Accounting: Customers + Vendors: Vendors: Refunds

Purpose

This document covers creating a Vendor Refund within the Accounting app of Odoo 14.

Process

To get started, navigate to the Accounting app.

We handle vendor refunds the same way as customer invoice credit notes. In fact, we recommend you read that document first.

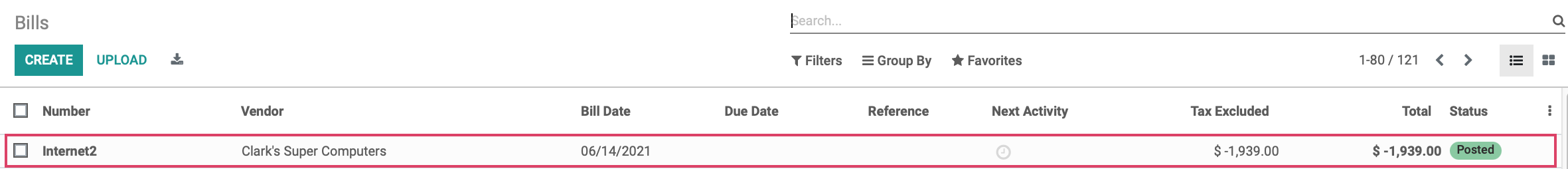

While we can manually record a refund through Vendors > Refunds, we recommend recording a refund directly from the posted, paid bill. To do so, go to VENDORS > BILLS. Once there, select the bill to record a refund for.

