USA State Payroll Rates + Resources: State of Minnesota: New Hire Reporting

Purpose

This document outlines the processes and requirements associated with doing your new hire reporting in the state of Minnesota.

New Hire Reporting

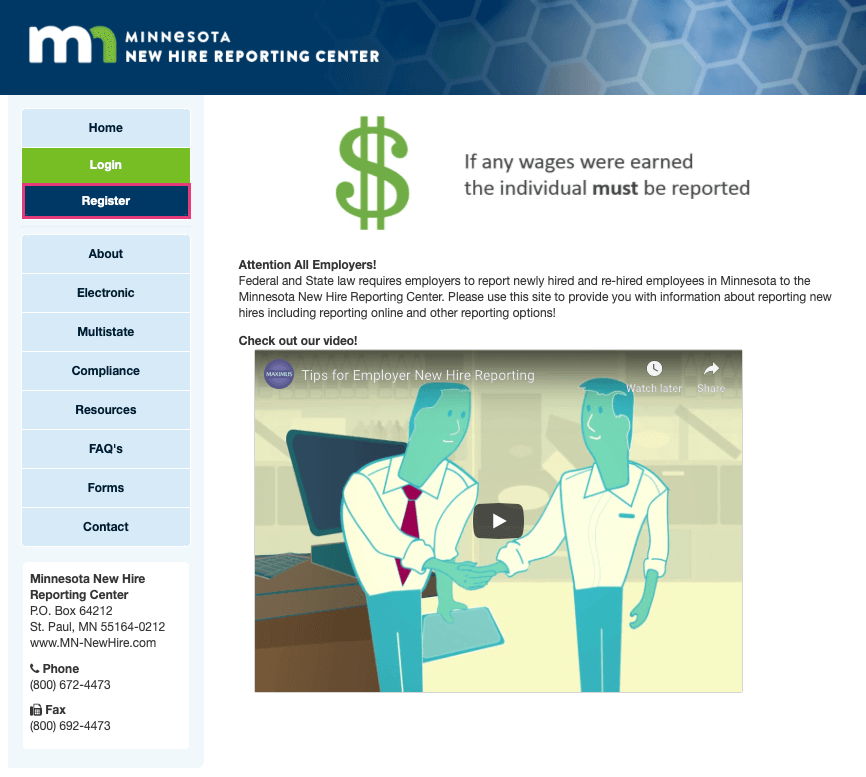

Federal and State law requires employers to report newly hired and re-hired employees in Minnesota to the Minnesota New Hire Reporting Center. This site will provide you with information about reporting new hires including reporting online and other reporting options.

Under Federal legislation, the State of Minnesota asks for the following information:

Employer's Federal Employer Identification Number (FEIN) - If you have more than one FEIN, please make certain you use the same FEIN you use to report your quarterly wage information when reporting new hires.

Employer's Name

Employer's Address

Employee's Name (First, Middle, Last)

Employee's Address

Employee's Social Security Number (SSN)

Employee's Date of Hire

Employee's Date of Birth (optional)

Additional information may be required if reporting electronically. For more information, visit the Electronic Reporting page.

To register for the first time from this site, click on the Register button.

You may also send the printable New Hire Form to:

Minnesota New Hire Reporting Center

PO Box 64212

St. Paul, MN 55164-0212

FAX (800) 692-4473

For assistance, contact the Minnesota New Hire Reporting Center at (800) 672-4473.