USA State Payroll Rates + Resources: State of Montana: Filing State Income Taxes, W2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with filing state income taxes as well as how to file W-2s and 1099s, if needed, in the state of Montana.

State Income Tax Withholding

Due to changes to the federal Form W-4, the Montana Department of Revenue has implemented Montana Employee’s Withholding Allowance and Exemption Certificate (Form MW-4) for state purposes.

The Montana Department of Revenue will no longer accept the federal Form W-4 in place of MW-4. The federal Form W-4 should only be used for federal withholding allowance and exemption purposes.

You must file your employee’s Form MW-4 with the Department of Revenue only if one or both of the following apply:

The employee is claiming more than 10 allowances, or

The employee is claiming one of the withholding exemptions listed in Section 2 of the form MW-4.

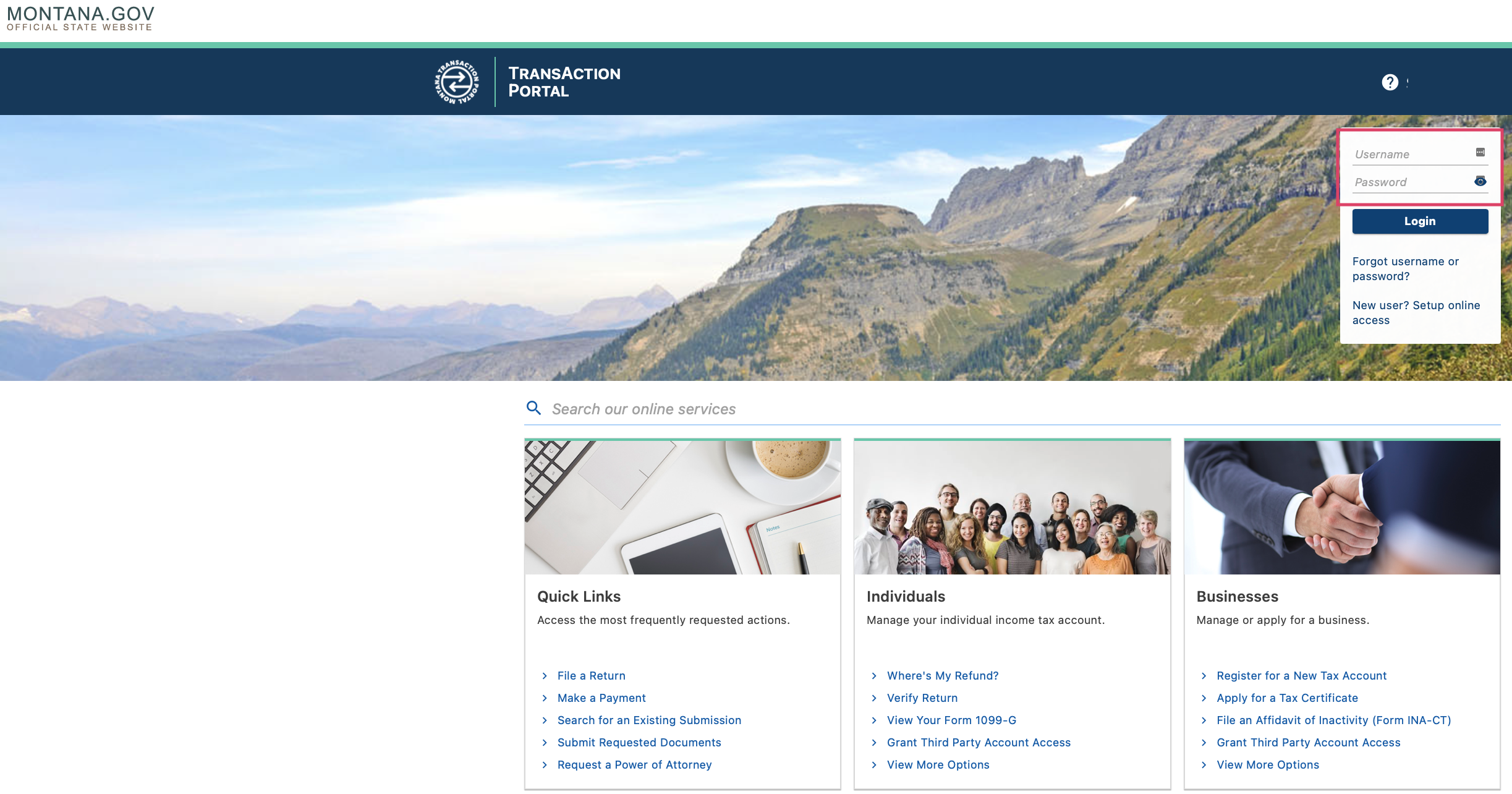

If an employee provides you with a Form MW-4 that meets one or both of the conditions above, you must submit this form to the department by the last day of the payroll period in which the form was received. File online using the department’s TransAction Portal (TAP).

Employer's must log in to file a FORM MW-4

For more information about this process, visit the Montana Department of Revenue.

Do not mail Form MW-4 to the department. You should keep a copy of all Forms MW-4 you receive from your employees with your records.

If an employee doesn't complete a Form MW-4, withholding Montana tax as if the employee is single with zero withholding allowances.

See other employer instructions on the Form MW-4.

State Income Tax Withholding Reporting and Deposits

The withholding payments schedule is determined by the Montana Department of Revenue based on the total amount you withheld during the previous year's look-back period.

Newly registered employers will follow a monthly payment schedule.

For established or existing employers, the department will complete a look-back review to determine the business' reporting and payment schedule for the next calendar year.

The look-back period for the net tax year's filing frequency is the 12-month period from July 1 of the preceding year to June 30 of the current year.

If you did not have employees for the entire duration of the look-back period, follow the monthly payment schedule unless notified by the Department of Revenue.