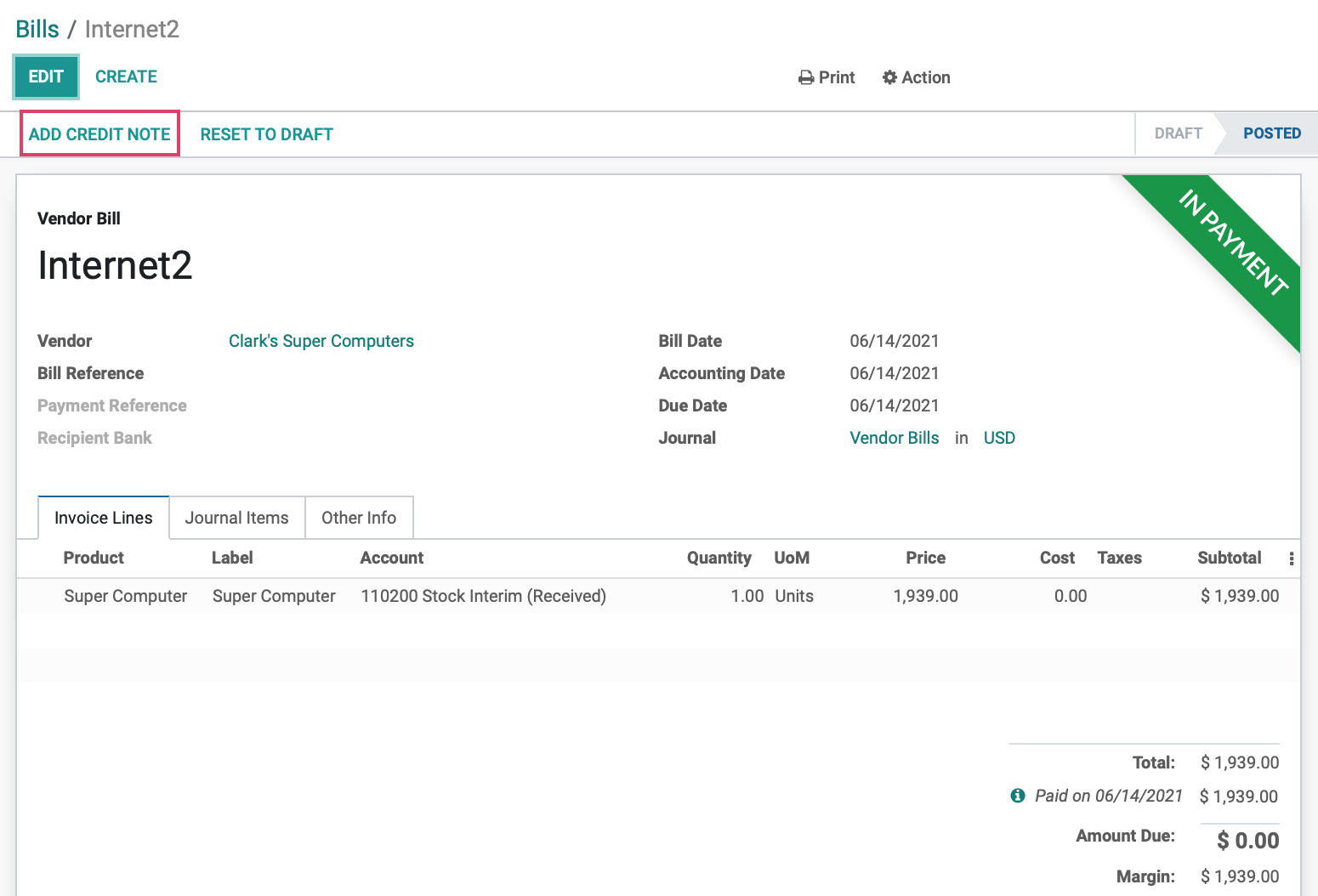

Click ADD CREDIT NOTE.

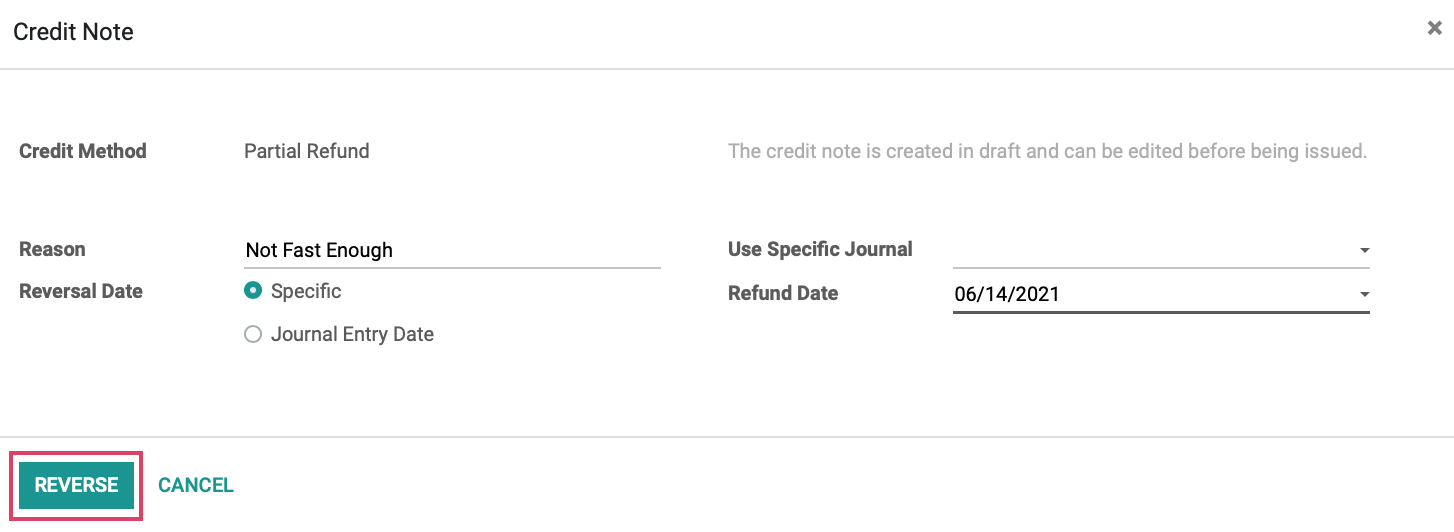

This will open a modal to create the Credit Note (i.e. Refund).

Credit Method: 'Partial Refund' is the preset value and cannot be changed.

Reason: Enter a reason for the refund.

Use Specific Journal: To record the refund to a journal different from what the payment was recorded to, select that journal here.

Reversal Date: To select a date to record this to, select 'Specific', then select the Refund Date. It will default to today's date. To record the refund for the same date the payment was recorded, select 'Journal Entry Date'.

