Accounting: Configuration: Expenses

Purpose

The purpose of this documentation is to outline the use cases and processes associated with the Odoo 13 Expenses application. We'll go over the app configuration, as well as Expense Product configuration.

We'll then show you how to submit, post, approve, and charge expenses to the client.

Process

To get started, navigate to the Expenses application.

Configuring Expenses

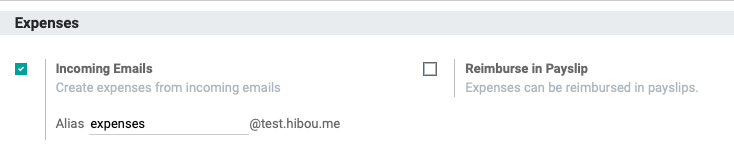

Within the expenses application, click on CONFIGURATION > SETTINGS.

Emails: If selected, you will enter an email alias where expenses can be emailed to in order to generate expenses.

Reimburse in Payslip: Select this option to reimburse via payslip rather than separate payments.

When you're done, click Save.

Expense Products

Next, click CONFIGURATION > EXPENSE PRODUCTS.

Expense Products are products that have the 'Can be Expensed' checkbox selected. Here you will see a kanban view of Expense Products if any exist.

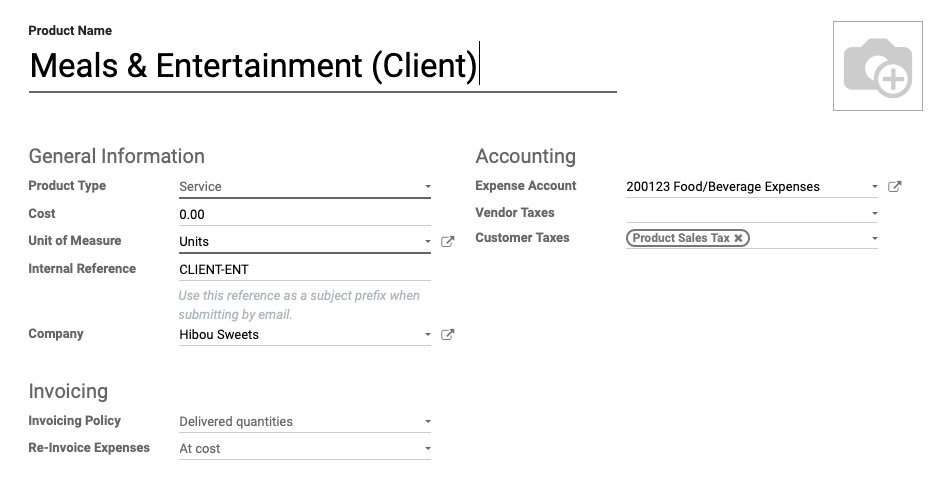

To create a new Expense Product, click CREATE. Complete the following form according to these guidelines:

Product Name: The name of the expense. Here are some common expense products to serve as examples:

Travel Expenses [Internal]: Used for airfare, car rental, hotels and other similar expenses that are associated with travel that is not being invoiced back to a customer.

Travel Expenses [Client]: Used for airfare, car rental, hotels and other similar expenses that are associated with client travel and will be invoiced back to a customer.

Meals and Entertainment [Internal]: Used for meals and food purchases that will not be invoiced back to a customer.

Meals and Entertainment [Client]: Used for meals and food purchases that will be invoiced back to a customer.

Other Products: Various broad products for other expenses, such as office supplies.

General Information

Product Type: Expenses, such as travel and food, should be service products.

Cost: This can be configured to have a set cost, but you may wish to leave this at $0 and set the price appropriately on each expense.

Unit of Measure: Enter the unit of measure for this product (e.g. each, per unit).

Internal Reference: When emailing expenses, this code will serve as a subject prefix when submitting expenses via email.

Company: If you're in a multi-company environment, leave this blank to apply to all companies. Otherwise, select the individual company this should apply to.

Accounting

Expense Account: This should be an expense account that makes sense for the type of product. For example, Travel Expenses are assigned a Travel Expenses expense account. Here are some example expense product and account matchups:

Travel Expenses [Internal]: 220107 Travel Expenses

Travel Expenses [Client]: 220107 Travel Expenses

Meals and Entertainment [Internal]: 220150 Meals and Entertainment Expenses (50%)

Meals and Entertainment [Client]: 220108 Meals and Entertainment Expenses (Client)

Other Products: An existing expense account that makes sense given the nature of the product (Supplies Expenses for office supplies, for example

Vendor Taxes: Taxes that are automatically applied when this expense is purchased.

Customer Taxes: Taxes that are automatically applied when this expense is sold

Invoicing

Invoicing Policy: Leave this blank for all expenses that will not be invoiced back to a client. If it will be invoiced back to a client, this should be set to 'Delivered Quantities' or 'Milestones'.

Re-Invoice Expenses: This should be set to 'No' for all expenses that will not be invoiced back to a client. If it will be invoiced back to a client, this should be set to 'At cost' or 'Sales price'.

