USA State Payroll Rates + Resources: State of Idaho: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with unemployment insurance reporting and payments in the state of Idaho.

Unemployment Insurance Reporting & Payments

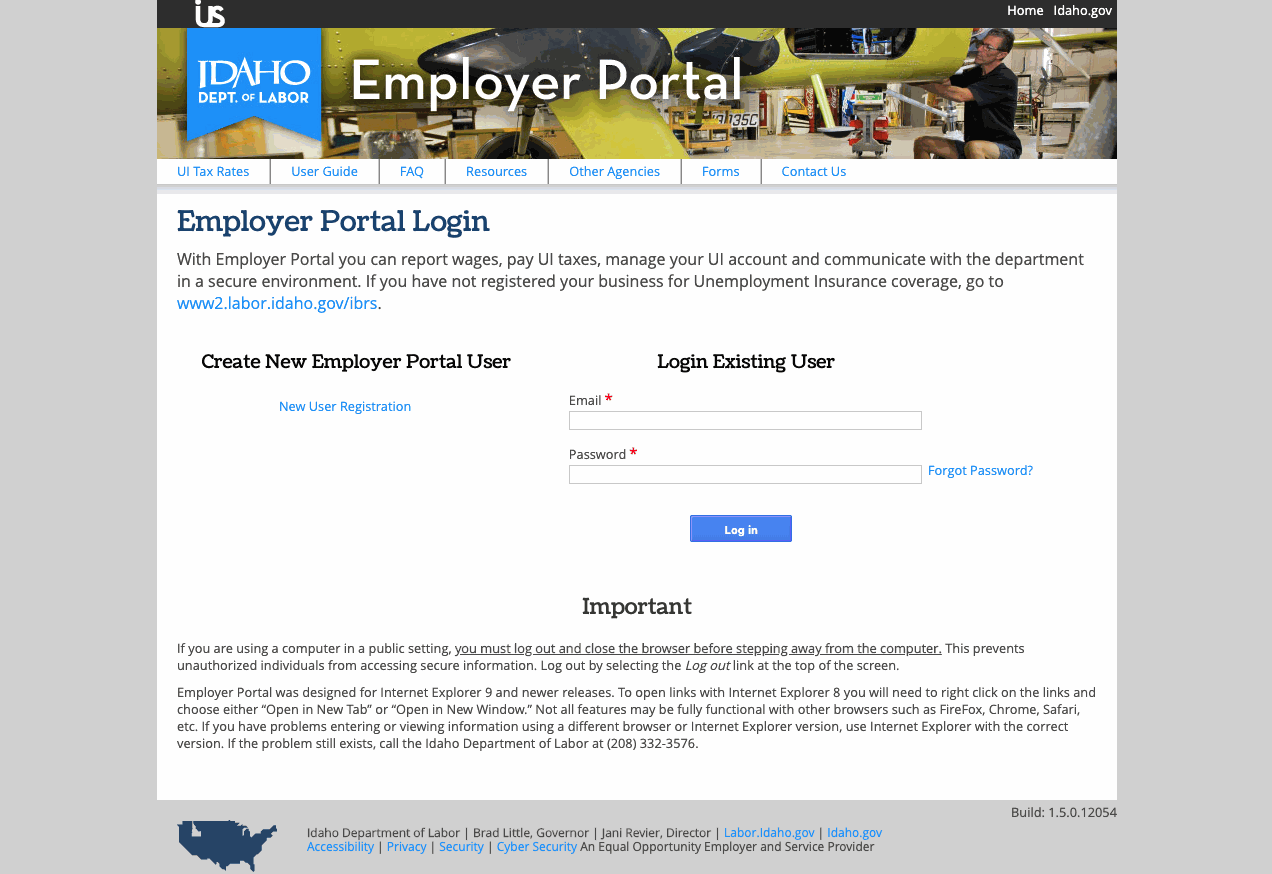

Employers must report and pay their unemployment insurance taxes online. Log into the Employer Portal using the information you used when you registered your business through the Idaho Business Registration System.

The reports and remittances are due the last day of the month for the quarter ended the preceding month, except when the last day falls on a weekend or holiday. In those cases, the next business day is the due date.

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 31st |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

For further details, you can reference the Idaho Unemployment Insurance Tax Information Handbook.