USA State Payroll Rates + Resources: State of Maine: New Hire Reporting

Purpose

This documentation outlines the processes and requirements associated with doing your new hire reporting in the state of Maine.

New Hire Reporting

Maine requires employers to report new hire information to the Maine Employment Security Department.

The employer must report any employee who fills out a W-4 form, whether full-time, part-time or student worker. Employers must report this information within 20 days of hiring an employee.

The information that must be provided:

Employer Information

Federal Employer ID Number (FEIN)

Employer Name

Employer Address, Phone, and Email

Employee Information

Employee Social Security Number (SSN)

Employee First + Last Names

Employee Address

Date of Hire (mm/dd/yyyy):

Empoyee Date of Hire

Employee State of Hire

Employee Date of Birth (mm/dd/yyyy): (optional)

Whether or not the employee is an Independent Contractor (1099)

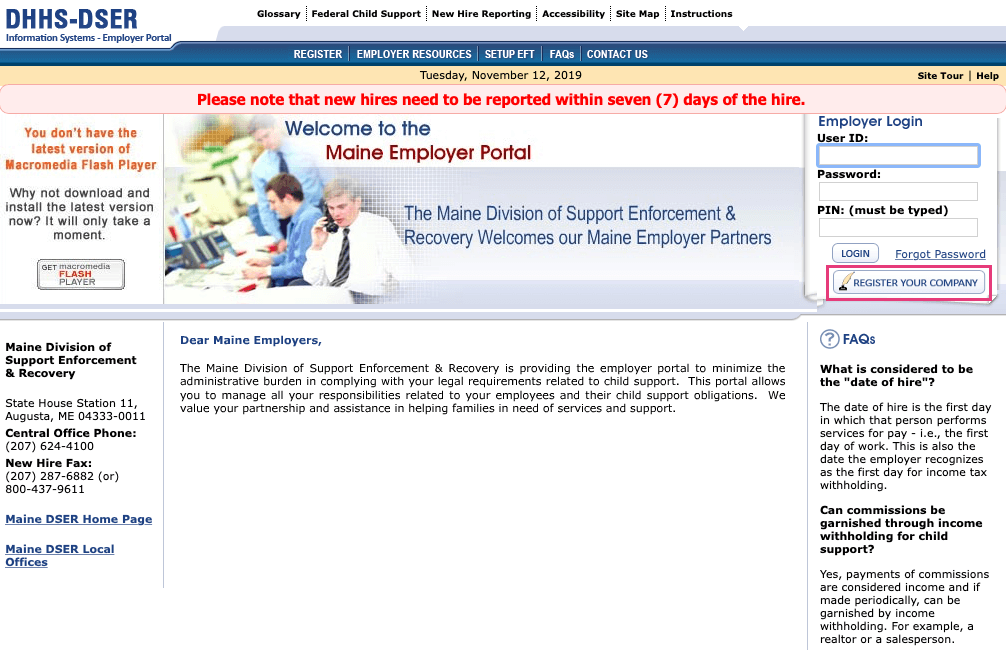

You can report online at the DHHS-DSER Information Systems - Employer portal. Once there, click on the Register Your Company button.

You can also fill out a Maine New Hire Reporting Form and send it to:

Division of Support Enforcement and Recovery

New Hire Reporting Program

11 State House Station

109 Capitol Street

Augusta, ME 04333-0011