When you're ready, click SAVE.

Important!

Configuring Products for Expenses that Will be Invoiced Back to Clients

If you are creating an expense product for an expense that will be invoiced back to the client at cost, don't create your expense product here. Instead, go through the Sales or Inventory applications to create the products. This gives you more control over the product configuration.

For these products, the following details still apply but you'll also want to configure the Income Account and the Expense Account (under the Accounting tab) to use the same expense account, allowing the account to wash out since the cost and the revenue will match.

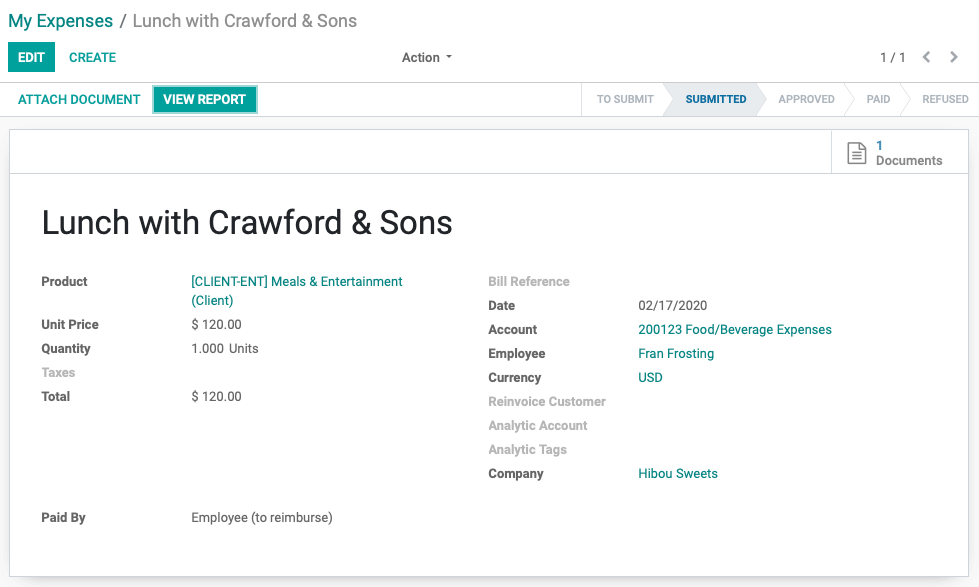

Submitting Expenses

Employees can submit their own expenses, and those with proper permissions can submit expenses on behalf of employees.

To submit an expense, click MY EXPENSES > MY EXPENSES. Once there, click Create and enter details in the following form.

Description: Describe the expense including enough details to make it easily identifiable ('Hotel for Trip to X Client', for example)

Product: Choose the appropriate expense product

Unit Price: Set the price based on the receipt total.

Quantity: Will typically be a quantity of one, unless multiple of the product were purchased on the same day at the same price.

Taxes: Typically none.

Total: Enter the total cost of the expense from the receipt.

Bill Reference: Something like a receipt or order number.

Date: The date the purchase was made.

Account: An appropriate expense account, as described above (usually filled by the product)

Employee: Select the employee responsible for the expense (usually yourself).

Currency: Select the currency of the receipt.

Reinvoice Customer: If the customer is to be invoiced for this expense, select the related Sales Order from the drop-down.

Analytic Account: If needed (e.g. to bill to a project like potentially large trips or marketing initiatives), or potentially an Analytic Account that is related to the Sale Order chosen earlier.

Analytic Tags: Add any relevant tags for reporting purposes.

Company: Select the company reimbursing this expense.

Paid By: Indicate who paid this initial expense.

Employee (to reimburse): Select this option if an employee made the purchase and needs to be reimbursed.

Company: Select this option if the company paid for the purchase and no reimbursement is needed.

When you've completed the form, click Save. Repeat this process to add all expenses to submit.

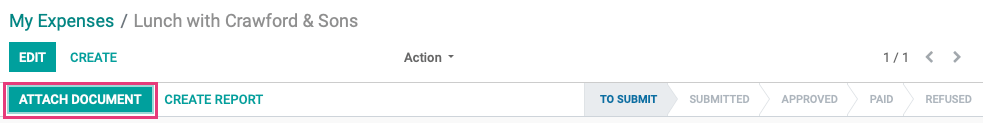

Next, click Attach Document and upload the receipt for this purchase.

