USA State Payroll Rates + Resources: State of Texas: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes and requirements associated with becoming a new employer in the state of Texas. Specifically, we will cover how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just Texas' requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Register for Unemployment Tax

Good to Know!

If you have already registered for unemployment tax, skip to the next section.

The liability for unemployment insurance tax is determined by several criteria. Once wages are paid, all employers should register with the Texas Workforce Commission (TWC) within 10 days of becoming liable for Texas unemployment tax. For more information, see Determine Whether You Need to Establish an Unemployment Tax Account.

An employing unit that is or becomes an employer in a calendar year is subject to unemployment insurance coverage during that entire calendar year

Liable employers must register with TWC using the Unemployment Tax Registration form. Doing so will create a tax account and allow employers to report wages paid to employees and remit taxes due in each calendar quarter.

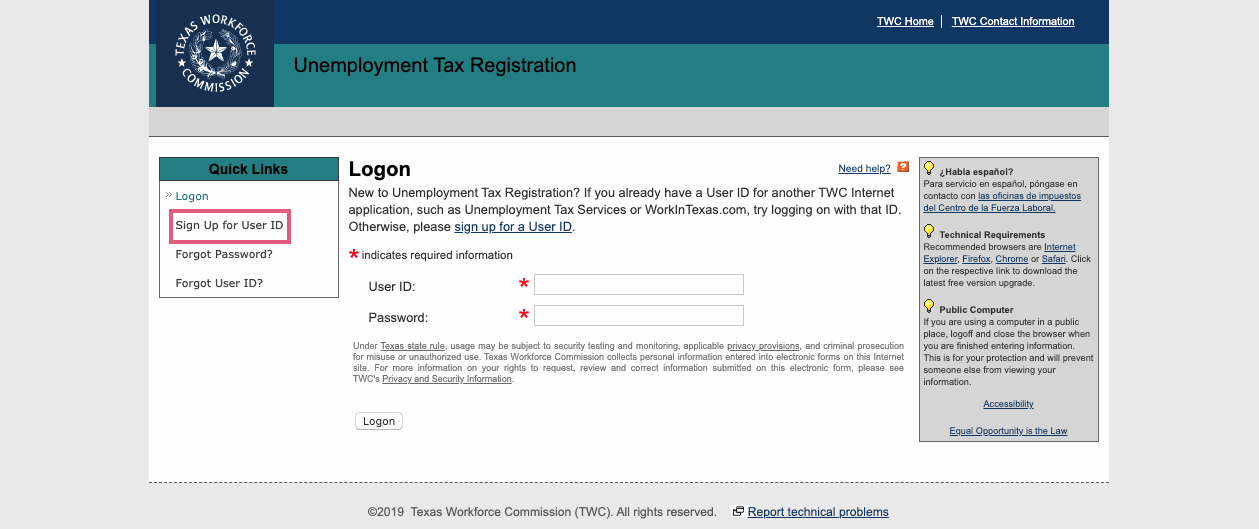

To register, click Sign Up for User ID and complete the form to create your account.