Withholding Payments Schedule

| Payment Schedule | Amount Withheld during Look-back period | Filing Schedule |

| Payments are not required. | Not Required | MW-3 and W-2 forms are due January 31st for all Payment Schedules. |

| Annual - pay on January 31st of the following year. | $1,199 or less | MW-3 and W-2 forms are due January 31st for all Payment Schedules. |

| Monthly - pay on the 15th of the following month. | $1,200 - 11,999 | MW-3 and W-2 forms are due January 31st for all Payment Schedules. |

| Accelerated - pay per federal schedule | $12,000 or more | MW-3 and W-2 forms are due January 31st for all Payment Schedules. |

Montana is required by law to:

Review your withholding and payment history to determine your payment schedule;

Notify you by November 1 of each year if your payment schedule will change for your account.

Here are your payment options:

Online: TransAction Portal (e-check or the credit/debit card)

Online: ACH Credit

Mail Check: Send the MW-1 payment voucher and check as instructed on the form.

MW-3, W-2, and 1099 Forms

On or before January 31st of each year, you are required to file the following with the Montana Department of Revenue:

Montana Annual W-2 1099 Withholding Tax Reconciliation form (MW-3) supporting the withholding reported on the FormsW-2 and 1099

Wage and Tax Statement (W-2) for each employee Montana wages were paid to, with or without withholding

1099 Forms with Montana state withholding

A completed Form MW-3 must be filed with the Department of Revenue by January 31st. The Form MW-3 will no longer be mailed every year. The most accurate and efficient way to file your Form MW-3 is electronically through the Transaction Portal (TAP). The Department does not accept the federal Form W-3. Each employer is also required to provide the department with a Form W-2 for each employee as prescribed by the IRS.

Whenever Montana wages are paid, you must prepare a Form W-2 for each employee regardless of whether any tax was withheld. 1099 forms with Montana state withholding amount are also required to be submitted to the department with MW-3.

Send paper MW-3 and 1099 forms (with MT withholding) and W-2 forms to

Montana Department of Revenue

PO Box 5835

Helena, MT 59604-5835.

For further details, see the Withholding Taxes on Wages Guide.