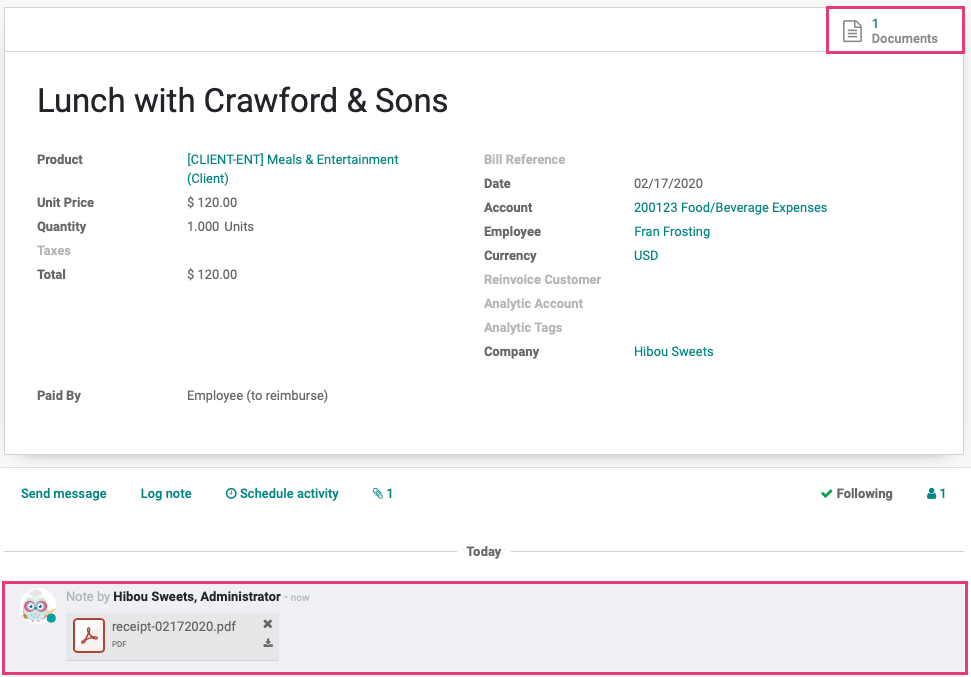

Once you've uploaded your document(s), a chatter notification will display with a link to download it. You'll also see the Documents smart button with an updated total of documents added.

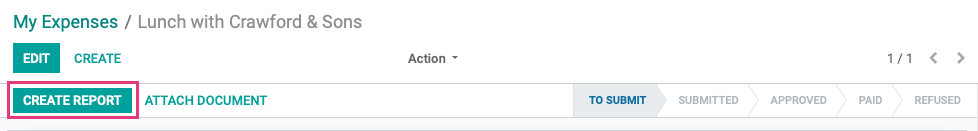

If everything looks correct, click Create Report.

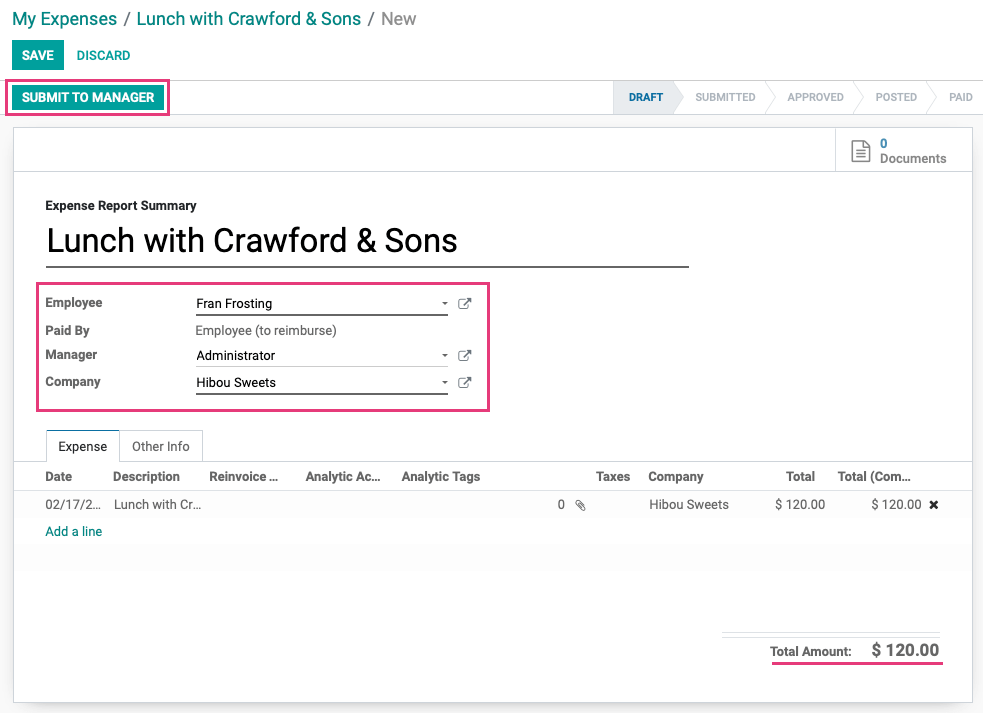

This will take you to a draft Expense Report Summary where most of the data you've entered will be populated. It will include information for all expenses not yet submitted.

Review the information on this page. When you're ready, click Save (if it shows as an option) and then click Submit to Manager. After submitting the expense it will be routed to an administrator for approval.

