USA State Payroll Rates + Resources: State of Wyoming: Obtaining a TIN + Unemployment Insurance

Purpose

This document outlines the processes and requirements associated with becoming a new employer in the state of Wyoming. Specifically, we will cover how to Register for Unemployment Insurance and a Workers' Compensation Account.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Wyoming's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registration for Unemployment Insurance and Workers' Compensation Account

As an employer of one or more individuals in the state of Wyoming, you are required to maintain employment records that will permit an accurate determination of your Unemployment Insurance (UI) tax liability. If requested, you must submit reports to establish if you are a covered employer and/or your contribution liability.

According to the state of Wyoming Compensation Statute, any employer subject to this act shall not commence business or engage in work in Wyoming without:

Applying for workers' compensation coverage under this act and

Receiving a statement of coverage from the division

Effective July 1, 2014, the Workers' Compensation Act allows an election of coverage for corporate officers, limited liability company members, partners, and sole proprietors. This act clarifies that the election is available even if the business has no other employees covered or coverable by the Workers' Compensation Act.

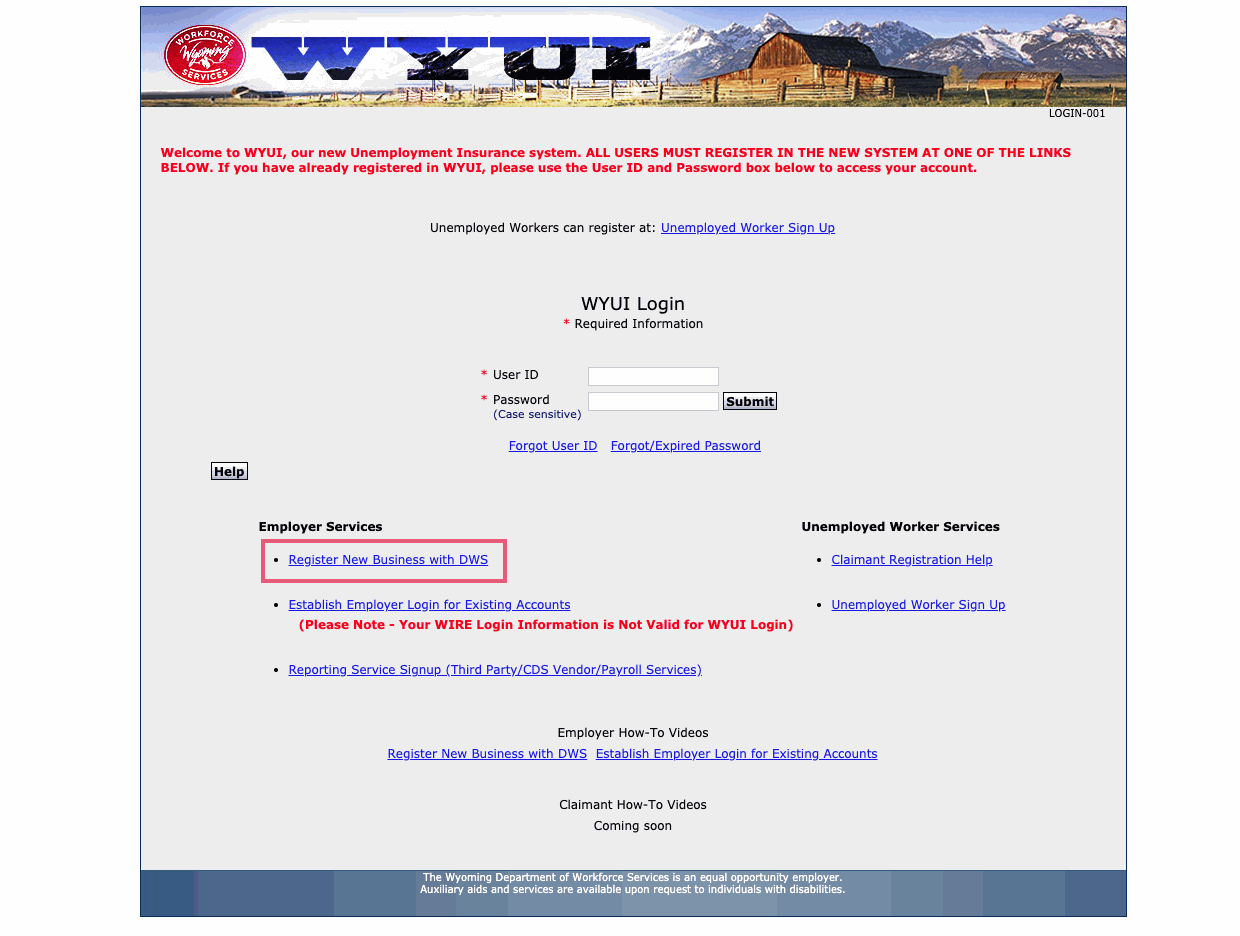

You can establish your required Unemployment Insurance and Workers' Compensation business account online by going to the State of Wyoming Unemployment Insurance system and then clicking on Register New Business with DWS.