Accounting: Accounting: Actions: Tax Lock Dates

Purpose

This document covers the configuration of Tax Lock Dates in the Accounting application of Odoo 14. A Tax Lock Date will move any new transactions and its tax values, whose accounting date is prior to the date set, to the next open tax period. This is to ensure that no changes can be made to a report once its period has closed.

Good to know!

It is recommended to lock your tax date before working on Closing Fiscal Period to End the Year to ensure that other users can not modify or add transactions that would otherwise have an impact on the closing journal entry, which will help avoid some tax declaration errors.

Process

To get started, navigate to the Accounting app.

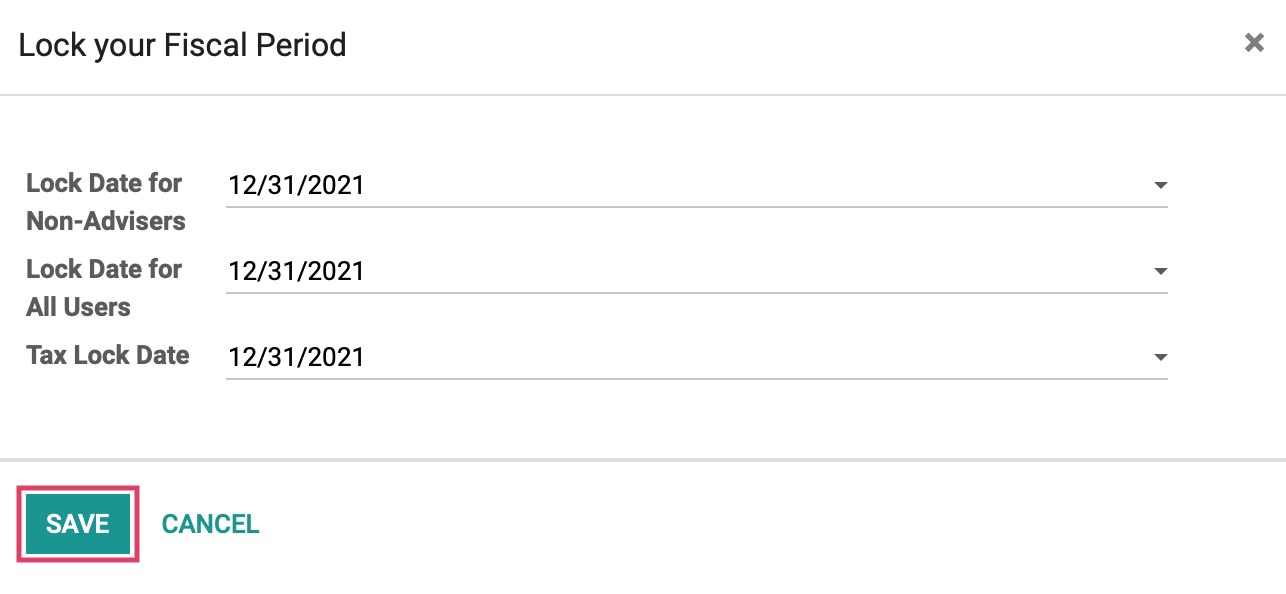

To set your lock dates, go to Accounting > Actions >Lock Dates .

Lock Date for Non-Advisors: Only users with the Advisor role can edit accounts before and including this date. A possible use case would be to lock a period inside an open fiscal year.

Lock Date for All Users: No user, including Advisors, can edit accounts before and including this date. Use case is to lock a fiscal year, for example.

Tax Lock Date: No users can edit journal entries related to a tax before and including this date.

Click SAVE when finished.