Batch Expenses

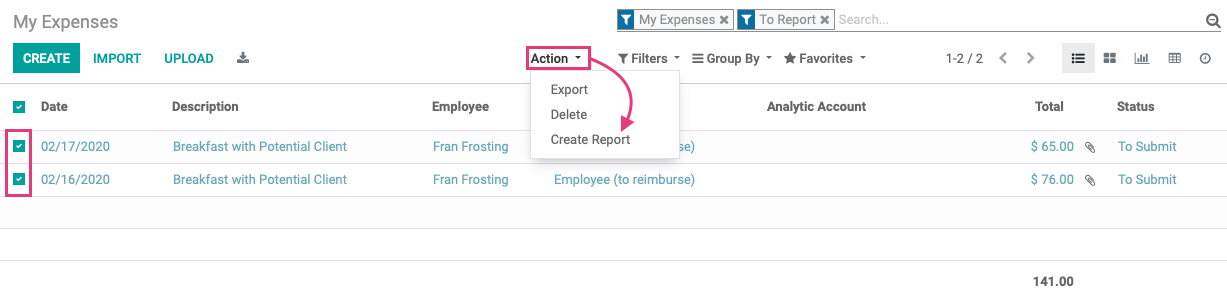

You can submit several reports at once through My Expenses > My Expenses. Simply select all reports to submit, then click Action > Create Report. This brings you to the draft Expense Summary Report we covered, above.

Good to Know!

Sometimes when you transition from an expense to the expense summary, the document count won't update. You can click Save on the summary and reload the page to make sure the count is correct.

Approving Expenses

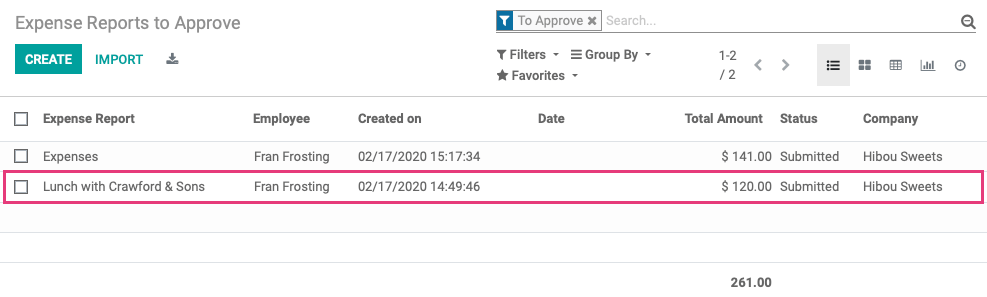

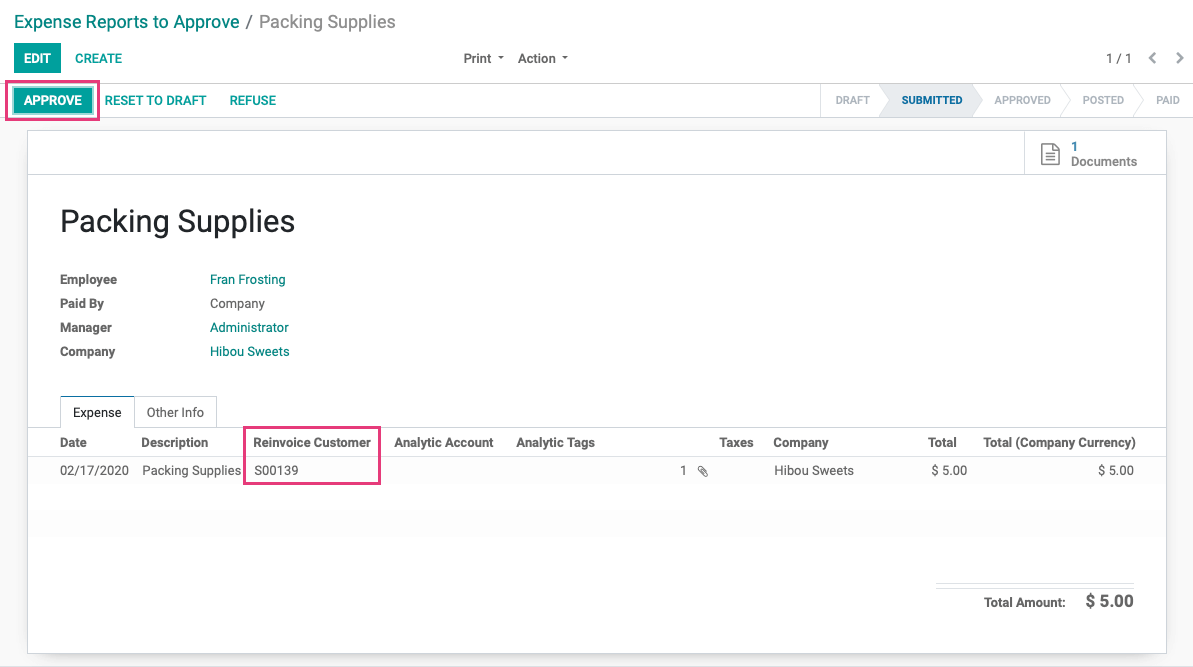

As an administrator, you can review pending expenses by clicking Expense Reports > To Approve.

