USA State Payroll Rates + Resources: State of Texas: Unemployment Insurance Reporting & Payments

Purpose

This documentation outlines the processes and requirements associated with submitting unemployment insurance reports and submitting unemployment insurance payments in the state of Texas.

Unemployment Insurance Reporting & Payments

The Texas Workforce Commission (TWC) requires all employers to report Unemployment Insurance (UI) wages and remit quarterly UI taxes electronically via TWC Unemployment Tax Services. This system allows employers with 1,000 or fewer employees to file wage reports online.

Other filing options are:

Uploading a file (Excel or comma-separated format)

Using an employer's last report as a starting point

Entering the wage details manually

Submitting a No Wages report when an employer did not pay any wages in the quarter

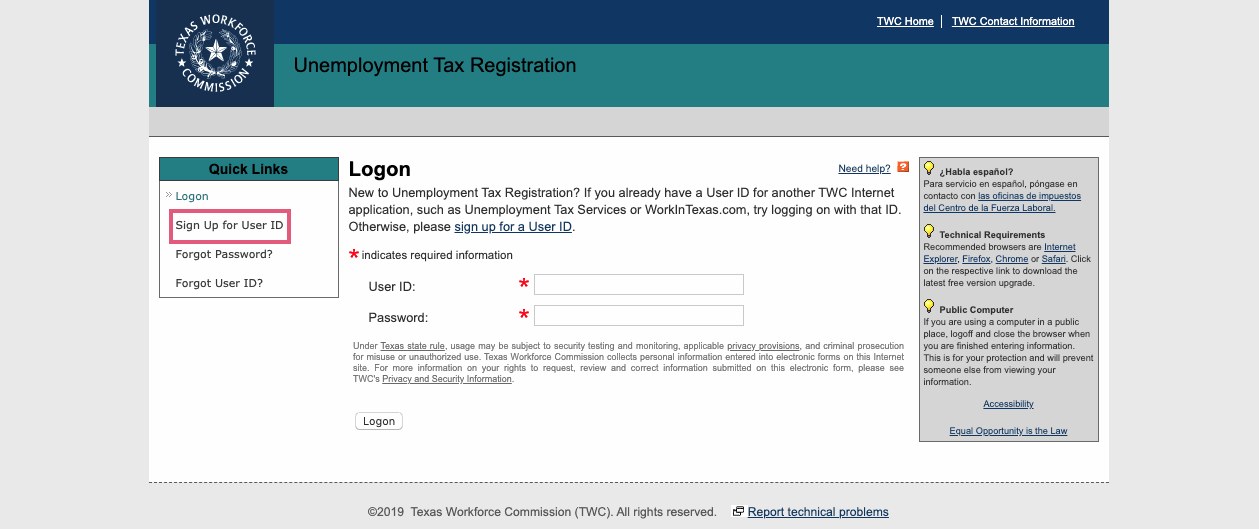

To file online, login, or create an account on the TWC Unemployment Tax Services page.

| 1st Quarter | January - March | Due April 30th |

| 2nd Quarter | April - June | Due July 31st |

| 3rd Quarter | July - September | Due October 31st |

| 4th Quarter | October - December | Due January 31st |

If the due date for a report or tax payment falls on a Saturday, Sunday, or a legal holiday on which Texas Workforce Commission offices are closed, reports and payments are considered timely if they are received on or before the following business day.

For further details, visit the TWC Unemployment Tax Services page and/or Unemployment Benefits Basics for Employers.

Good to Know!

Texas' 2022 taxable wage base is currently $9,000. New employers use the greater of the average rate for all employers in the NAICS code to which they belong or 2.7% (includes an employment training investment assessment of 0.1%)