USA State Payroll Rates + Resources: State of Ohio: New Hire Reporting

Purpose

This documentation outlines the processes and requirements associated with reporting new hires in the state of Ohio.

New Hire Reporting

In Ohio, employers must report new hires to the Ohio New Hire Reporting Center.

Ohio Revised Code Section 3121.89-3121.8911 requires all employers to submit their new hire reports within 20 days after the employee is hired. Reports must be submitted within 20 days of the date payments begin.

Employers who submit reports magnetically or electronically shall submit the reports in two monthly transmissions not more than sixteen days apart. Submitting quarterly wage reports to the Ohio Employment Security Commission does not satisfy the obligation to submit timely New Hire Reports.

Temporary Employees: Employees only need to be reported once and do not need to be re-reported each time they are placed with a new client. However, they do need to be reported if the worker has a break in service or a gap in wages from your company in excess of 60 days.

The information you'll be asked to provide is as follows:

Required Employer Information:

- Employer's Federal Employer Identification Number (FEIN). If you have more than one FEIN, please make certain you use the same FEIN you use to report your quarterly wage information when reporting new hires.

- Employer's Name

- Employer's Payroll Processing Address

Required Employee Information:

- Employee's Name (First, Middle, Last)

- Employee's Mailing Address

- Employee's Social Security Number (SSN)

- Employee's Date of Hire

- State of Hire

Required Independent Contractor Information:

- Independent contractor's name

- Independent contractor's address

- Independent contractor's social security (SSN) or federal tax identification number (FEIN)

- Date payment begins

- Length of time the independent contractor will be performing services for the employer

Optional Employer Information:

- Employer income tax credit status

- Employer second address

Optional Employee and Independent Contractor Information:

- Employee gender

- Employee work status

- Employee's Date of Birth

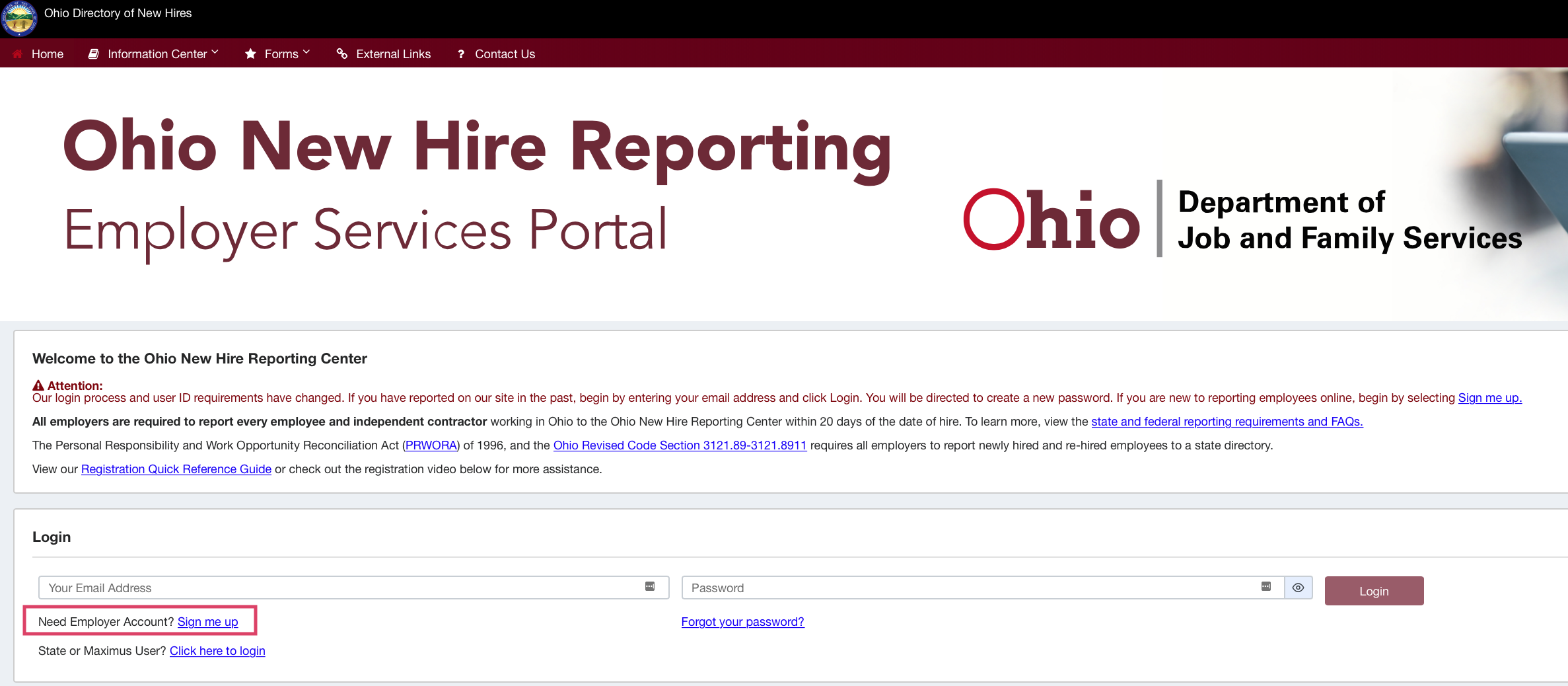

You can report new hires in several ways. The easiest way is through the Ohio New Hire Reporting Center. Once there, click Sign Me Up.

If you use a payroll service, you can ask the service to report your new hires. See the Third-Party Payroll page for more information on how to do this.

If you do not wish to report electronically, you can report using the Ohio New Hire Reporting Form, a printed list that contains the required information on the New Hire Reporting Form or using a W-4 form. Mail or fax the reports here:

Ohio New Hire Reporting Center

P.O. Box 15309

Columbus, OH 43215

Fax: (888) 872-1611

For further information, please refer to the Frequently Asked Questions page or the State and Federal Requirements Page. You can also contact the center by calling (888) 872-1490 or (614) 221-5330.