USA State Payroll Rates + Resources: State of West Virginia: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes and requirements associated with becoming a new employer in the state of West Virginia. Specifically, we will cover how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just West Virginia's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Income Tax Withholding and Unemployment Compensation

Good to Know!

If you have already registered for Income Tax Withholding and Unemployment Compensation, skip to the next section.

Every employer making payment of any wage or salary subject to the West Virginia personal income tax is required to deduct and withhold the tax from such wages or salaries and remit the tax withheld to the State Tax Department.

Every person or company with employees, with very few exceptions, in this state must file for Unemployment Compensation coverage, and obtain Workers’ Compensation Insurance coverage from a private insurance company.

Employers can register for withholding tax and unemployment compensation coverage with West Virginia State Tax Department. They can complete the Application for Registration Certificate (Form WV/BUSAPP) and return it to:

West Virginia State Tax Department

PO Box 11425

Charleston, WV 25339-1425

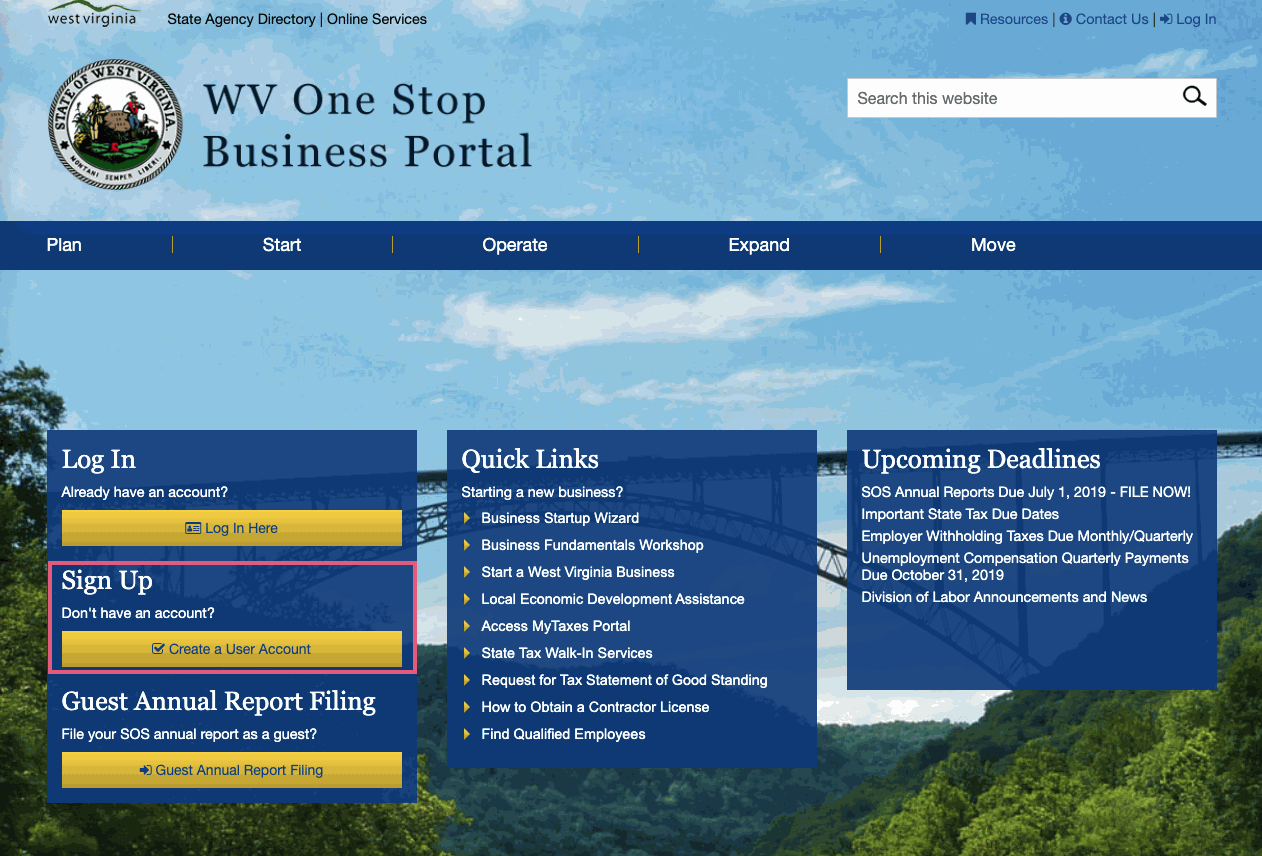

Alternatively, they may register with all agencies on the WV One Stop Business Portal. On this page, click CREate a User Account.

Upon receipt of your Application for Registration Certificate, the department will determine which tax forms you should receive by reviewing the application. For each tax you are responsible for, an account ID number will be assigned. Once your application is processed, you will receive your West Virginia Business Registration Certificate. A list of West Virginia tax accounts and their identification numbers will be provided. Unless indicated otherwise, tax returns will be mailed prior to their due dates. After your business is registered, you may choose to file and pay online at the West Virginia State Tax Department.