Inventory : Operations: Landed Costs

Repository Versions:

Purpose

The purpose of this documentation is to outline the use case and processes associated with Landed Costs.

Landed costs are the total cost of a landed shipment including:

Purchase Price

Freight

Insurance

Other Costs up to the Port of Destination.

In some instances, it may also include the customs duties and other taxes levied on the shipment.

In other words, landed costs are: The total price of a product once it has arrived at a buyers door (Cost of Product + Shipping + Customs + Risk).

Processes

Enabling Landed Costs

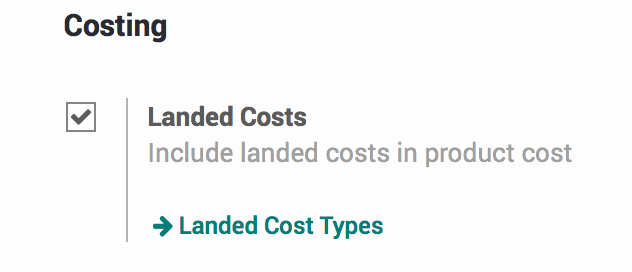

Once there, click on Configuration > Settings. Scroll down to the Costing section and check the checkbox for Landed Costs. When ready, hit the Save button.

Configuring Landed Cost Types

Click on Configuration > Landed Cost Types.

