USA State Payroll Rates + Resources: State of Florida: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Florida. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Florida's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Reemployment (Unemployment) Tax

A business is liable for state reemployment tax if, in the current or preceding calendar year, the employer:

Has paid at least $1,500 in wages (which includes paying $800 each to two workers) in a calendar quarter; or

Has had at least one employee (does not need to be the same employee) for any portion of a day in 20 different weeks within the same calendar year; or

Is liable for federal unemployment tax.

A new business is required to report its initial employment in the month following the calendar quarter in which employment begins; however, submission of quarterly reports alone is not sufficient to register as an employer.

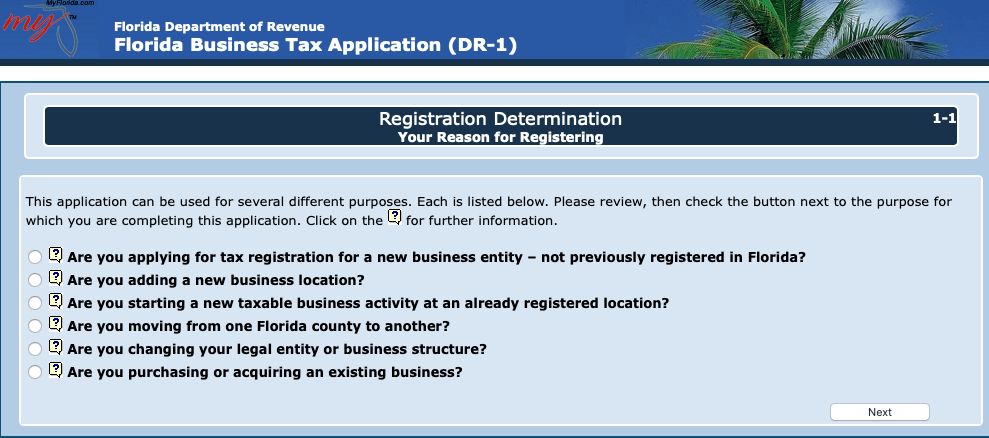

A Florida Business Tax Application (DR-1) must be completed to provide the necessary information to determine if the employer is liable for the payment of the reemployment tax as provided by law.

Registration can be completed online at the Florida Department of Revenue website.