USA State Payroll Rates + Resources: State of Kentucky: New Hire Reporting

Purpose

This documentation outlines the processes and requirements associated with doing your new hire reporting in the state of Kentucky.

New Hire Reporting

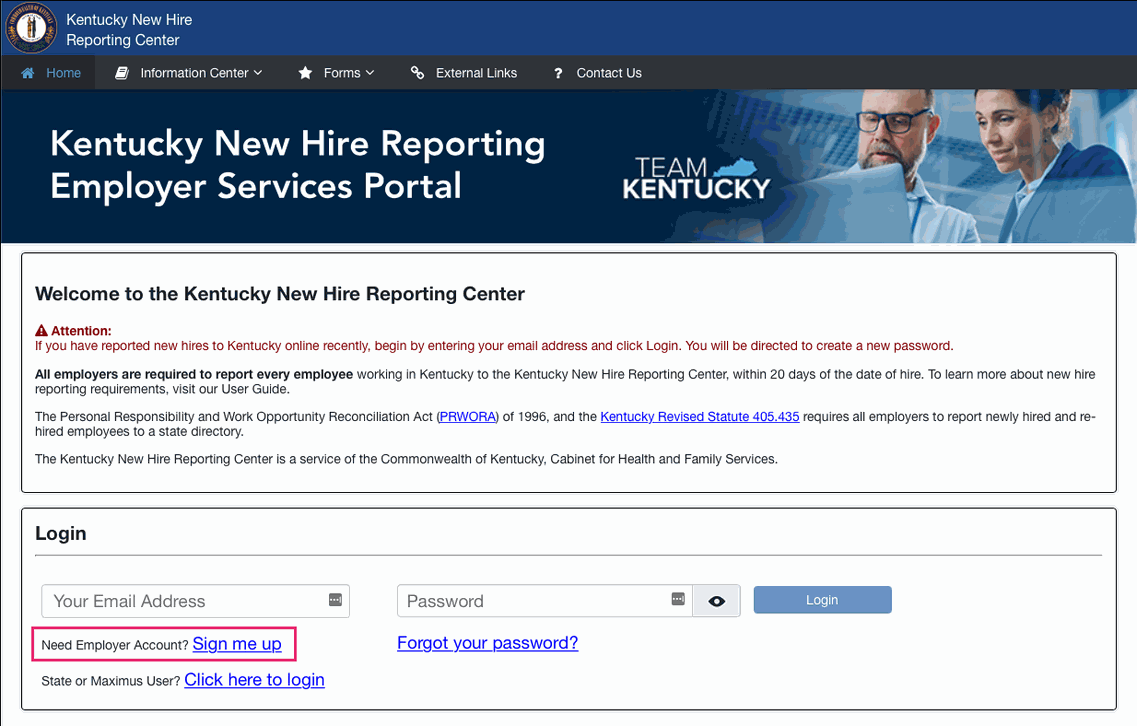

Kentucky requires employers to report all new or re-hires. The Kentucky New Hire Reporting Form must be filed within twenty (20) days of the hiring or return to work of the employee. Please visit the Kentucky New Hire Reporting Center and click on the Sign me up button.

You'll be asked to report the following information:

Employee's full name

Employee's address

Employee's Social Security Number

Employee's Date of Hire

Employee's Availability of Medical Benefits (optional)

Employee’s Date of Birth (optional)

Employer's name

Employer's Federal Employer Identification Number (FEIN)

Employer's Kentucky Employer Identification Number (KEIN)

Employer's address

Provide address where Income Withholding Orders should be sent

Employer’s Phone, Fax, Email, Contact Name (optional)

For more information, refer to the Kentucky Employer User Guide PDFs.