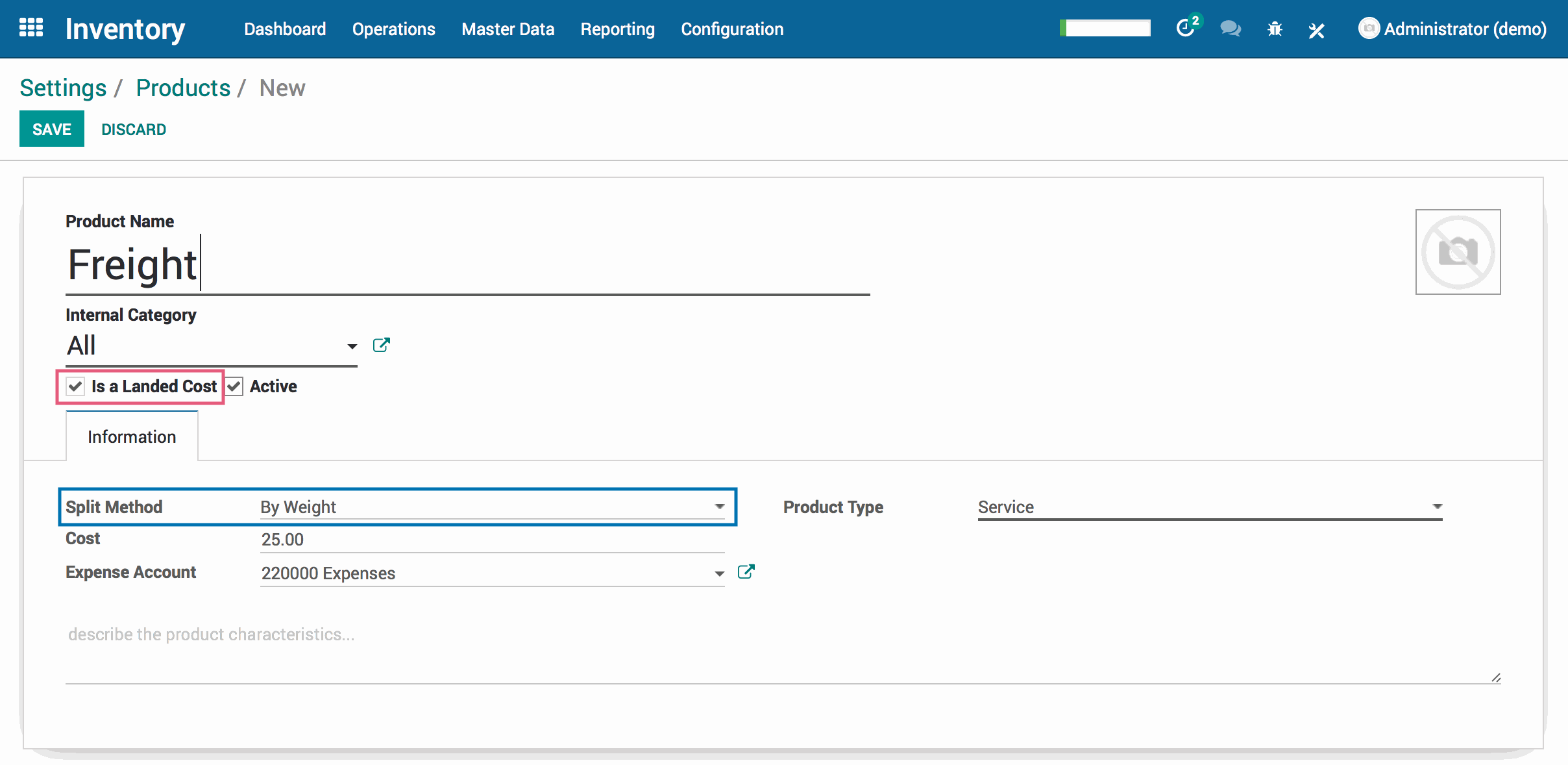

Here you will see a Kanban view of Landed Cost products. Landed Cost products are products that have the 'Is a Landed Cost' checkbox selected.

Hit the Create button.

Fill in the following details:

Name: The name of the Landed Cost.

Split Method: Select a Split Method, the types of which are outlined below in more detail.

Expense Account: This should be an expense account that makes sense for the product.

Product Type: Select the appropriate product type; in most cases this will be Service.

When ready, hit the Save button.

Good to Know!

Landed Cost Split Methods

There are a handful of Split Methods that can be applied to a landed cost product. Here is a quick reference for how each behaves:

Equal: Cost will be equally divided by moved line

By Quantity: Cost will be divided based on the product quantity

By Current Cost: Cost will be divided based on the product's current cost

Weight: Cost will be divided based on weight

Volume: Cost will be divided based on volume

Important!

A Landed Cost can only be used on products configured with the FIFO costing method (sometimes referred to as the 'Real Price’ costing method). The costing method for a product is configured on the product category.

Alternatively, we have a module that allows for Landed Cost to work with AVG costing method for version 11 of Odoo.