When ready, click REVERSE.

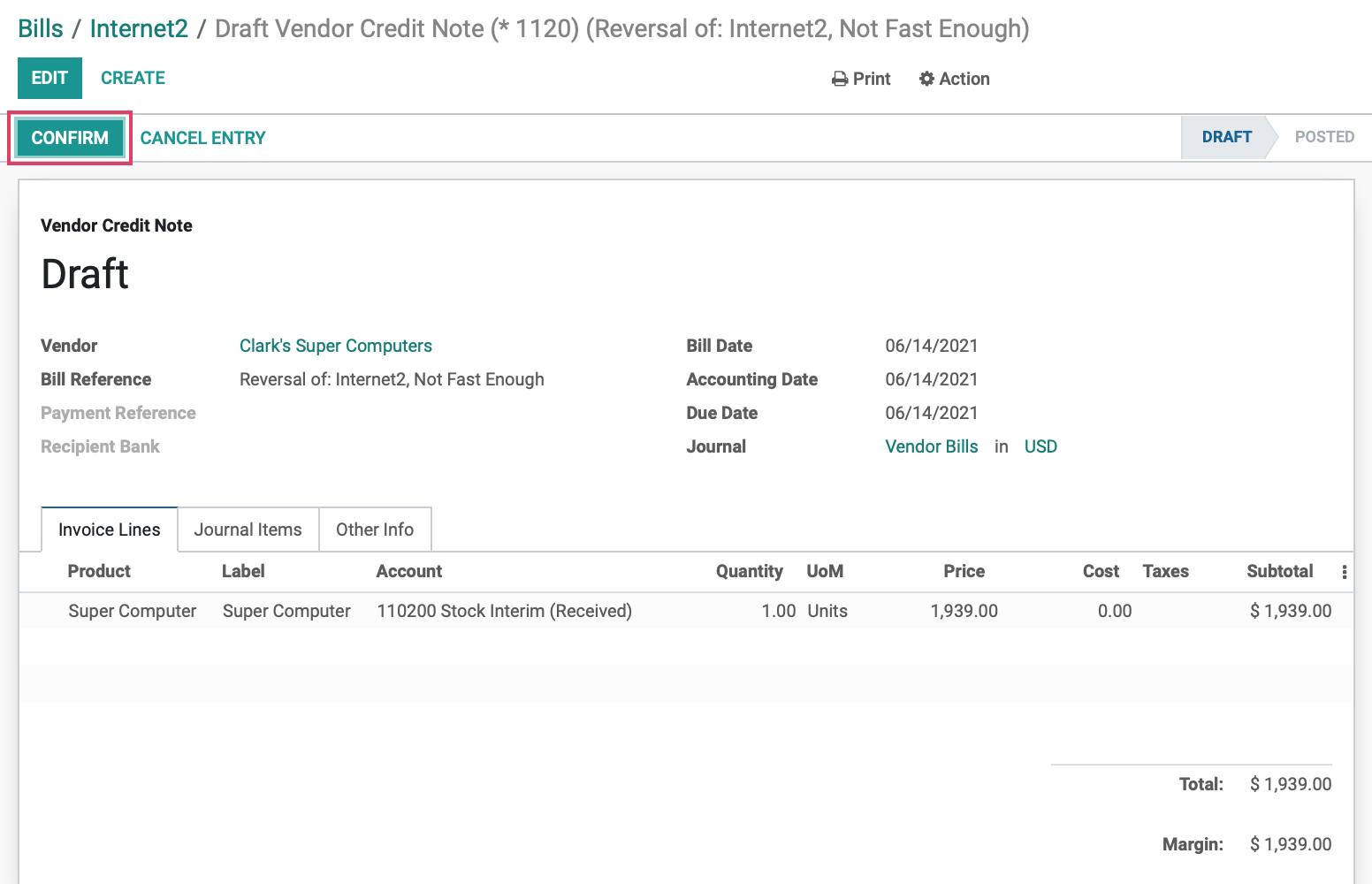

This will create a Draft invoice that needs to be confirmed to complete the workflow, click CONFIRM to move the invoice from a Draft to a Posted state.