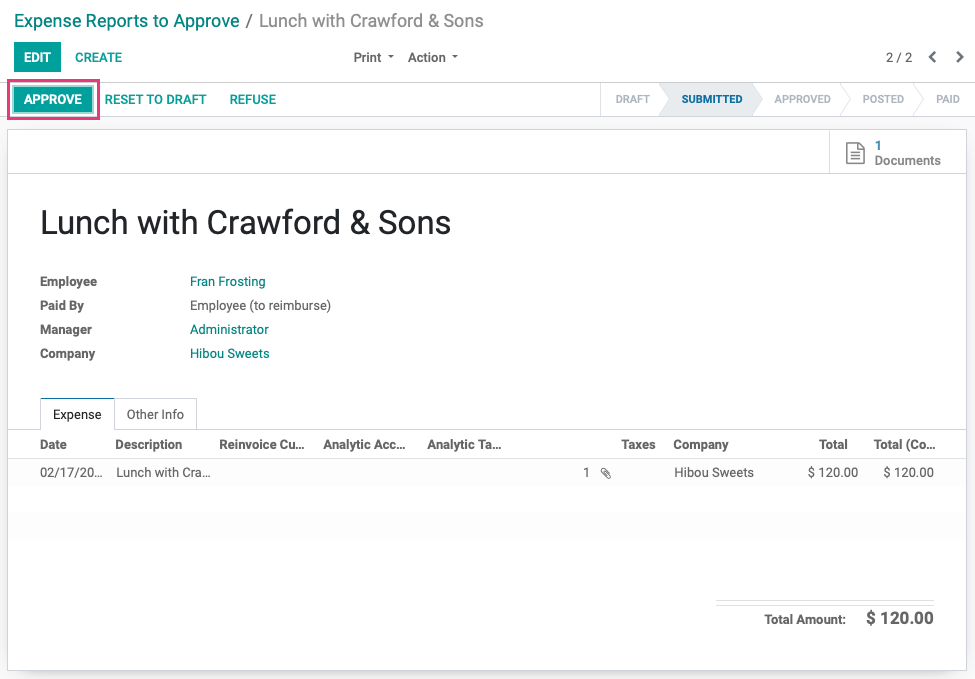

Here you will see a list of expenses that are awaiting approval. Select one from the list for review.

If the expense has been created correctly and the appropriate documentation has been attached, click APPROVE. This will move it to the next stage where you'll Post the expenses.

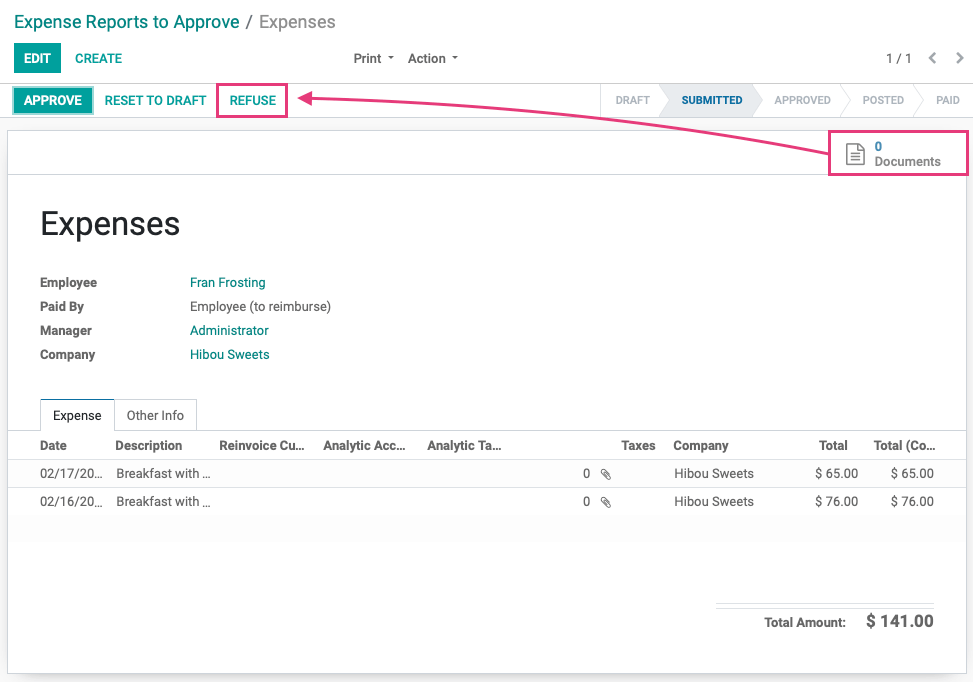

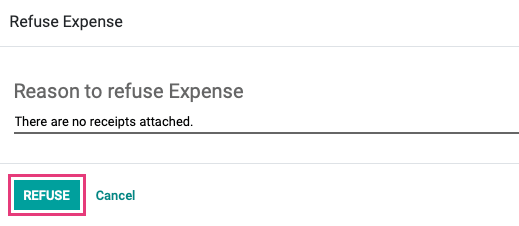

If the expense wasn't submitted correctly, like the following example which is missing receipts, click Refuse.