Linking a Landed Cost to a Warehouse Transfer

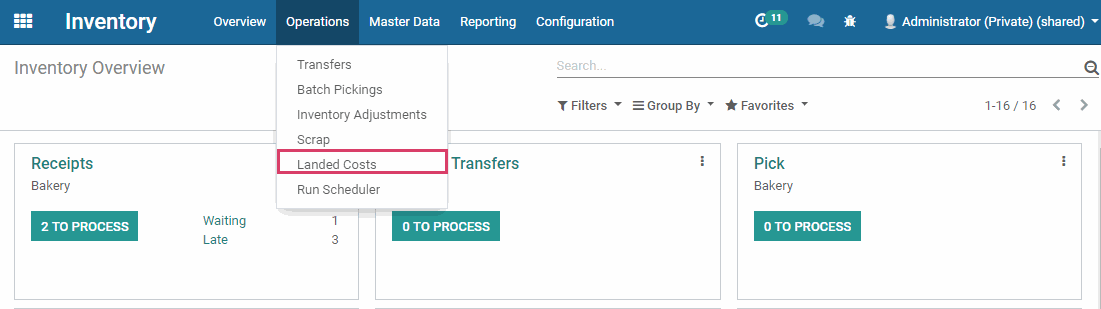

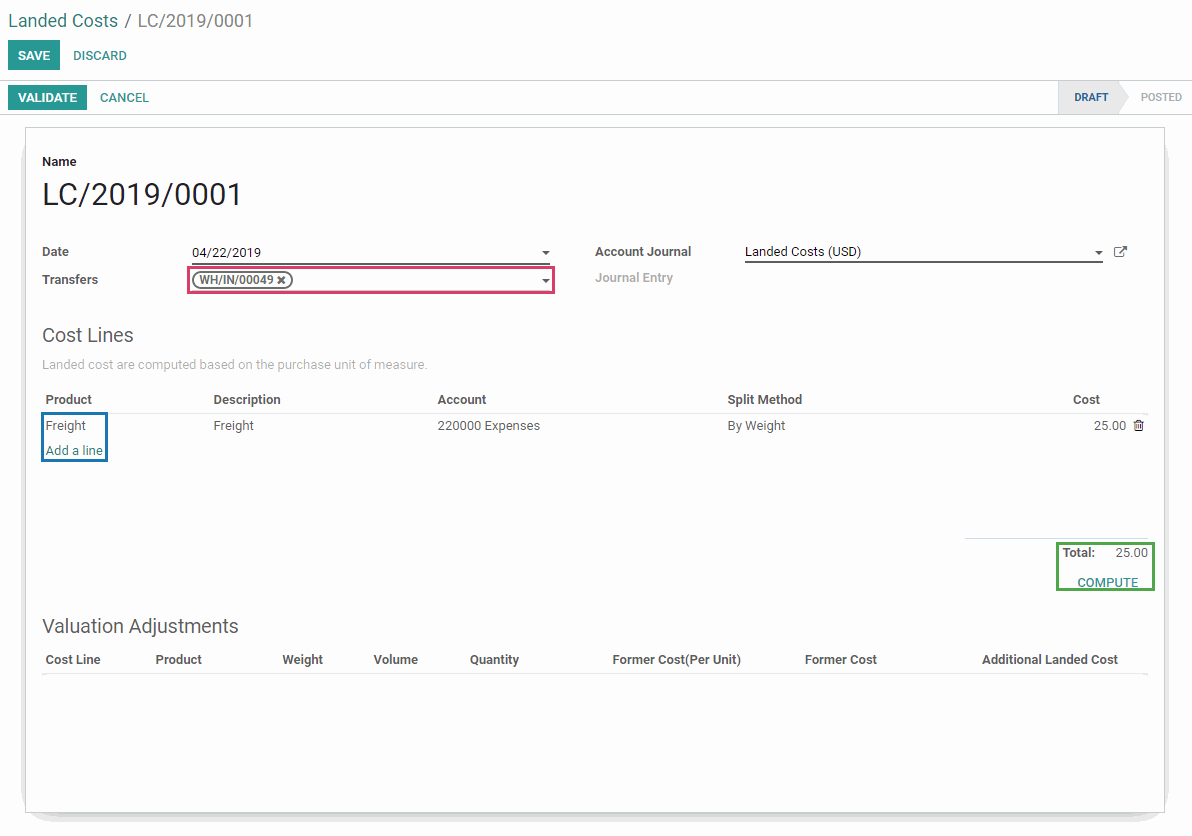

Now, click on Operations > Landed Costs. Hit the Create button.

Fill in the following details:

Transfers: Select the transfers you want to attribute landed costs to from the dropdown menu.

Account Journal: The journal in which you want to post the landed costs.

Cost Lines: Click Add an item to add a previously created Landed Cost Type. Add as many cost lines as needed.

