USA State Payroll Rates + Resources: State of Nebraska: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Nebraska. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Nebraska's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Income Tax Withholding Certificate

Good to Know!

If you have already registered for an income tax withholding certificate, skip down to the next section.

If you have an office or conduct business in Nebraska and are considered an employer for federal purposes, you must withhold income taxes for Nebraska. This includes payments made to all employees, including nonresidents, for services performed in the state.

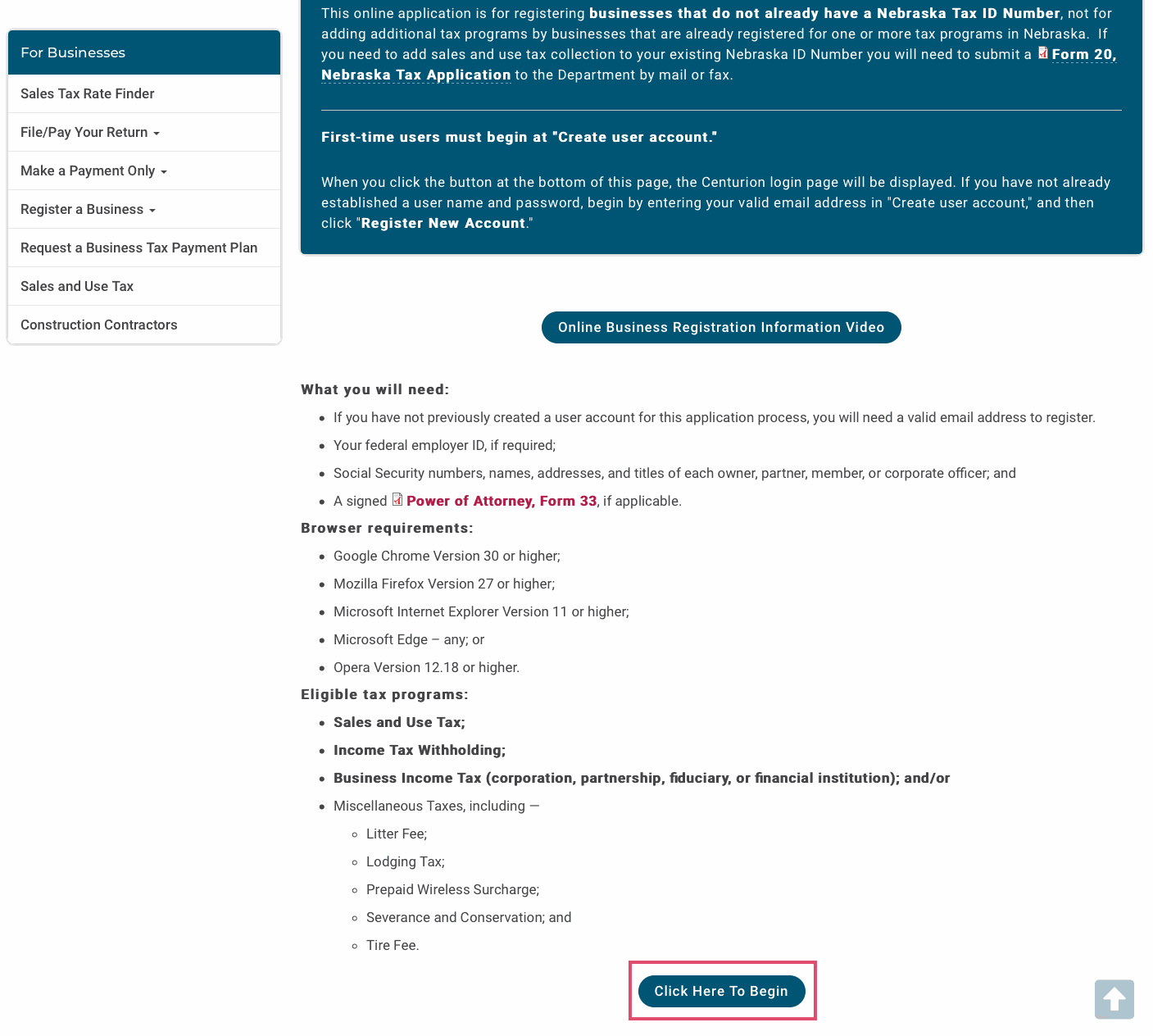

To apply for an income tax withholding certificate, you must complete a Nebraska Tax Application, Form 20, or on the Nebraska Department of Revenue website.

Once there, scroll down, and select Click Here to Begin.

Register for Unemployment Tax Account

Every employer who begins operations in the state and employs a person or persons is required to file an Application For An Unemployment Insurance Account Number, (UI Form 1) (found on page 35 of the 2017 New Employer Guide) even though such an employer may not be liable to the Law.

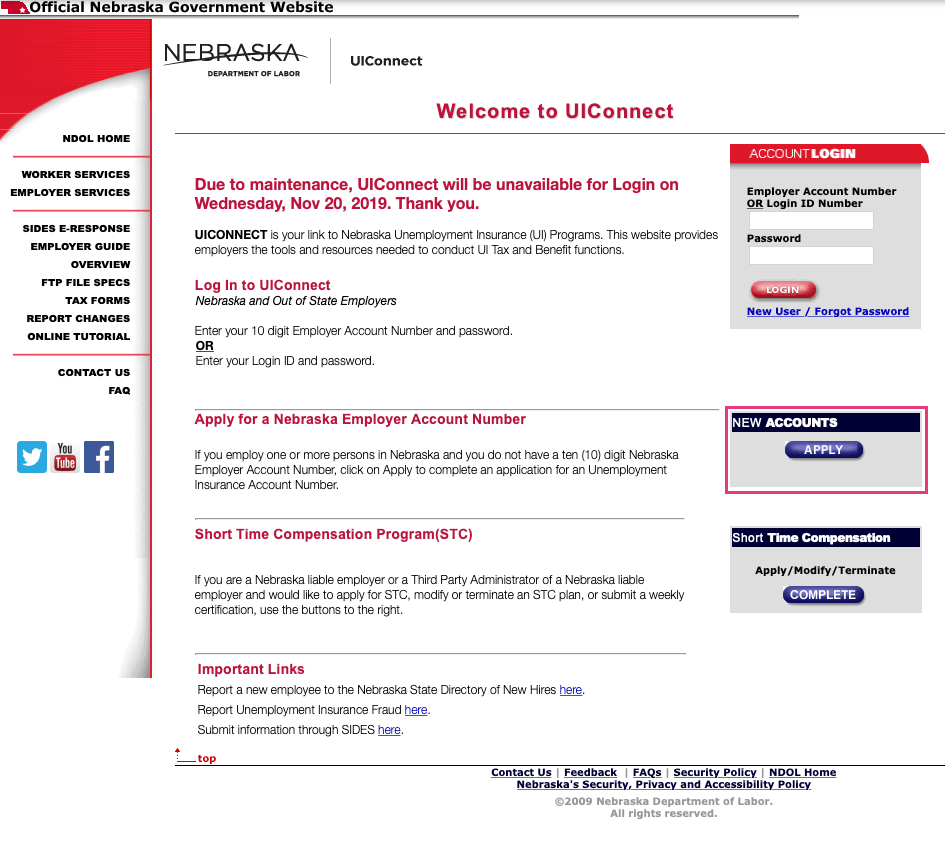

You can get an application for an unemployment insurance account by calling (402) 471-9898. You may also register for an account on the Nebraska Department of Labor UIConnect website.

Once there, click the Apply button under New Accounts.