USA State Payroll Rates + Resources: State of Pennsylvania: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Pennsylvania. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Pennsylvania's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Registering for Income Tax Withholding and Unemployment Insurance Account Number

If you employ one or more persons, you need to register to withhold PA personal income tax on all compensation paid to Pennsylvania resident employees, and on compensation paid to nonresident employees (other than residents of New Jersey, Maryland, Virginia, West Virginia, Ohio, and Indiana from whose wages you withhold the reciprocal state’s tax) for work performed in Pennsylvania.

In accordance with the provisions of the Pennsylvania (PA) UC Law, all enterprises providing full and/or part-time employment to one or more workers must register with the Department of Labor & Industry, Office of UC Tax Services. An enterprise may be a sole proprietorship, partnership, corporation, limited liability company, business trust, association, etc.

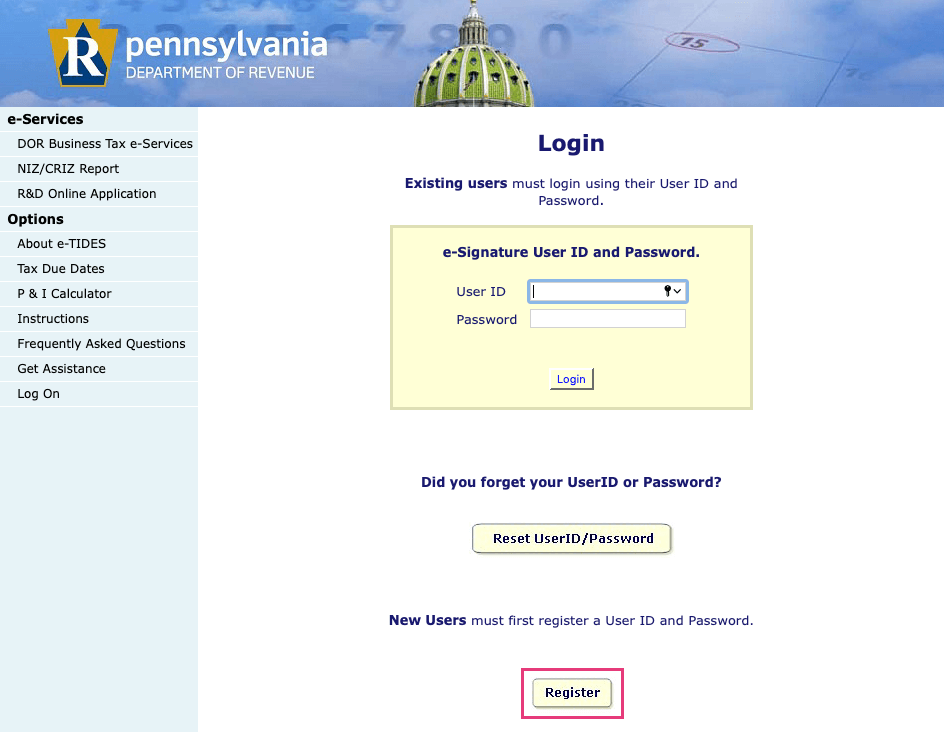

Employers register by filling out a PA Enterprise Registration Form (PA-100) or electronically in e-Tides.