USA State Payroll Rates + Resources: State of Missouri: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes, and requirements associated with becoming a new employer in the state of Illinois. Specifically, we will cover how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just Missouri's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Withholding Tax and Unemployment Insurance Account

Good to Know!

If you have already registered for a Withholding Tax and Unemployment Insurance account, skip to the next section.

Every employer maintaining an office or transacting any business within the state of Missouri and making payment of wages to a resident or nonresident individual must obtain a Missouri Employer Tax Identification Number.

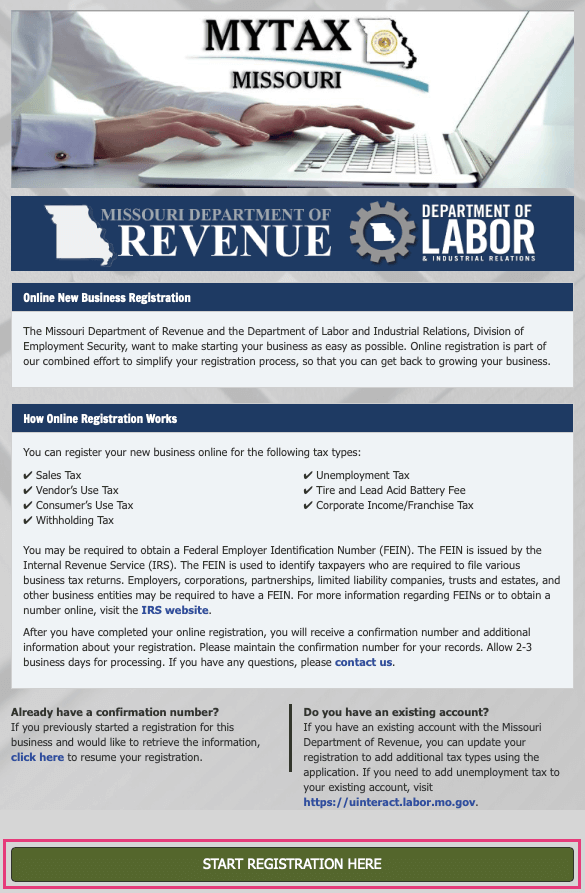

You can complete the online registration application that can be found at MyTax Missouri: Online Business Registration to register with the Missouri Department of Revenue, or, you can complete the paper Form 2643, Missouri Tax Registration Application, and submit it to the Missouri Department of Revenue | Taxation Division, P.O. Box 357, Jefferson City, MO 65105-0357.

For the Online Business Registration, click on START REGISTRATION HERE.