USA State Payroll Rates + Resources: State of New Mexico: Filing State Income Taxes, W2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with filing state income taxes as well as how to file W-2s and 1099s, if needed, in the state of New Mexico.

State Income Tax Withholding

New Mexico does not have a form equivalent to the federal Form W-4. For New Mexico withholding tax, you should use a federal Form W-4 and write across the top of that form: "For New Mexico Withholding Tax Only." Retain it in your files for reference.

State Income Tax Withholding Reporting & Deposits

After you register your business, you should receive information from the TRD about how often you must report on and pay withholding taxes. This may, for example, be monthly or quarterly. In general, the more you withhold, the more frequently you’ll need to make withholding tax payments.

Monthly filers must report and pay online.

Quarterly filers can report and pay online or by mail.

To report and pay online, go to the NM Taxation & Revenue Department | Taxpayer Access Point (TRD TAP) webpage. To file on paper (if permitted), complete Form CRS-1, Combined Report Form and submit by regular mail along with your payment.

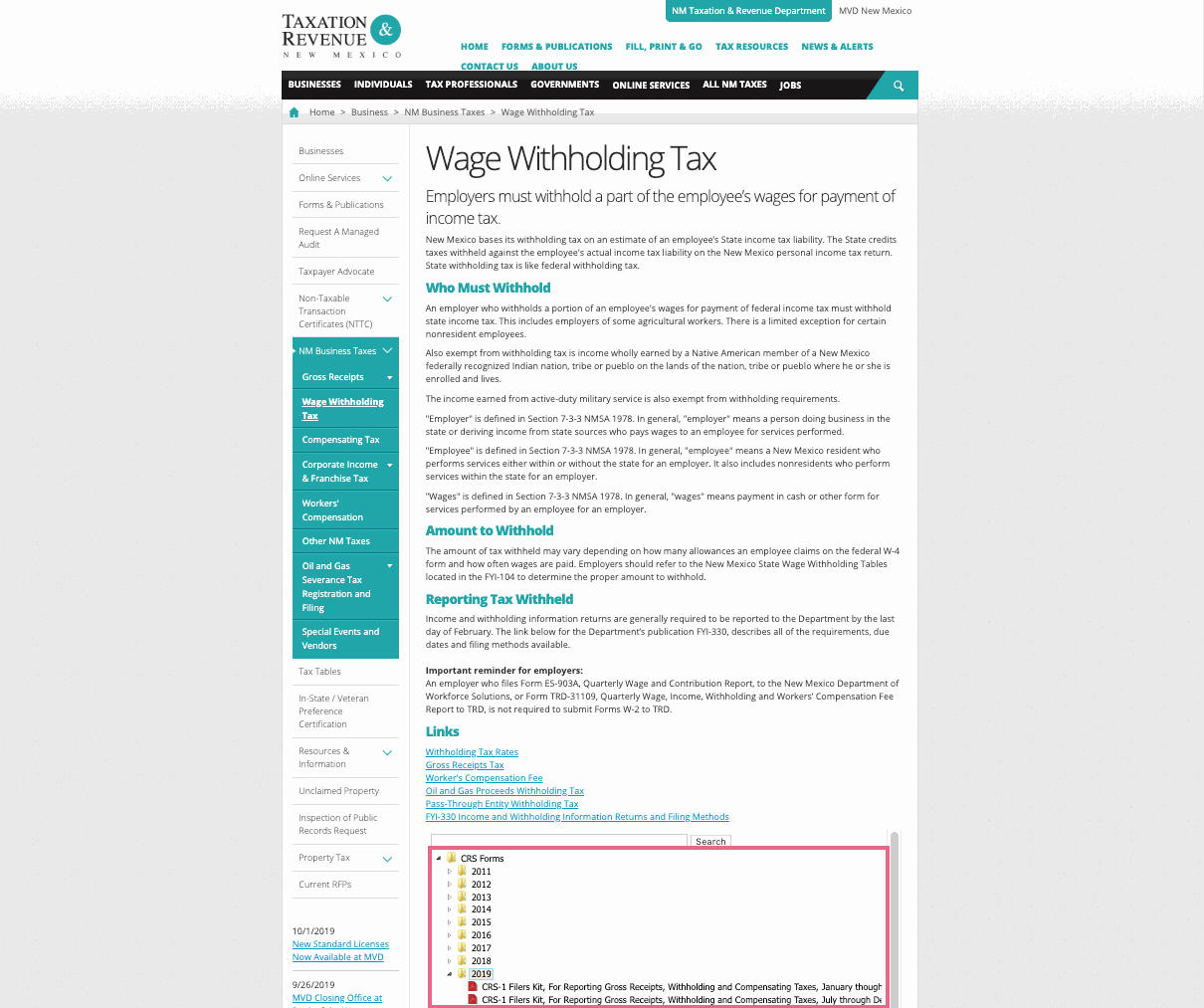

On the TRD Wage Withholding Tax website, click on CRS Forms link near the bottom and select the correct year. Notice that there are different CRS-1 Filers kits for each half of the year.

Select the appropriate form and follow the instructions to fill it out and send it in to the TRD.

W-2 and 1099 forms

For all filings below, electronic filing is available and encouraged. The Taxation and Revenue Department's approved electronic medium includes:

Combined Federal/State Filling

Forms W-2, 1099-R and 1099-Misc are due to the Taxation and Revenue Department by the last day of February of the following year.

Annual Summary (reconciliation) Form RPD-41072 must be completed and kept in your records. You do not need to submit the reconciliation form to the Department unless some or all of the income and withholding return information is not provided to the Department through an electronic medium.

If mailing paper copies to the Department, send all CRS-related information returns to:

New Mexico Taxation and Revenue Department

P.O. Box 25128

Santa Fe, NM 87504-5128.

For further details, visit the TRD Wage Withholding Taxes webpage.