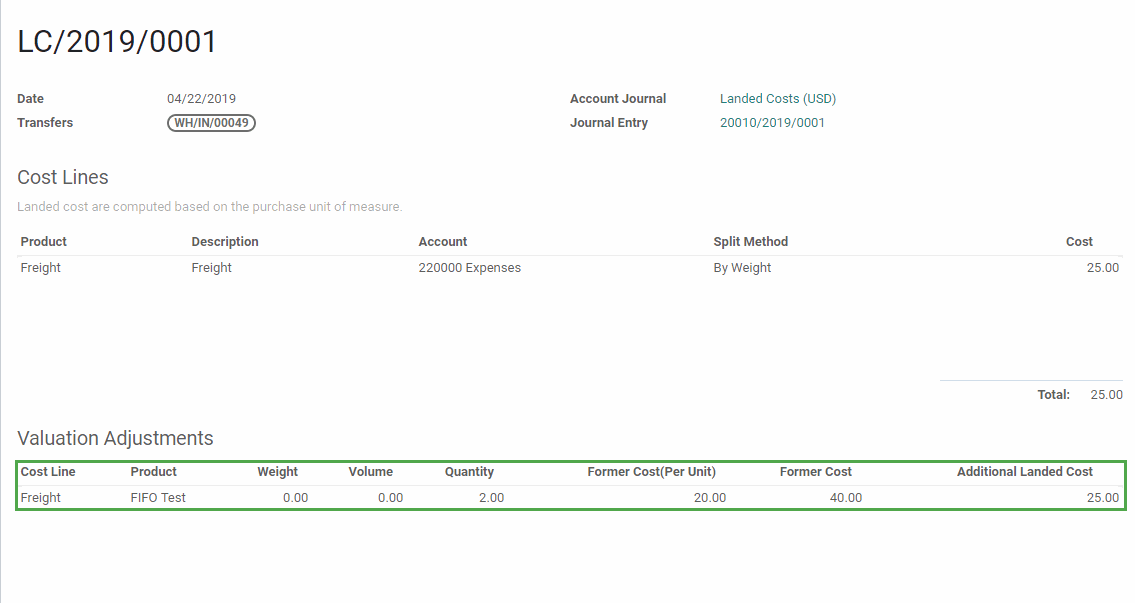

When finished, click Compute.

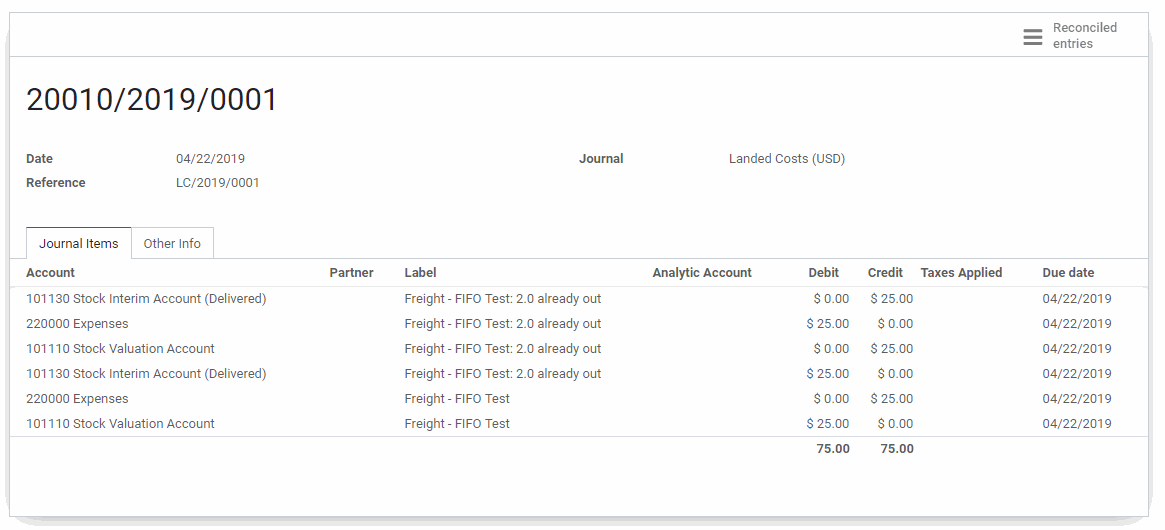

Upon validation, a journal entry will be created in the previously selected Account Journal. You will now have a link to the in the Journal Entry field.

If you click on this link, you will be brought to the entry and it is here that you will see the credit(s) from the Expense account that was selected when creating the landed cost type as well as the debit(s) to your Stock Valuation Account.