USA State Payroll Rates + Resources: State of Connecticut: Filing State Income Taxes, W-2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with filing state income taxes, W-2s, and 1099s, as needed, in the state of Connecticut.

State Income Tax Withholding

To determine the amount of state of Connecticut income tax withholding, employees should complete a Connecticut Form CT-W4 Employee's Withholding Certificate. Every employee, on or before the date of commencement of employment, shall furnish his or her employer with a signed Connecticut withholding exemption certificate relating to the withholding code, additional, and/or reduced withholding amount.

Employers are required to keep copies of completed state CT-W4 forms for their employees in their files. The forms serve as verification that state income taxes are being withheld according to the employee’s instructions and needs to be available for inspection if the state requests it.

The Forms W-4 and CT-W4 generally are valid until the employee provides new ones. However, employees who claim exemption from withholding must renew the exemption annually by filing new Forms W-4 and CT-W4 by February 15 each year.

State Income Tax Withholding Reporting & Deposits

All employers are required to file all withholding forms electronically and pay any associated taxes by electronic funds transfer (EFT). Failure to comply will result in penalties.

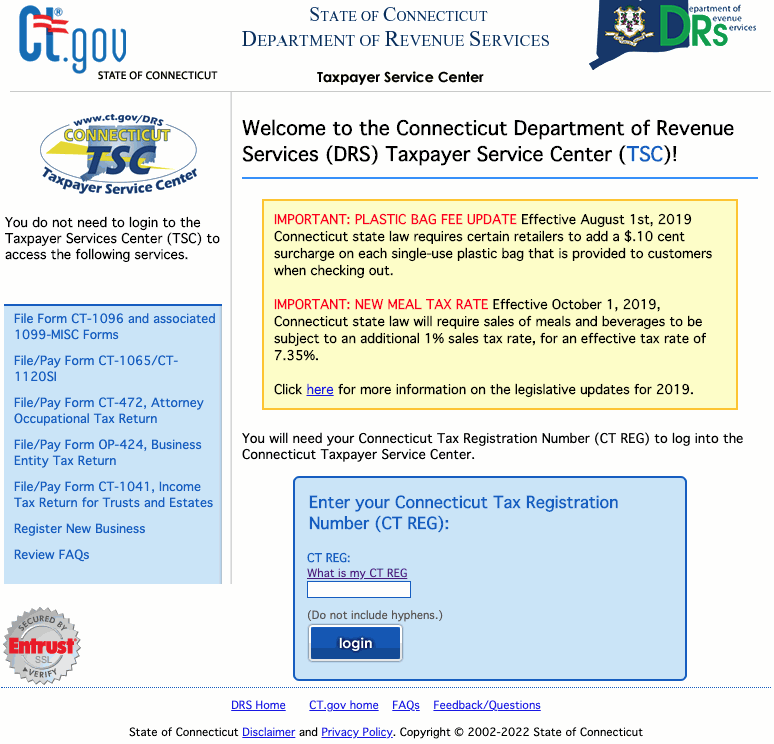

File withholding information through the Taxpayer Service Center (TSC). It is a free, fast, easy, and secure way to conduct business with the Department of Revenue Services (DRS). Go to Connecticut Department of Revenue Services (DRS) Taxpayer Service Center (TSC) and enter your CT Tax Registration Number to begin.

Each calendar year DRS will classify you either as a weekly remitter, monthly remitter, or quarterly remitter. The classification relates to how much time you have to remit Connecticut income tax withholding to DRS after wages are paid to employees and Connecticut income tax is deducted and withheld from those wages.

Your classification is based on your reported liability for Connecticut income tax withholding during the 12-month look-back period.

The 12-month look-back period for the calendar year 2022 is the 12-month period that ended on June 30, 2021.

DRS will notify you by mail of your new payment frequency if the prior classification has changed. Most new employers will be classified as quarterly remitters.

Remittance Due Dates:

Unless you are a seasonal, annual, agricultural, or household employer filer, if you are registered for Connecticut income tax withholding, you must electronically file Form CT-941 even if no tax is due or has been withheld for a quarter.

Quarterly Reconciliation Due Dates:

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 30st |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

This requirement applies to you even if you are not required to file a quarterly reconciliation for federal withholding purposes.

If you make timely withholding payments and owe no additional withholding for the quarter, you have ten days after the normal due date to file Form CT-941.

For further details, see the Employer's Tax Guide (Circular CT).

W-2 Forms 1099 Forms

Filing 25 or More W-2s

Form CT-W3 (Annual Reconciliation of Withholding) is due on or before January 31 and will be completed as part of the electronic filing process when you upload Copy 1 of federal Forms W-2.

If you file 25 or more Forms W-2 reporting Connecticut wages paid, you are required to file the Form CTR-W3 electronically at the Connecticut Department of Revenue Services (DRS) Taxpayer Service Center (TSC) unless you have been granted a waiver from electronic filing of information returns.

Filing 24 or Fewer W-2s

If you file 24 or fewer Forms W-2 reporting Connecticut wages paid you are encouraged to file the Form CTR-W3 electronically but may file paper forms without requesting a waiver. Please note that each Form CT-W3 is year specific. To prevent any delay in processing your return, the correct year’s form must be submitted to DRS.

You must file every Copy 1 of federal Form W-2 with Form CT-W3 even if you didn’t withhold any Connecticut income tax.

For further details, see instructions for the Form CT-W3.

1099 Forms

Connecticut does participate in combined federal and state filing. In most cases, if you participated in combined filing for your 1099s, then you do not need to send 1099s to the Connecticut Department of Revenue, they should already have a copy.

Form CT-1096 is due January 31, 2022.

Filing 25 or More 1099s

If you file 25 or more Forms 1099-MISC, 1099-R, or W-2G you are required to file electronically unless you have been granted a waiver from the electronic filing of information returns.

Filing 24 or Fewer 1099s

If you file 24 or fewer Forms 1099-MISC, 1099-R, or W-2G you are encouraged to file electronically but may file paper forms without requesting a waiver. Please note that each form is year specific. To prevent any delay in processing your return, the correct year’s form must be submitted to DRS.

For further details, see the instructions for Form CT-1096.