USA State Payroll Rates + Resources: State of North Carolina: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of North Carolina. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of North Carolina's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Register for Withholding Tax Account Number

Good to Know!

If you have registered for a withholding tax account number, skip to the next section.

North Carolina law requires withholding of income tax from salaries and wages of all residents regardless of where their wages were earned, and from wages of nonresidents for personal services performed in North Carolina.

Each new employer required to withhold North Carolina income tax must complete and file Form NC-BR with the Department of Revenue.

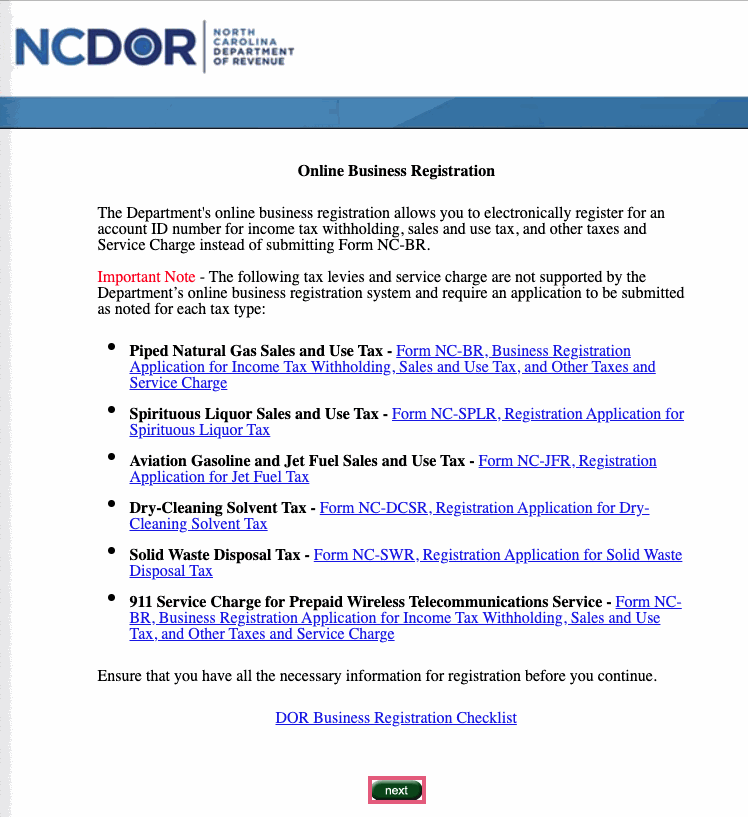

You are encouraged to register online with the North Carolina Department of Revenue | Online Business Registration. From this page, read the information shown and click next to continue with the process of creating your account.

You may also complete and mail Form NC-BR to:

N.C. Department of Revenue

P.O. Box 25000

Raleigh, NC 27640-0100

You should receive your new State identification number within four weeks of filing the paper Form NC-BR.

Register for Unemployment Insurance Account

You are liable for unemployment tax if you are:

A general business employer with at least one worker in 20 different calendar weeks during a calendar year, or with a payroll of at least $1,500 in any calendar quarter;

An employer subject to the Federal Unemployment Tax Act (FUTA)

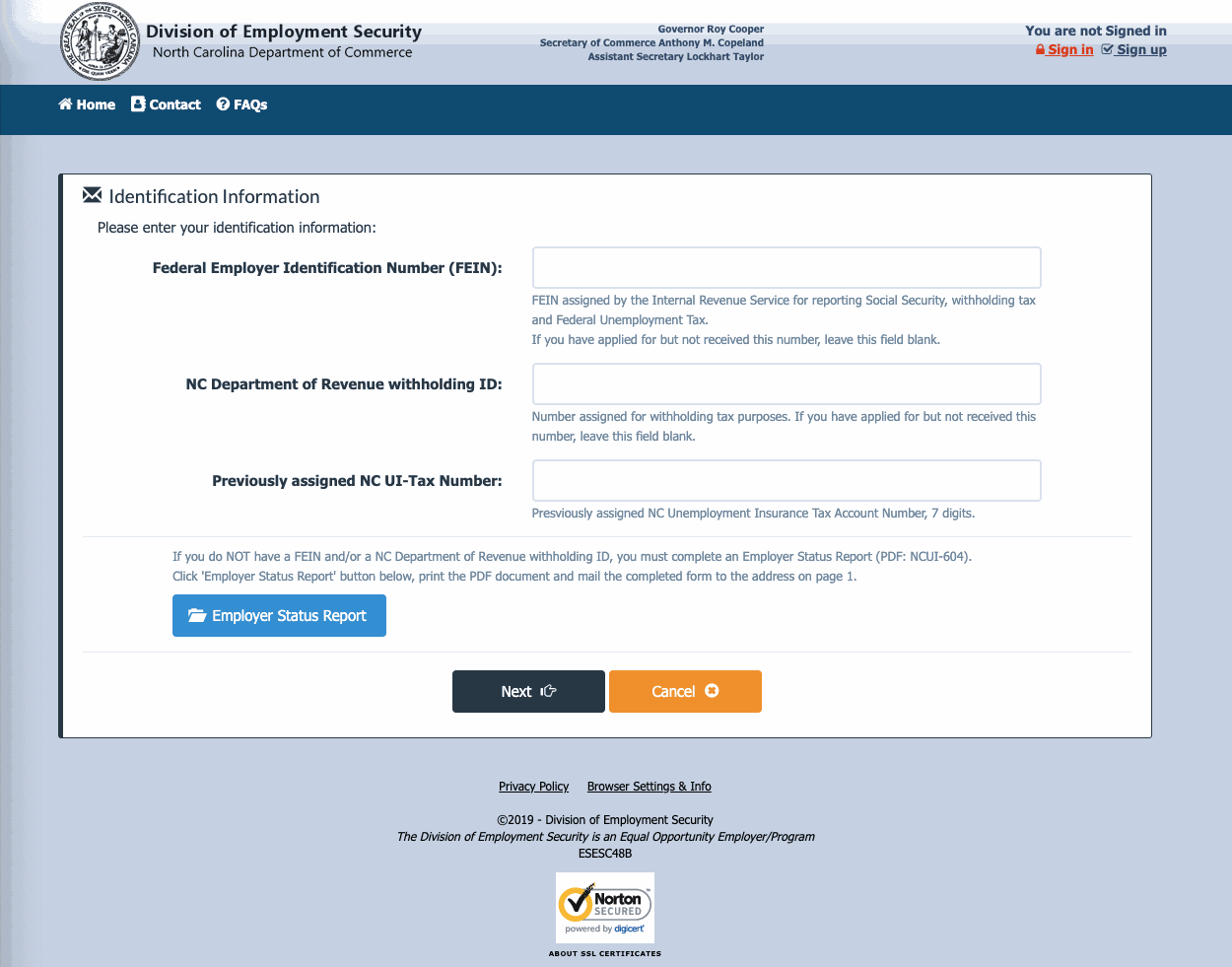

You can apply for a UI Tax Account Number online with the North Carolina Department of Commerce and receive a quick determination as to if you're liable.

You can also download Form NCUI 604 and mail it to the Division of Employment Security:

NC Dept. of Commerce

Division of Employment Security

Post Office Box 26504

Raleigh, N.C. 27611-6504

Employers will receive a PIN number in the mail after an account number has been assigned. You can use the PIN to conduct business online with DES and monitor your account.