USA State Payroll Rates + Resources: State of Louisiana: Filing State Income Taxes, W-2s, and 1099s

Purpose

This documentation outlines the processes and requirements associated with Filing State Income Taxes, W-2, and 1099s, as needed, in the state of Louisiana.

State Income Tax Withholding

To determine the amount of state income tax withholding, employees should complete a Louisiana Department of Revenue Employee Withholding Exemption Certificate (L-4). Every employee, on or before the date of commencement of employment, shall furnish his or her employer with a signed Louisiana Withholding Exemption Certificate (L-4) relating to the withholding status, exemptions dependents, and/or increase or decrease in the amount to be withheld each pay period.

Employers are required to keep copies of completed state L-4 forms for their employees in their files. The forms serve as verification that state income taxes are being withheld according to the employee’s instructions and needs to be available for inspection if the state requests it.

The Forms W-4 and L-4 generally are valid until the employee provides new ones. However, employees who claim exemption from withholding must renew the exemption annually by filing new Forms W-4 or L-4 by February 15th of each year.

State Income Tax Withholding Reporting & Deposits

| Withholding From Combined wages | Filing Frequency | Filing Due | Payment Frequency | Payment Due |

| Less than $500 per month | Quarterly (Paper form or electronically) | Last day of the month following the end of the quarter. | Quarterly (Paper form or electronically). | Last day of the month following the end of the quarter. |

| $500 - $4,999 | Quarterly (Paper form or electronically) | Last day of the month following the end of the quarter. | Monthly (Paper form or electronically). | On the last day of the month following the close of the monthly period. |

| $5,000 and up | Semi-Monthly (Must be electronically) | By the fifteenth of the month following the close of the quarter. | Semi-Monthly (Must be filed electronically). | Taxes withheld for the 1st-15th of the month are due by the end of the same month. |

Payments for the last period of the quarter must be submitted with the L-1 return. All other payments must be submitted with an L-1V payment voucher.

Form L-3, W-2s, and 1099s

You must file Form L-3 annually to reconcile your withholding account regardless of your filing cycle for Form L-1 and to transmit copies of information Returns (Federal Forms W-2, W-2G, and 1099) to the Louisiana Department of Revenue (LDR) either:

By filling out a Form L-3 (fewer than 50 Forms W-2)

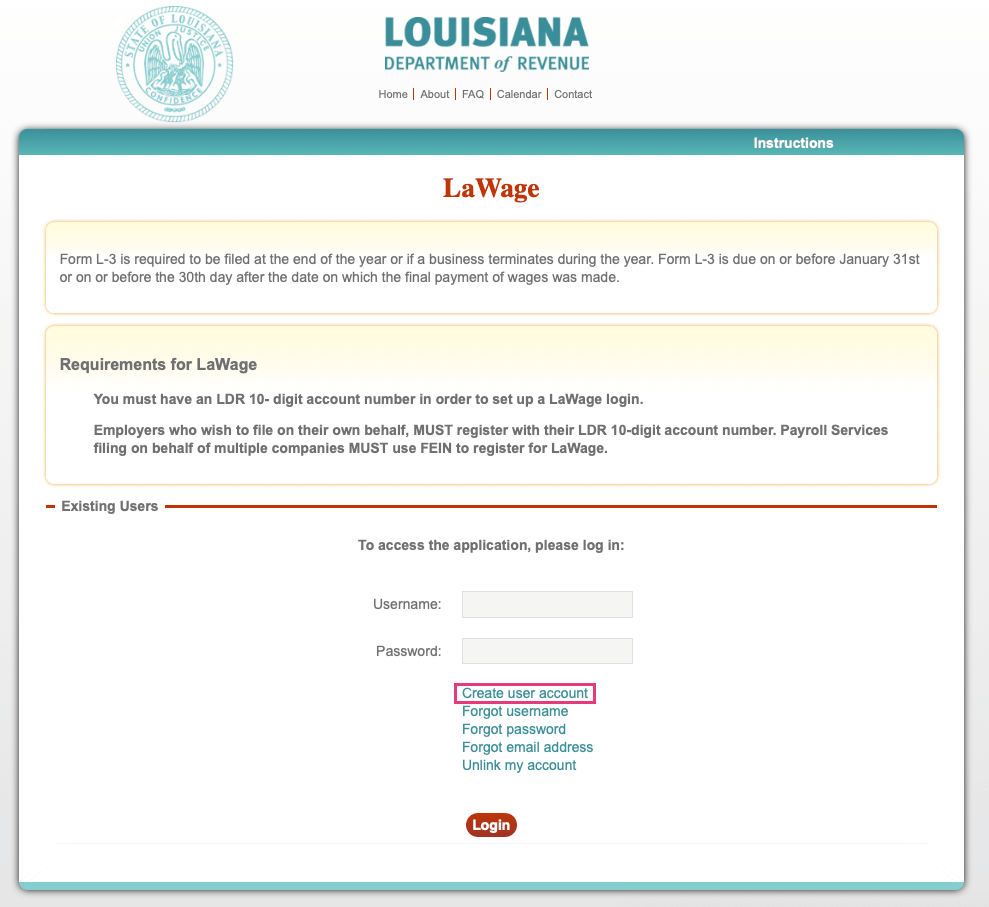

Online at LaWage (more than 50 Forms W-2). Use your Louisiana Department of Revenue 10-digit account number in order to set up a LaWage login/new user account. Click on "Create user account".

Form L-3 must be filed at the end of the year or if a business terminates during the year. Form L-3 is due on or before January 31st, or on or before the 30th day after the date on which the final payment of wages was made.

For more information, see Louisiana Withholding Tables and Instructions for Employers.