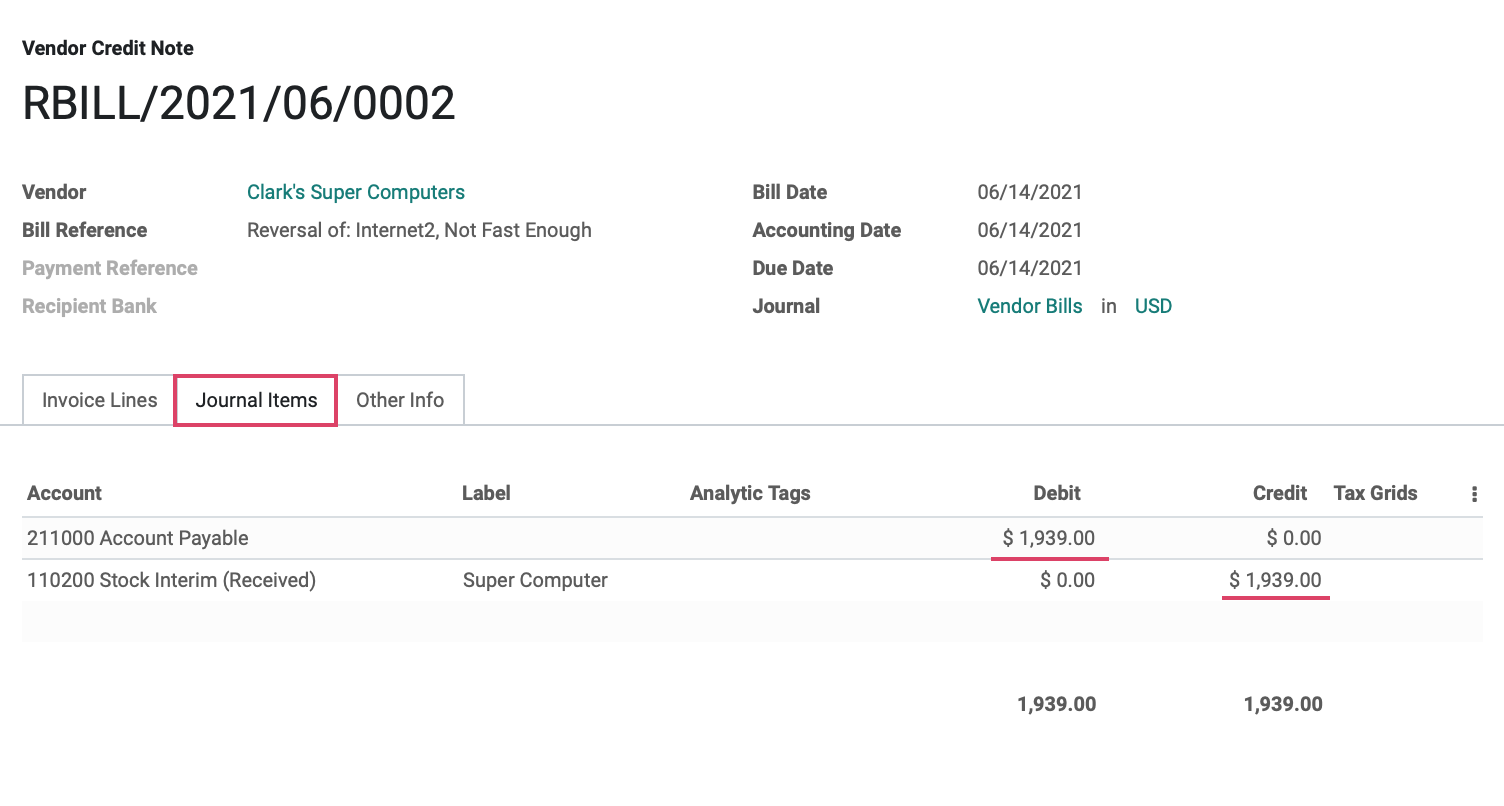

An added benefit to creating a credit note from within a bill is that Odoo will automatically create a reverse entry on the journal that zeroes or balances out the items made by the original bill. By clicking on the Journal Items tab, we will see just that in the Credit column to balance out the Debit.