Enter a reason for refusal, then click Refuse again.

Posting Expenses

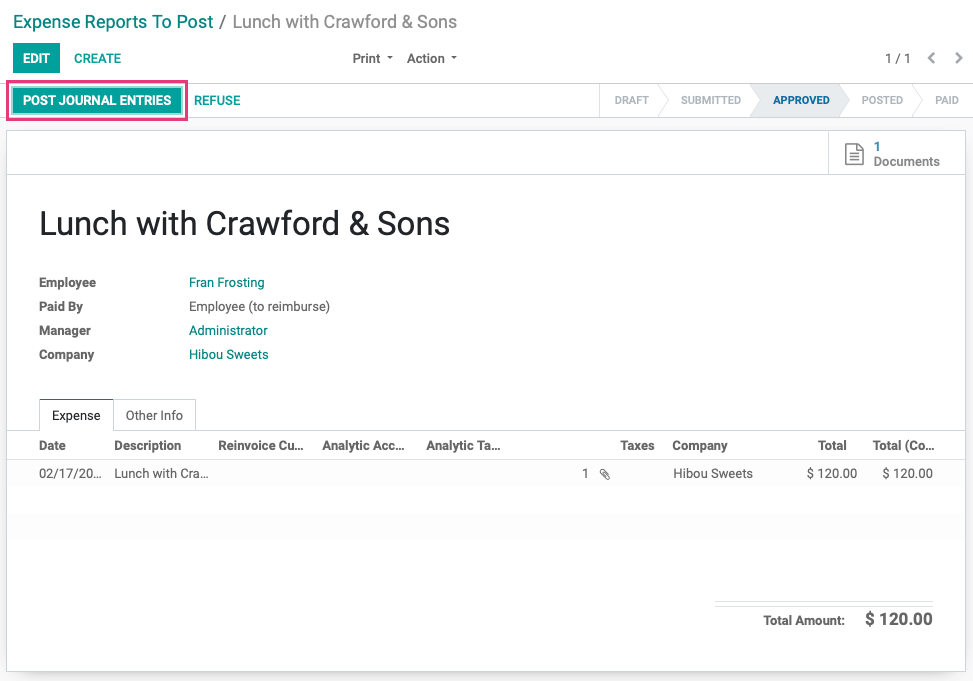

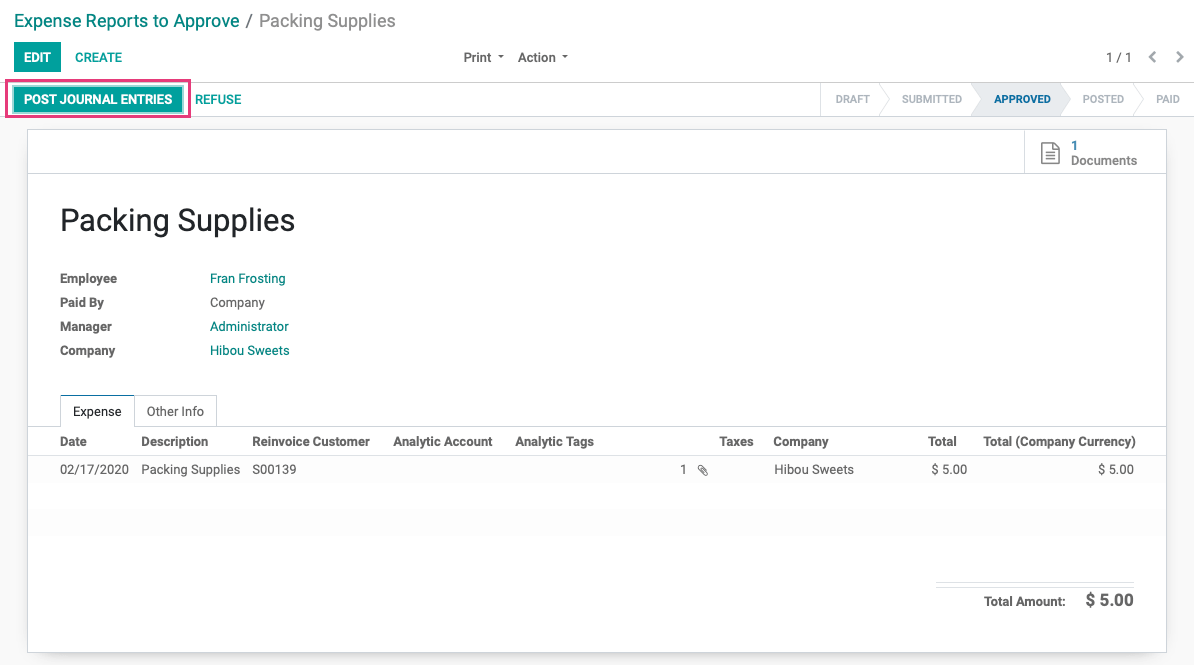

If you're not coming directly from an approved invoice, you can view the reports ready to post by clicking Expense Reports > To Post and selecting an expense to post from the list.

