayed at the top of the report.

Mail: Missouri Department of Revenue, PO Box 3340, Jefferson City, MO 65105–3340

FAX: to (573) 526–8079

File Transfer Protocol (FTP):

You must use the required file submission layout. See FTP Electronic Reporting for additional information.

Contact New Hire Reporting at (888) 663-6751 to request technical assistance in implementing the FTP to report new hires.