USA State Payroll Rates + Resources: State of New Hampshire: Unemployment Insurance Reporting & Payments

Purpose

This documentation outlines the processes and requirements associated with filing Unemployment Insurance reports and making Unemployment Insurance payments in the state of New Hampshire.

Unemployment Insurance Reporting & Payments

Each employer must file an Employer Quarterly Tax and Wage Report (attachment VIII) every quarter after being found liable to contribute to the state Unemployment Insurance.

The report must be filed for every quarter even if no employment was provided in that quarter and no taxes were due.

An employer who expects to provide no employment for one or more quarters may make a written request for a waiver of filing requirements for the quarter involved.

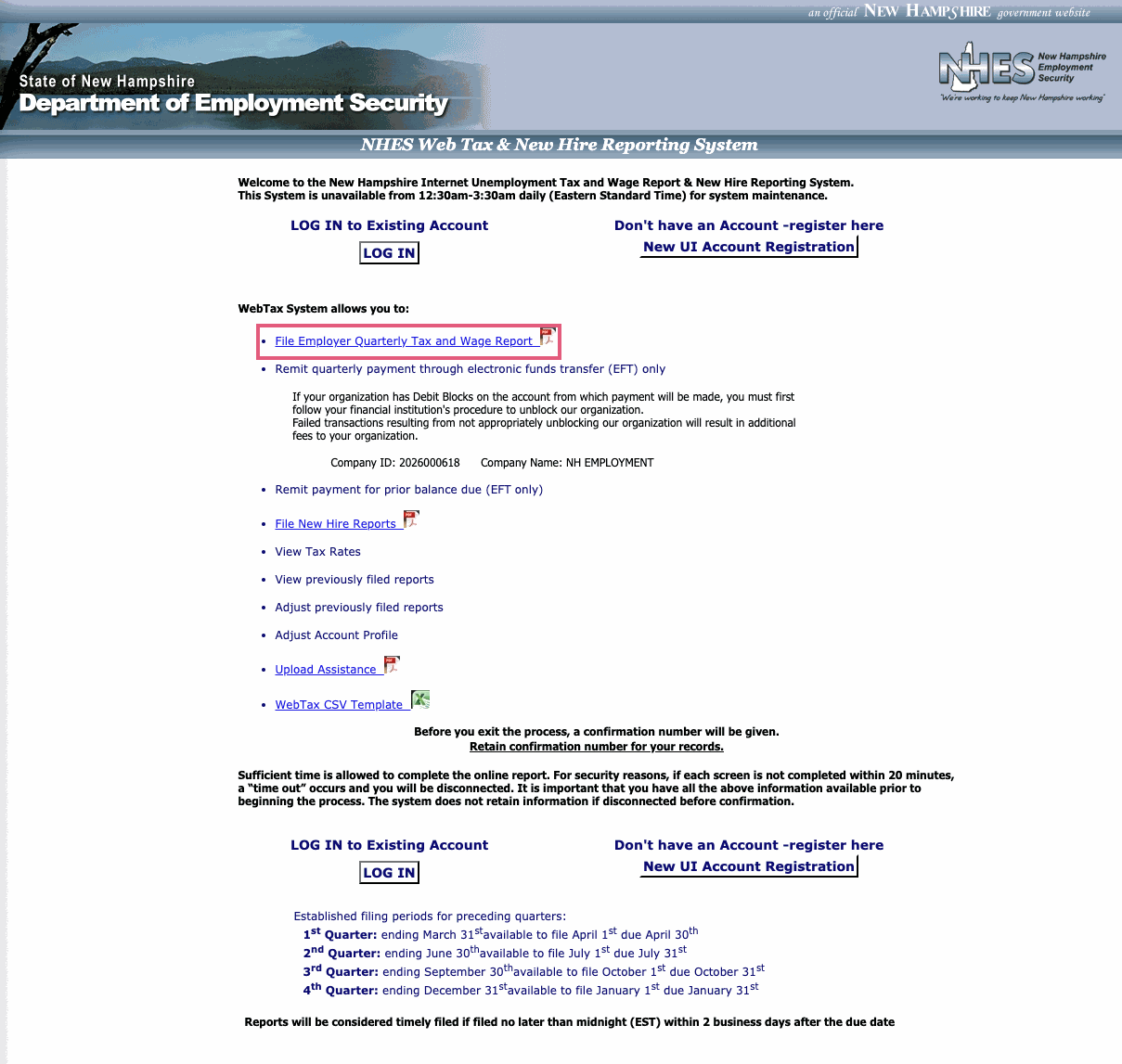

The Employer Quarterly Tax and Wage Report is mailed to every employer at the end of each quarter. Employers can also file online using the WebTax application.

Employers reporting 50 or more employees must file their wage reports electronically.

If filing online, click on File Employer Quarterly Tax and Wage Report and follow the instructions to file the report.

Some information, including the quarter covered, due date, taxable wage base, applicable tax rate, and any balance due or credit, will be preprinted either on the form or displayed on the WebTax website.

The employer must complete all other items and return the signed form with all money due by the due date.

If using the WebTax online filing system, employers have until two days after the due date to file their report.

Employers using WebTax can also remit their payment via Electronic Funds Transfer (EFT).

Due Dates:

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

For further details, see the New Hampshire Employment Security Employer Handbook.