This page is your final review. If everything still looks correct, click POST JOURNAL ENTRIES.

Once entries are posted, one of two things will happen.

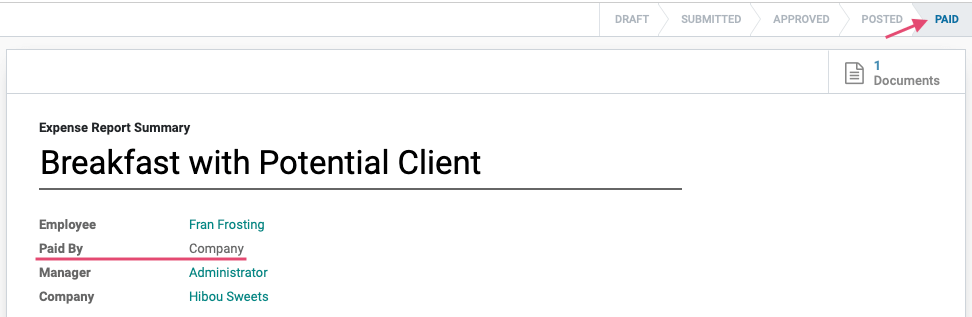

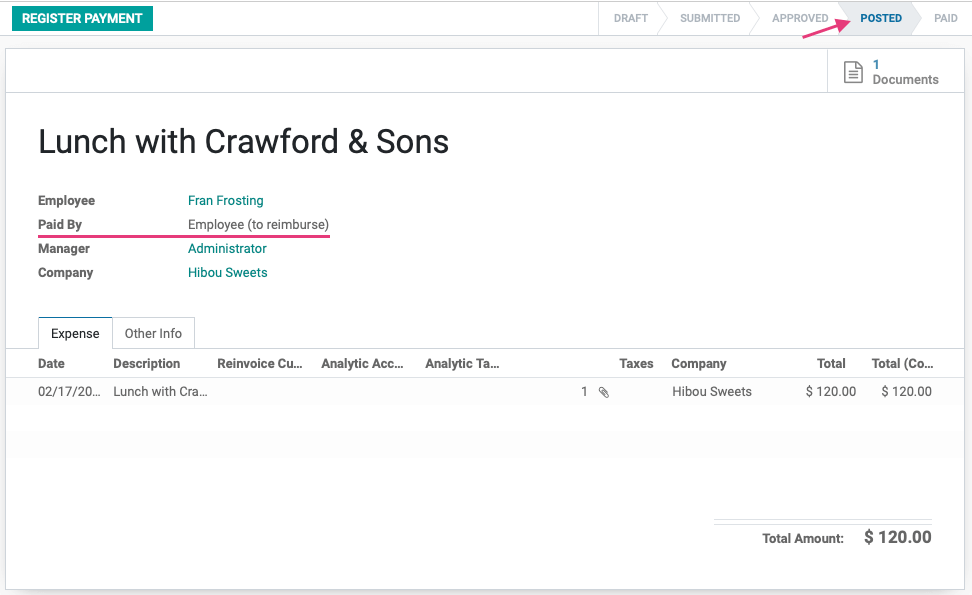

If Payment By was set to Company, there will be no further action until the charge hits a card or bank, at which point it will be reconciled. This expense will be marked as Paid.

If Payment By was Employee (to Reimburse), the status will change to Posted and you'll have the option to Register Payment directly from the expense. The unpaid expense will also be listed under Expense Reports > TO PAY where you'll be able to register payment.

