USA State Payroll Rates + Resources: State of South Dakota: Reemployment Assistance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with submitting reemployment assistance reports and payments in the state of South Dakota.

Reemployment Assistance Reporting & Payments

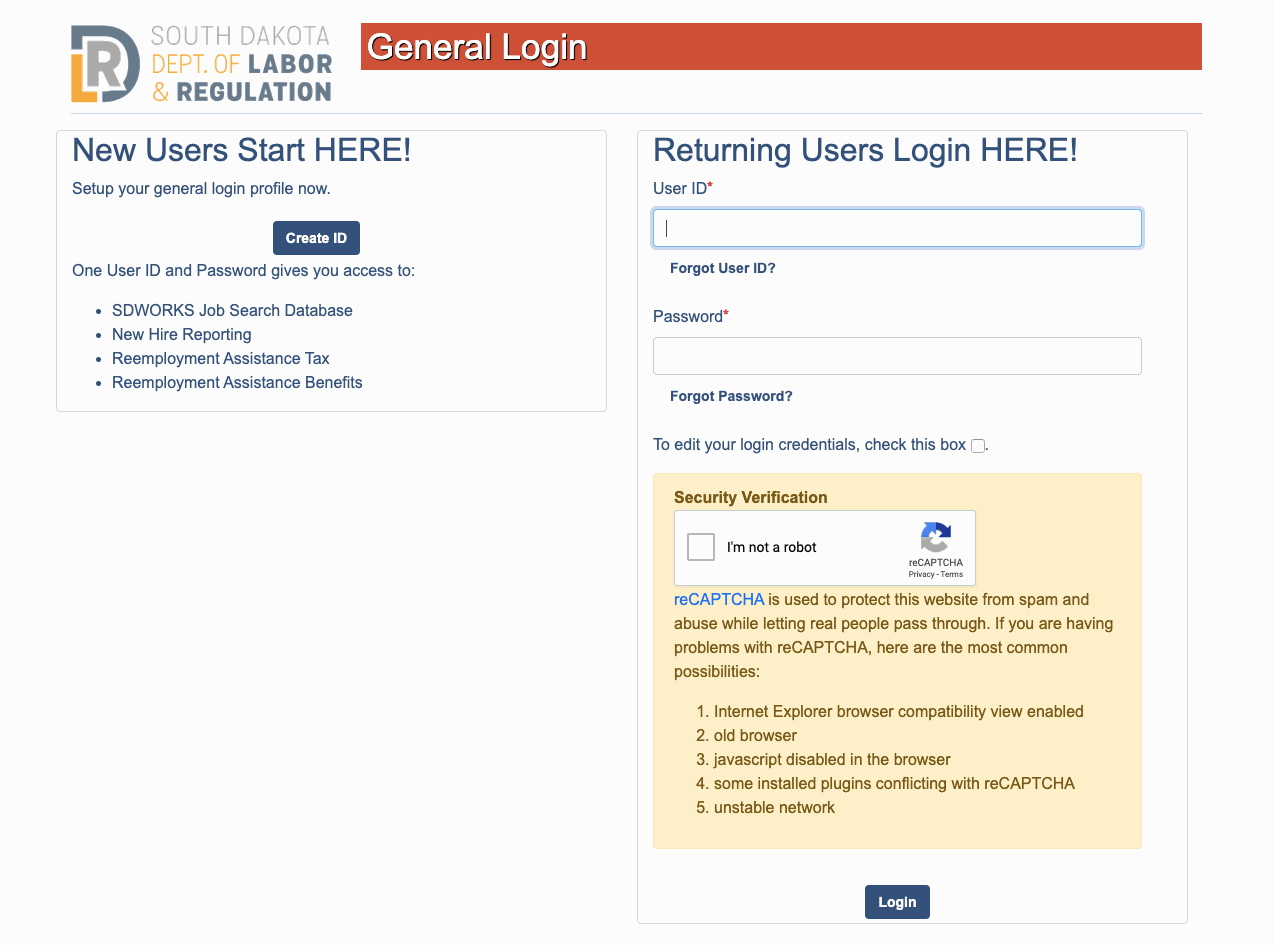

The fastest and most efficient way for employers to file their quarterly wage report is online, through the Quarterly Wage Reporting System.

You may also complete the printable form, Employers Quarterly Contribution, Investment Fee, and Wage Report (Form 21), and send it to:

Reemployment Assistance Division - Tax Unit

SD Department of Labor and Regulation

P.O. Box 4730

Aberdeen, SD 57402-4730

Fax: 605.626.3347

All reports are due the last day of the month following the end of the quarter:

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

If the due date is on a weekend or holiday, the next business day becomes the date the quarterly reports and payment must be submitted.

For further details, see the Reemployment Assistance Handbook.