USA State Payroll Rates + Resources: State of Maryland: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Maryland. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Maryland's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for an Income Tax Withholding and Unemployment Insurance Account

All employers are required to register with the Revenue Administration Division by filing a Combined Registration Application Form CRA.

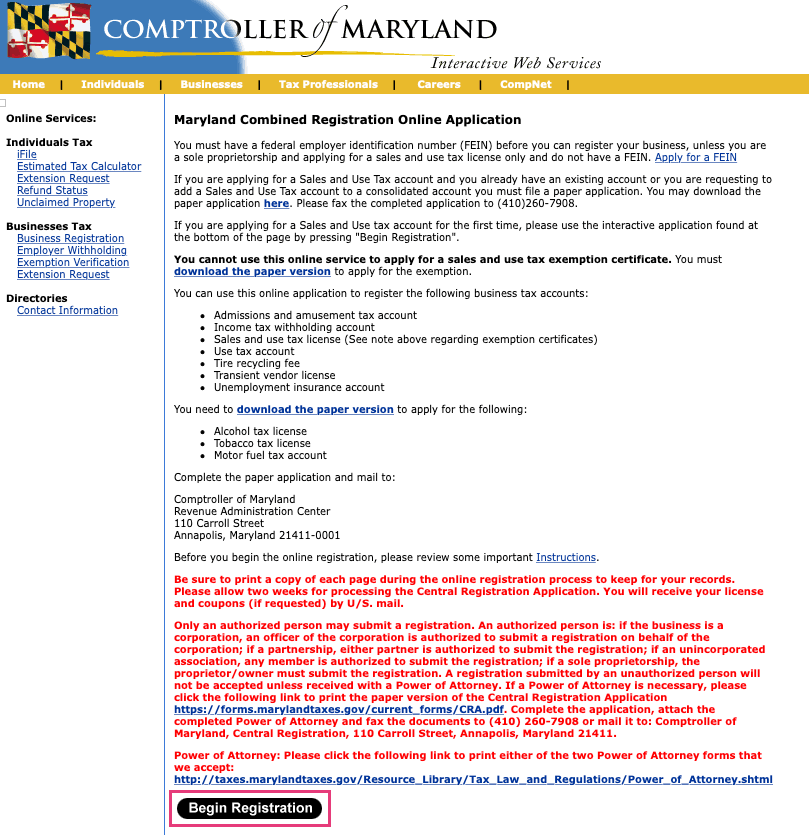

You also can register at the Comptroller of Maryland website. From this site click the Begin Registration button.

The employer will be assigned a CRN that will be used for employer income tax withholding as well as most other Maryland business taxes. Do not wait until withholding payments are due to register as an employer.

You can contact the Revenue Administration Division by mail at the below address:

Revenue Administration Division

Annapolis, Maryland 21411

Phone: (410) 260-7980.