Re-Invoicing to Clients

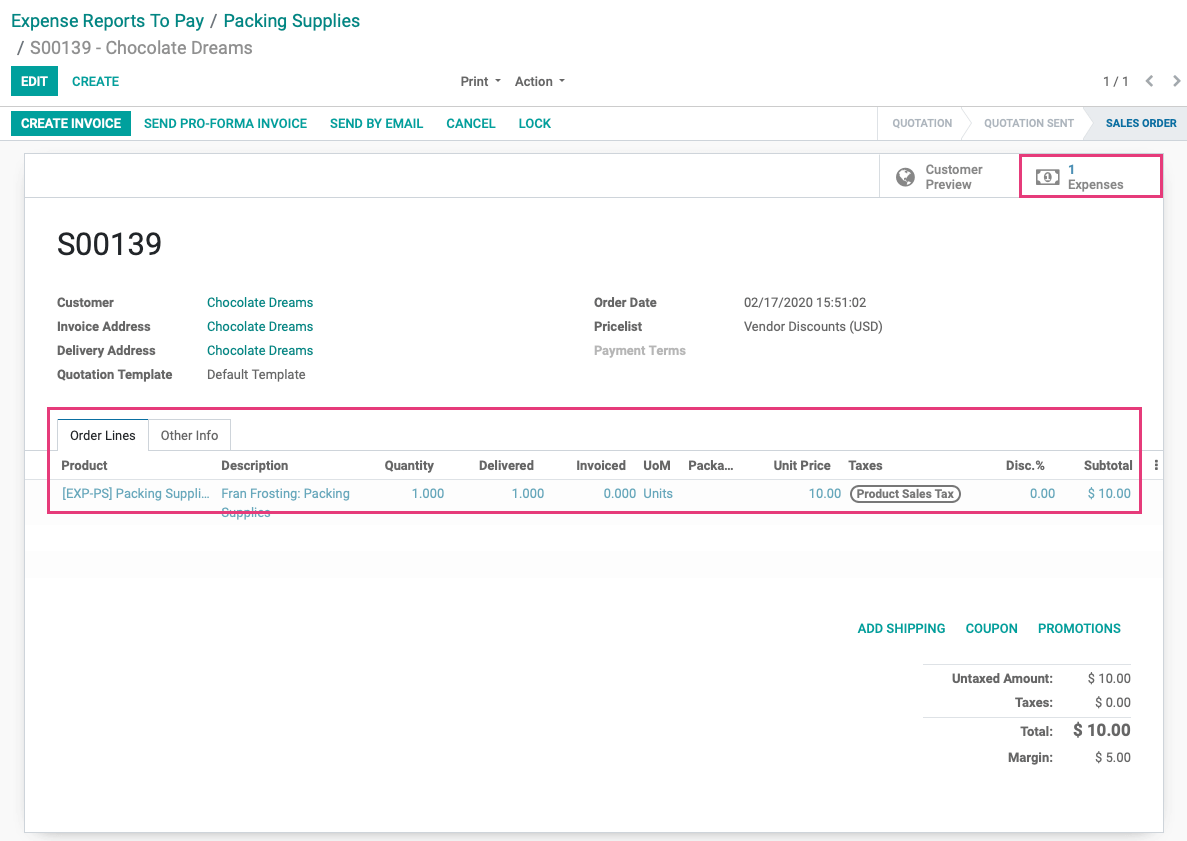

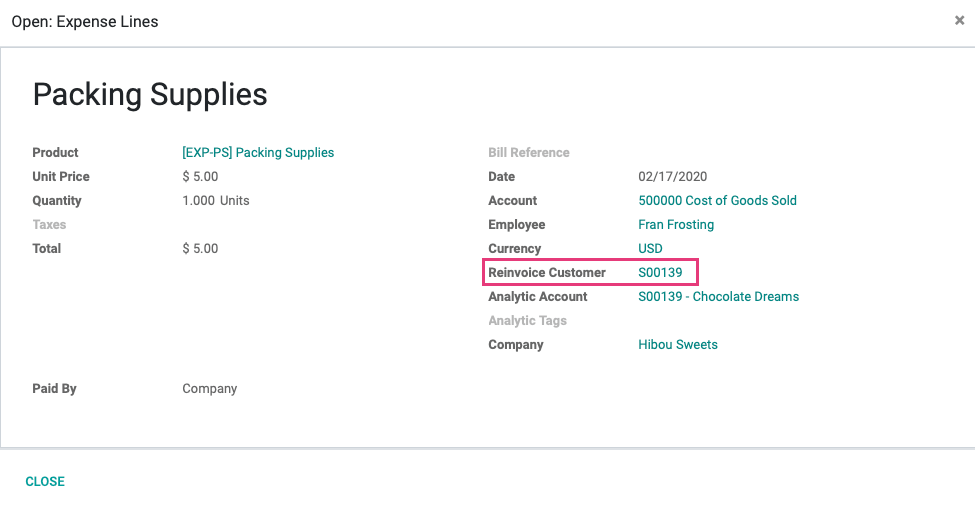

In this example, we're clicking Approve on an expense configured to Reinvoice Customer. You'll see the related, open Sales Order in the Expense lines.

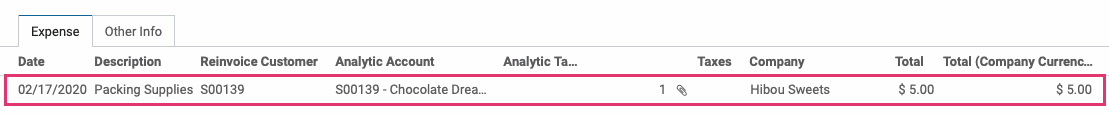

Next, we'll click Post Journal Entries on the approved expense.

To review the Sale Order, click the expense line:

Then click the Sale Order reference number:

On the Sale Order, you can see the entry was created and there's a smart button that links back to the related Expenses.