USA State Payroll Rates + Resources: State of Wisconsin: Unemployment Insurance Reporting & Payments

Purpose

This document outlines the processes and requirements associated with unemployment insurance reporting and payments in the state of Wisconsin.

Unemployment Insurance Reporting & Payments

A quarterly wage report is required in addition to the quarterly UI contribution (tax) report. The Wisconsin Department of Workforce Development (DWD) Employer Portal can be used for reporting both tax and employee wage information and making payments.

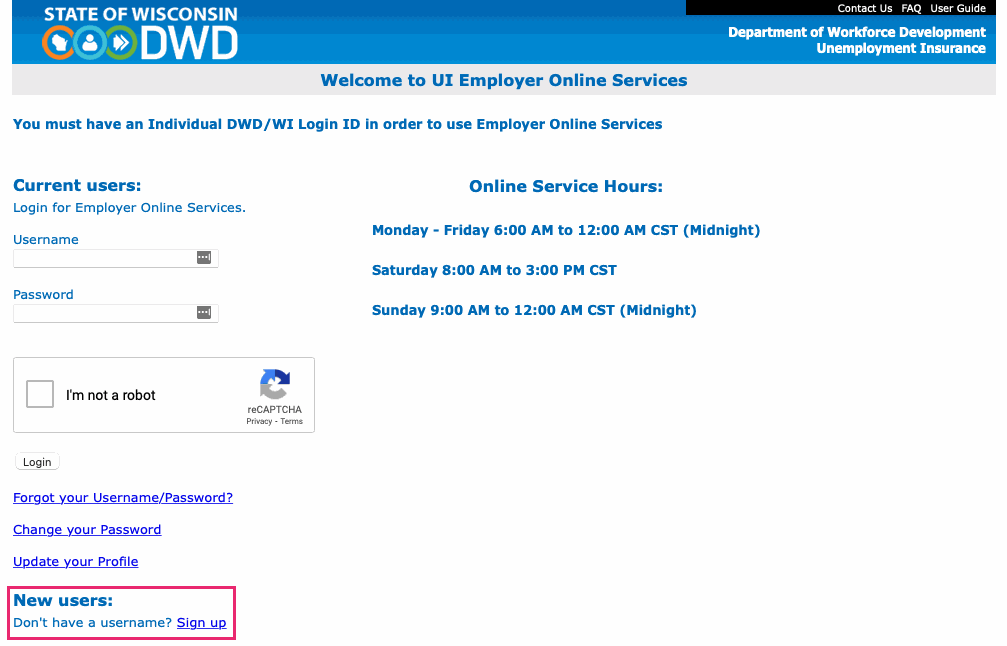

If you haven't yet registered, click the Create Logon ID under New Users:

Wage Reporting

Each employer is required to furnish a report containing wage data for every employee paid in the calendar quarter. Employers are required to file the wage and tax reports even though they may be unable to make the required contribution payment.

Reports and payments are due each quarter at the end of the subsequent month.

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

Employers with 25 or more employees must file their wage reports electronically on the Tax and Wage Reporting System/DWD Portal. Once you are required to file electronically you must continue to file electronically in the future.

Wage reports may be submitted using the following methods:

The wage detail is required in addition to the Quarterly Contribution Tax Report.

For further details, you can go to the State of Wisconsin's Department of Workforce Development Unemployment Insurance Handbook for Employers (UCB-201-P). See Section 4 - Wage Reporting.

Tax Reporting

Employers with 25 or more employees in a quarter are required to file their reports electronically on the Tax and Wage Reporting System/DWD Portal. Once you are required to file electronically, you must continue to file electronically in the future.

Reports may be submitted using the following methods:

Tax and Wage Reporting System / DWD Portal (see above for registration)

Electronic Tax Reporting for Employer Service Providers (ESPs)

The Quarterly Tax Report is required in addition to the Quarterly Wage Report.

For further details, you can go to the State of Wisconsin's Department of Workforce Development Unemployment Insurance Handbook for Employers (UCB-201-P). See Section 2 - Tax.

Wage and tax reports are due within 30 days after the end of the quarter being reported. For online filers, payment can be done through electronic payment (preferred) or by check.

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

For more information, see the Wisconsin Unemployment Insurance Handbook for Employers.