USA State Payroll Rates + Resources: State of Delaware : Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Delaware. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Delaware's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for a Withholding Account

Good To Know!

If you have already registered for a withholding account, skip to the next section.

You must register for a withholding account if you:

Maintain an office or transact business within Delaware, and

Make payments of wages or other remuneration to residents or non-residents which are taxable in Delaware and which are subject to withholding under the Internal revenue Code.

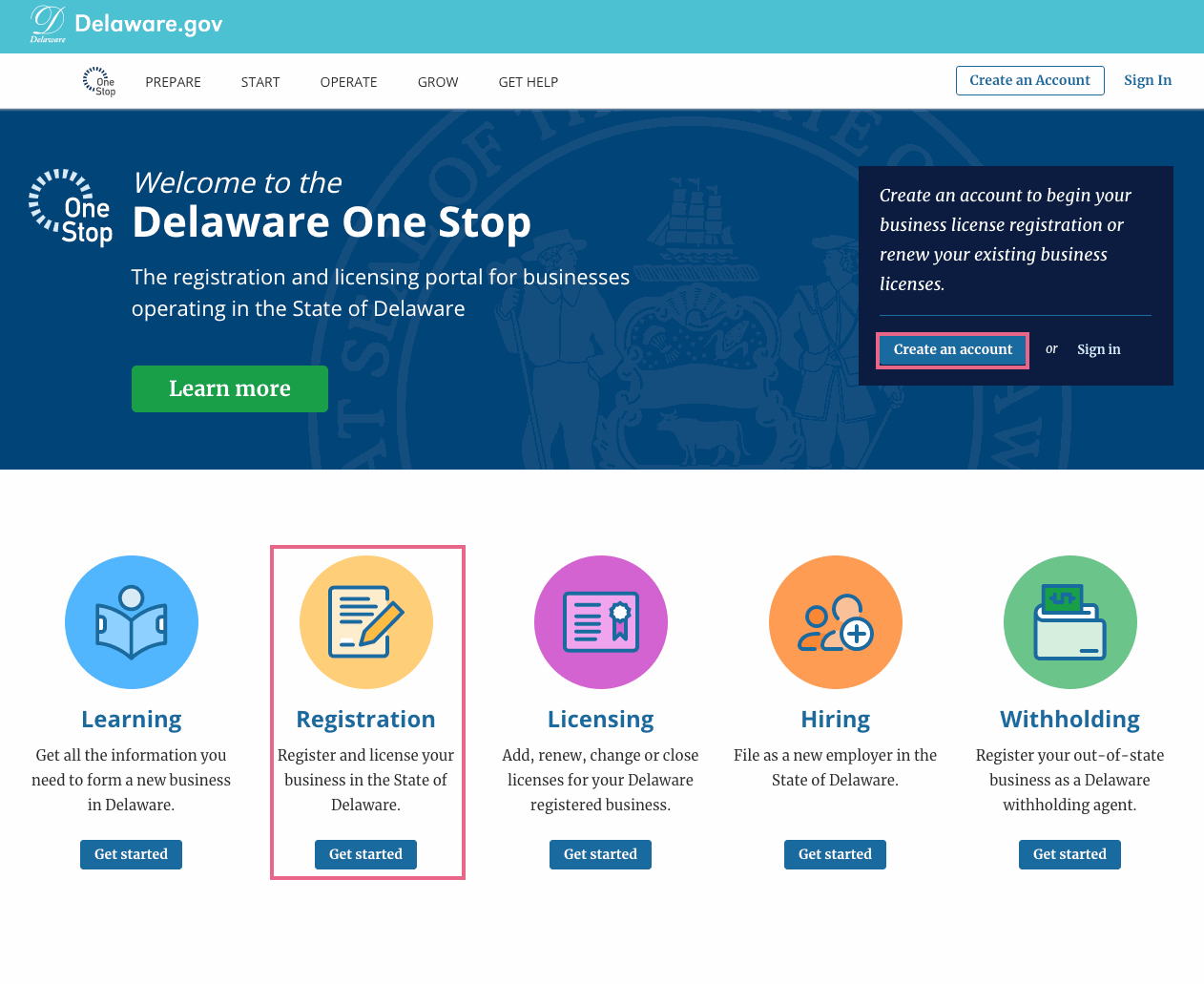

To open a withholding account, you can register online using the One-Stop Business Licensing and Registration system (Click on Create an account or Get started under Registration).

If you'd prefer to fax or mail the information, send a completed Form CRA (Combined Registration Application for State of Delaware Business License and/or Withholding Agent) to:

Delaware Division of Revenue

P.O. Box 8995

Wilmington, DE 19899-8995

Fax: (302) 577-8203

Register for Unemployment Insurance Account

Employers are liable with respect to any calendar year if they:

Pay wages of $1,500 or more during any calendar quarter in the current or preceding calendar year, or

Employ at least one person for some portion of a day in each of 20 different calendar weeks, whether or not such weeks were consecutive, in either the current or preceding calendar year.

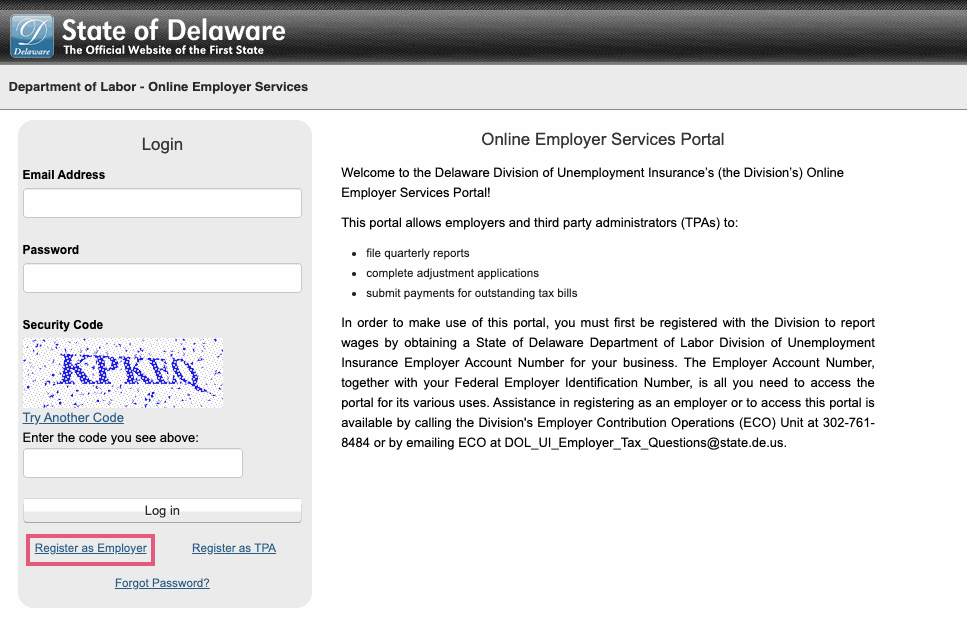

In order to file quarterly wage reports, submit adjustment applications, update employer information and pay outstanding taxes, you need to register on the Division's online employer portal. Click on Register as Employer.