USA State Payroll Rates + Resources: State of South Carolina: New Hire Reporting

Purpose

This document outlines the processes and requirements associated with reporting new hires in the state of South Carolina.

New Hire Reporting

In South Carolina, employers must report new hires to South Carolina New Hire Reporting.

Under Section 43-5-598 of the South Carolina Code of Laws and 42 USC Sec. 653a, all employers must report newly hired employees within 20 days after the employee's first day of work.

You'll need the following information for each new hire:

Employer Name

Employer Address

Employer Federal Identification Number

Employer Phone Number (optional)

Employee Name

Employee Address

Employee Social Security Number

Employee Date of Birth

Employee Date of Remuneration (first day of work)

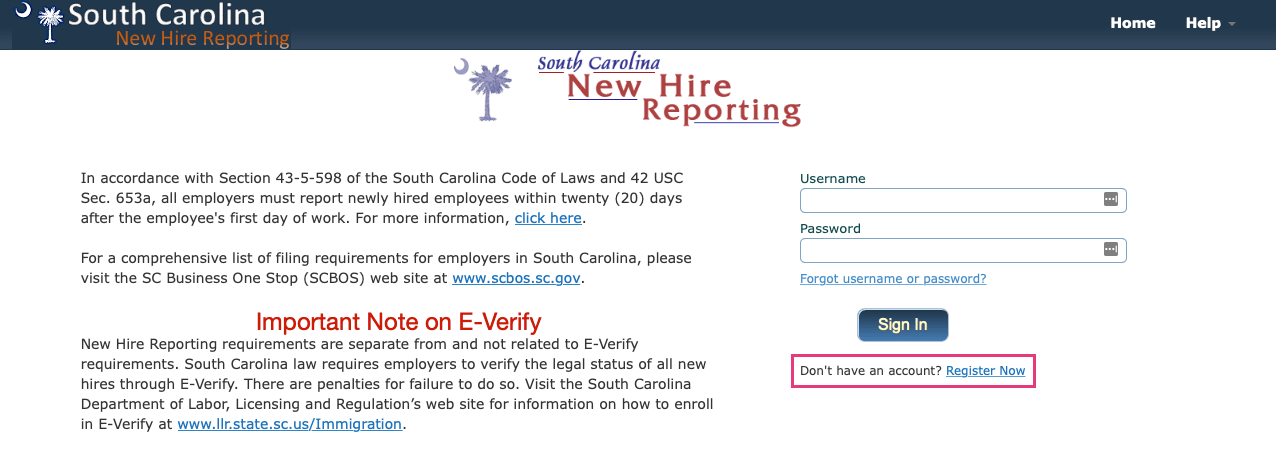

You can report new hires in several ways. The fastest is via the South Carolina New Hire Reporting website. Once there, click Register Now.

South Carolina Department of Social Services, Child Support Services Division

Attn: New Hire Reporting Program

P.O. Box 1469

Columbia, SC 29202-1469

Fax: (804) 898 9100

For further information, please visit the South Carolina Business One Stop website or call at (803) 898-5690.